Food Lion 2011 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2011 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

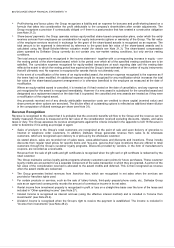

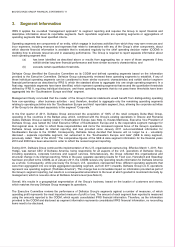

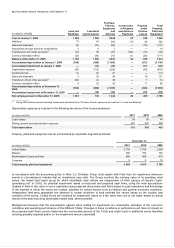

86 // DELHAIZE GROUP FINANCIAL STATEMENTS ’11

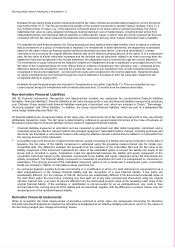

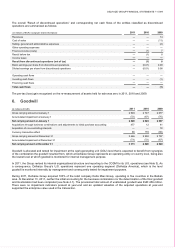

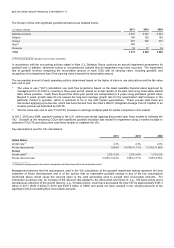

Year ended December 31, 2009 (in millions of EUR) United States Belgium(2)

Southeastern

Europe and

Asia(3) Corporate Total

Revenues(1)

13 618

4 616

1 704

—

19 938

Cost of sales

(9 817)

(3 690)

(1 306)

—

(14 813)

Gross profit

3 801

926

398

—

5 125

Gross margin

27.9 %

20.0 %

23.4 %

—

25.7%

Other operating income

34

36

8

—

78

Selling, general and administrative expenses

(3 046)

(772)

(346)

(28)

(4 192)

Other operating expenses

(60)

(5)

(2)

(2)

(69)

Operating profit

729

185

58

(30)

942

Operating margin

5.4 %

4.0 %

3.4 %

—

4.7 %

Operating profit from discontinued operations

—

1

—

—

1

Other information

Assets

6 927

1 750

897

174

9 748

Liabilities

2 670

1 027

550

1 092

5 339

Capital expenditures

331

115

70

4

520

Non-cash operating activities:

Depreciation and amortization

381

89

36

9

515

Impairment loss(4)

17

3

—

2

22

Share-based compensation

18

1

—

1

20

_______________

(1) All revenues are from external parties.

(2) Belgium includes Delhaize Group’s operations in Belgium and the Grand Duchy of Luxembourg.

(3) Southeastern Europe and Asia includes in 2011 the Group’s operations in Greece, Romania, Serbia, Bulgaria, Bosnia and Herzegovina, Montenegro, Albania

and Indonesia and in 2010 and 2009 the Group’s operations in Greece, Romania and Indonesia.

(4) No impairment loss was recorded or reversed in equity.

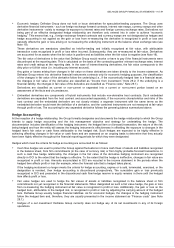

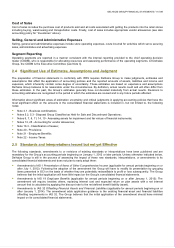

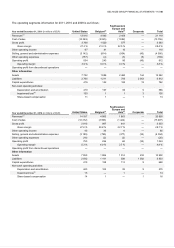

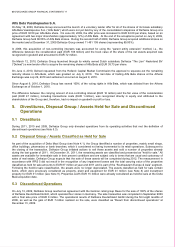

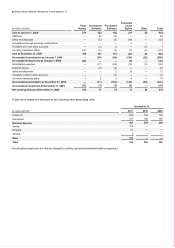

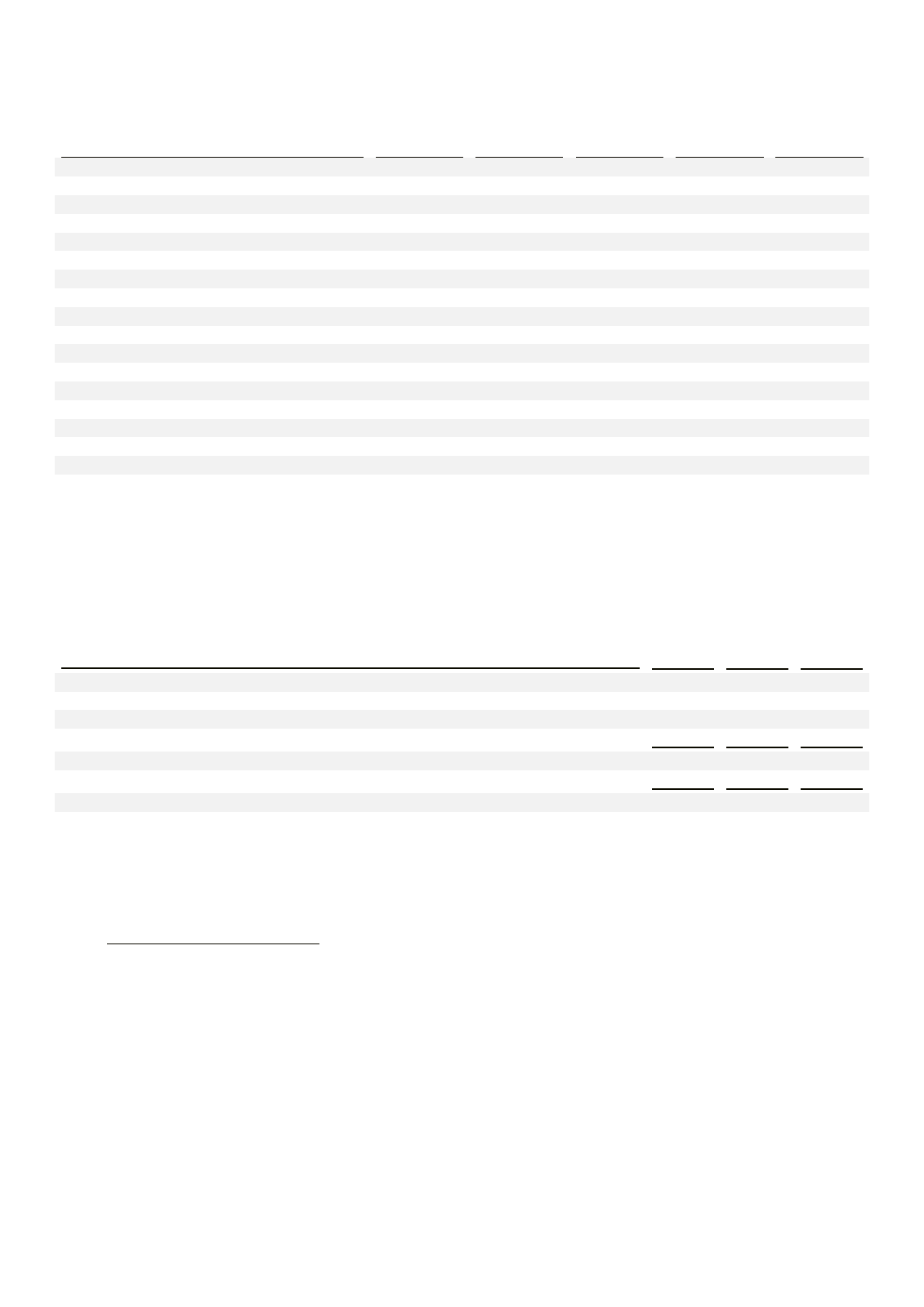

Delhaize Group’s operation of retail supermarkets represents approximately 90% of the Group’s consolidated revenues. The

remaining revenue represents wholesale retail revenues. Total revenues can be further analyzed as follows:

(as a percentage of revenues) 2011 2010 2009

Retail revenues

- Food - perishable

37.9%

40.0%

39.4%

- Food - non-perishable

36.1%

35.5%

35.9%

- Non-food 15.0% 13.8% 14.1%

Total retail revenues

89.0%

89.3%

89.4%

Wholesale revenues 11.0% 10.7% 10.6%

Total revenues

100.0%

100.0%

100.0%

Delhaize Group is not reliant on any individual major customer and, consequently, there are no individual customers where the

total amount of revenue derived from that customer would be more than 10% of Delhaize Group’s revenue.

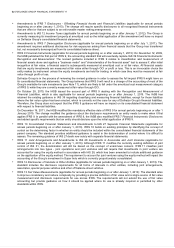

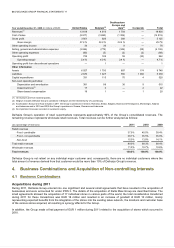

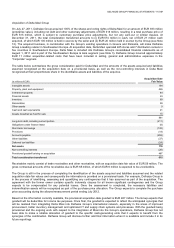

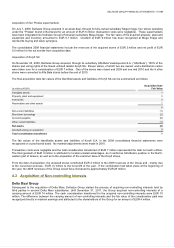

4. Business Combinations and Acquisition of Non-controlling Interests

4.1 Business Combinations

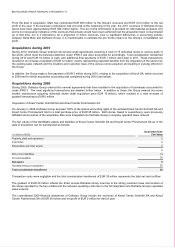

Acquisitions during 2011

During 2011, Delhaize Group entered into one significant and several small agreements that have resulted in the acquisition of

businesses and were accounted for under IFRS 3. The details of the acquisition of Delta Maxi Group are described below. The

small agreements allowed the acquisition of 17 individual stores in various parts of the world, the total consideration transferred

during 2011 for these transactions was EUR 16 million and resulted in an increase of goodwill of EUR 10 million, mainly

representing expected benefits from the integration of the stores into the existing sales network, the locations and customer base

of the various stores acquired, all resulting in synergy effects for the Group.

In addition, the Group made a final payment of EUR 1 million during 2011 related to the acquisition of stores which occurred in

2010.