Food Lion 2011 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2011 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

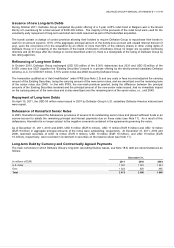

DELHAIZE GROUP FINANCIAL STATEMENTS ’11 // 117

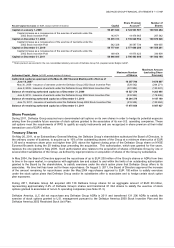

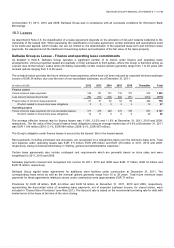

Free cash flow is defined as cash flow before financing activities, investments in debt securities and sale and maturity of debt

securities and can be summarized as follows:

(in millions of EUR) 2011

Net cash provided by operating activities

1 106

Net cash used in investing activities

(1 265)

Sale of debt securities (net) (72)

Free cash flow

(231)

Cash used in investing activities was significantly impacted by the acquisition of Delta Maxi (EUR 574 million, see Note 4.1).

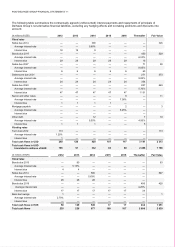

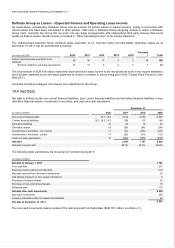

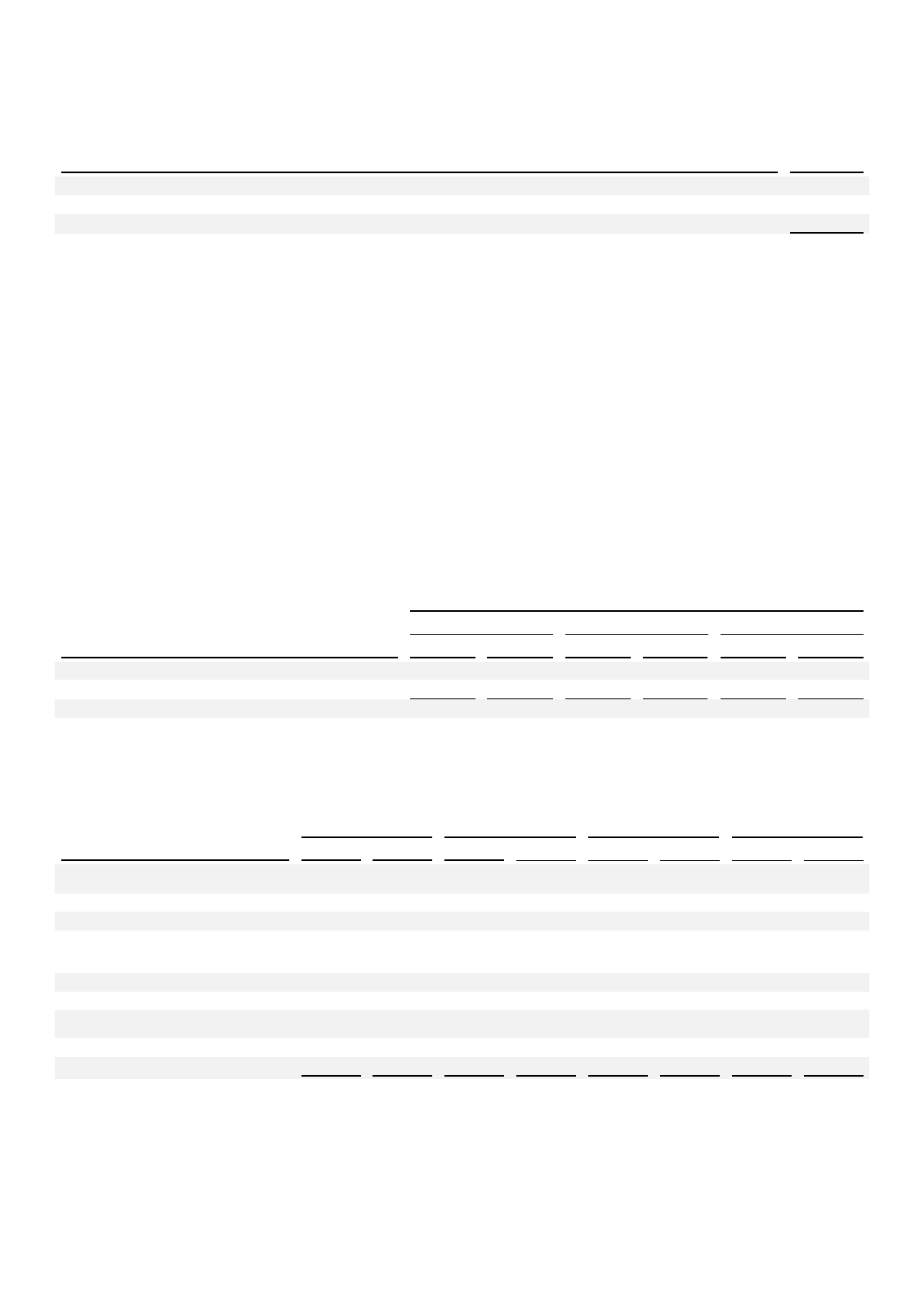

19. Derivative Financial Instruments and Hedging

The Group enters into derivative financial instruments with various counterparties, principally financial institutions with investment

grade credit ratings. The calculation of fair values for derivative financial instruments depends on the type of instruments:

• Derivative interest rate contracts: the fair value of derivative interest rate contracts (e.g., interest rate swap agreements) is

estimated by discounting expected future cash flows using current market interest rates and yield curve over the remaining

term of the instrument.

• Derivative currency contracts: the fair value of forward foreign currency exchange contracts is based on forward exchange

rates.

• Derivative cross-currency contracts: the fair value of derivative cross-currency contracts is estimated by discounting

expected future cash flows using current market interest rates and yield curve over the remaining term of the instrument,

translated at the rate prevailing at measurement date.

Derivative instruments are carried at fair value, being the amount for which a resulting asset could be exchanged or a liability

settled:

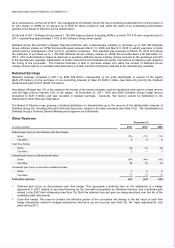

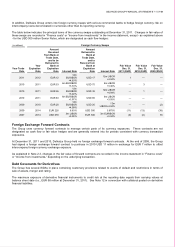

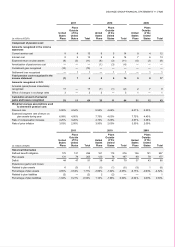

December 31,

2011 2010 2009

(in millions of EUR)

Assets Liabilities Assets Liabilities Assets Liabilities

Interest rate swaps

57 — 61 — 61 —

Cross currency swaps

1 20 5 16 35 40

Total

58 20 66 16 96 40

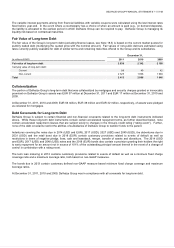

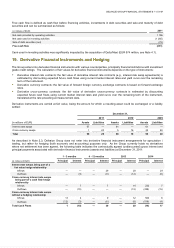

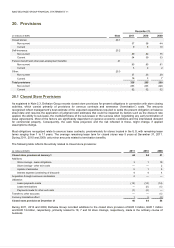

As described in Note 2.3, Delhaize Group does not enter into derivative financial instrument arrangements for speculation /

trading, but rather for hedging (both economic and accounting) purposes only. As the Group currently holds no derivatives

where net settlement has been agreed, the following table indicates the contractually agreed (undiscounted) gross interest and

principal payments associated with derivative financial instruments (assets and liabilities) at December 31, 2011:

(in millions of EUR)

1 - 3 months 4 - 12 months 2013 2014

Principal Interest Principal Interest Principal Interest Principal Interest

Interest rate swaps being part of a

fair value hedge relationship

Inflows

—

—

—

29

—

29

—

29

Outflows

—

(3)

—

(9)

—

(12)

—

(6)

Cross-currency interest rate swaps

being part of a cash flow hedge

relationship

Inflows

—

7

—

7

—

14

232

7

Outflows

—

(15)

—

—

—

(15)

(228)

(15)

Cross-currency interest rate swaps

without a hedging relationship

Inflows

13

4

—

9

—

12

500

6

Outflows (12) (3) — (6) — (8) (518) (4)

Total Cash Flows

1

(10)

—

30

—

20

(14)

17