Food Lion 2011 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2011 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

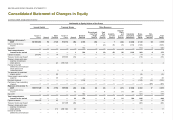

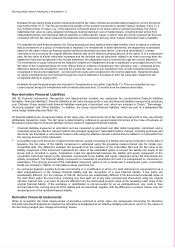

66 // DELHAIZE GROUP FINANCIAL STATEMENTS ’11

Consolidated Statement of Changes in Equity

(in millions of EUR, except number of shares)

Attributable to Equity Holders of the Group

Issued Capital Treasury Shares Other Reserves

Number of

Shares Amount

Share

Premium

Number of

Shares Amount

Retained

Earnings

Discontinued

Cash Flow

Hedge

Reserve

Cash

Flow

Hedge

Reserve

Available-

for-sale

Reserve

Actuarial

Gains

and

Losses

Reserve

Cumulative

Translation

Adjustment

Share-

holders’

Equity

Non-

controlling

Interests

Total

Equity

Balances at January 1,

2009

100 583 284

50

2 725

914 716

(56)

2 678

(10)

—

7

(22)

(1 229)

4 143

52

4 195

Other comprehensive

income

— — — — 1 — 1 (6) (5) (5) (131) (145) — (145)

Net profit — — — — — 514 — — — — — 514 6 520

Total comprehensive

income for the period

—

—

—

—

1

514

1

(6)

(5)

(5)

(131)

369

6

375

Capital increases

287 342

—

14

—

—

—

—

—

—

—

—

14

—

14

Treasury shares purchased

—

—

—

205 882

(10)

—

—

—

—

—

—

(10)

—

(10)

Treasury shares sold upon

exercise of employee

stock options

—

—

(7)

(165 012)

11

—

—

—

—

—

—

4

—

4

Excess tax benefit

(deficiency) on employee

stock options and

restricted shares

—

—

2

—

—

—

—

—

—

—

—

2

—

2

Tax payment for restricted

shares vested

—

—

(2)

—

—

—

—

—

—

—

—

(2)

—

(2)

Share-based compensation

expense

—

—

20

—

—

—

—

—

—

—

—

20

—

20

Dividend declared

—

—

—

—

—

(148)

—

—

—

—

—

(148)

(4)

(152)

Purchase of non-controlling

interests

— — — — — — — — — — — — (37) (37)

Balances at December 31,

2009

100 870 626

50

2 752

955 586

(54)

3 044

(9)

(6)

2

(27)

(1 360)

4 392

17

4 409

Other comprehensive

income

—

—

—

—

(1)

—

—

5

2

(1)

266

271

—

271

Net profit — — — — — 574 — — — — — 574 1 575

Total comprehensive

income for the period

—

—

—

—

(1)

574

—

5

2

(1)

266

845

1

846

Capital increases

684 655

1

25

—

—

—

—

—

—

—

—

26

—

26

Treasury shares purchased

—

—

—

441 996

(26)

—

—

—

—

—

—

(26)

—

(26)

Treasury shares sold upon

exercise of employee

stock options

—

—

(11)

(408 722)

22

—

—

—

—

—

—

11

—

11

Excess tax benefit

(deficiency) on employee —

—

1

—

—

—

—

—

—

—

—

1

—

1