Food Lion 2011 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2011 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

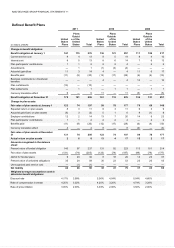

114 // DELHAIZE GROUP FINANCIAL STATEMENTS ’11

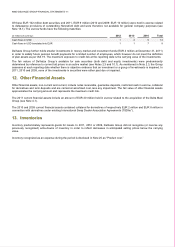

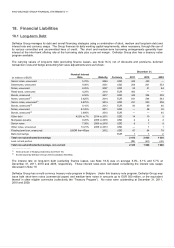

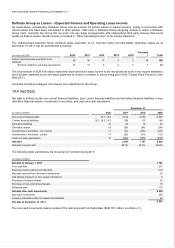

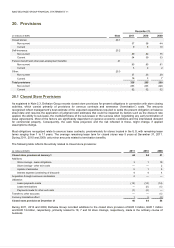

18.2 Short-term Borrowings

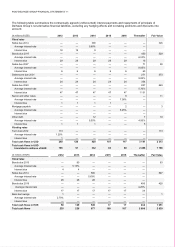

Short-term Borrowings by Currency

(in millions of EUR)

December 31,

2011 2010 2009

U.S. Dollar

—

2

35

Euro 45 14 28

Other currencies 15 — —

Total

60 16

63

The carrying amounts of short-term borrowings approximate their fair values.

On April 15, 2011, Delhaize Group and certain of its subsidiaries, including Delhaize America, LLC, entered into a EUR

600 million, five-year multi-currency, unsecured revolving credit facility agreement (the “New Facility Agreement”).

U.S. Entities

At April 15th, 2011, Delhaize America, LLC terminated all of its commitments under the 2009 Credit Agreement and joined the

New Facility Agreement.

Delhaize America, LLC had no outstanding borrowings under this agreement as of December 31, 2011 and no outstanding

borrowings under the 2009 Credit Agreement as of December 31, 2010 and USD 50 million (EUR 35 million) as of December 31,

2009.

Under the credit facilities that were in place at the various reporting dates, Delhaize America, LLC had no average daily

borrowings during 2011, USD 2 million (EUR 2 million) during 2010 and USD 3 million (EUR 2 million) during 2009. In addition to

the New Facility Agreement, Delhaize America, LLC had a committed credit facility exclusively to fund letters of credit of USD 35

million (EUR 27 million) of which approximately USD 16 million (EUR 13 million) was outstanding to fund letters of credit as of

December 31, 2011, USD 20 million (EUR 15 million) and USD 37 million (EUR 26 million) as of December 31, 2010 and 2009,

respectively.

Further, Delhaize America, LLC has periodic short-term borrowings under uncommitted credit facilities that are available at the

lenders’ discretion and these facilities were USD 150 million (EUR 116 million) at December 31, 2011. As of December 31,

2011, 2010 and 2009, Delhaize America, LLC had no borrowings outstanding under such arrangements, but used USD 5 million

(EUR 4 million) to fund letters of credit at December 31, 2011.

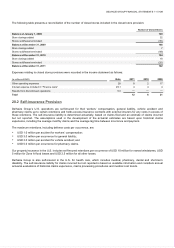

European and Asian Entities

At December 31, 2011, 2010 and 2009, the Group’s European and Asian entities together had credit facilities (committed and

uncommitted) of EUR 864 million (of which EUR 736 million of committed credit facilities and including the EUR 600 million New

facility Agreement: see above), EUR 490 million and EUR 542 million, respectively, under which Delhaize Group can borrow

amounts for less than one year (“Short-term Bank Borrowings”) or more than one year (“Medium-term Bank Borrowings”).

The Short-term Bank Borrowings and the Medium-term Bank Borrowings generally bear interest at the inter-bank offering rate at

the borrowing date plus a pre-set margin, or based on market quotes from banks. In Europe and Asia, Delhaize Group had EUR

60 million in outstanding short-term bank borrowings at December 31, 2011, of which EUR 46 million was drawn from the

committed credit lines, compared to EUR 14 million in outstanding short-term bank borrowings at December 31, 2010 and EUR

28 million borrowings outstanding at December 31, 2009, respectively, with an average interest rate of 2.95%, 4.83% and 3.83%,

respectively. During 2011, the Group’s European and Asian average borrowings were EUR 189 million at a daily average

interest rate of 5.20%.

In addition, European and Asian entities have credit facilities (committed and uncommitted) of EUR 14 million (of which EUR 2

million of committed credit facilities), exclusively to issue bank guarantees. Of these credit facilities approximately EUR 10

million was outstanding to fund letters of guarantees as of December 31, 2011 (EUR 4 million at December 31, 2010 and EUR 3

million at December 31, 2009).

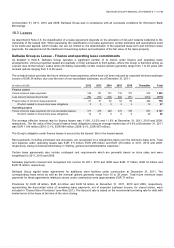

Debt Covenants for Short-term Borrowings

The New Facility Agreement, which replaced the 2009 Credit Agreement, and EUR 129 million committed European bilateral

credit facilities require maintenance of various financial and non-financial covenants. The agreements contain customary

provisions related to events of default and affirmative and negative covenants applicable to Delhaize Group. The negative

covenants contain restrictions in terms of negative pledge, liens, indebtedness of subsidiaries, sale of assets and mergers, as

well as minimum fixed charge coverage ratios and maximum leverage ratios based on non-GAAP measures. None of the debt

covenants restrict the abilities of subsidiaries of Delhaize Group to transfer funds to the parent.