Food Lion 2011 Annual Report Download

Download and view the complete annual report

Please find the complete 2011 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE BEST FOR LIFE

TOGETHER

Annual

rep rt

WWW.DELHAIZEGROUP.COM

2011

Table of contents

-

Page 1

rep rt 2011 Annual W W W . D E L H A I Z E G R O U P . C O M TOGETHER THE BEST FOR LIFE -

Page 2

...of 2011, Delha ize Group's sales netw ork consisted of 3 408 stores generatin g EUR 21.1 billion in re venues and Group share in net proï¬t of EU R 475 million. Delhaize Group employs approximately 160 000 associates worldwide. Delhaize Group has lea ding positions in food ret ailing in key markets... -

Page 3

... 12 14 15 Maxi Food Lion Bottom Dollar Food 17 Private Brands 18 Effective Operational Structures 20 Targeting Efficiencies 22 Local Products REVIEW (1) 24 Financial Review 27 United States 30 Belgium PERFORMANCE The strategy translated into numbers Evolution of the main brands in our... -

Page 4

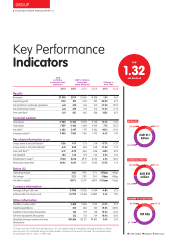

... 856 67.1% (1) These are non-GAAP ï¬nancial measures. (2) Calculated using the weighted average number of shares over the year. (3) Calculated using the total number of shares at the end of the year. (4) Calculated using an exchange rate of 1 EUR = 1.3920 USD. United States Belgium SEE & Asia -

Page 5

... and Chairman of its Energy Policy Committee and Mats Jansson who currently serves as an independent board member of Danske Bank after being President and CEO of SAS, the Scandinavian airline company, from 2006 to 2010. He held positions of increasing responsibility at Swedish food retailer ICA over... -

Page 6

...-OLIVIER BECKERS, CEO For Pierre-Olivier Beckers, CEO of Delhaize Group, 2011 was a year marked both by accomplishments as well as by the uncertainties in the global economy. These had an impact on all of Delhaize Groups' stakeholders. And 2012 will again likely be a time of change and uncertainty... -

Page 7

... a pioneer in food retail with respect to the development and implementation of new technologies in our stores. For example, in Belgium, Delhaize Direct established an important platform for customers to order online and to collect their groceries at a pick-up point in a Delhaize store. Based on the... -

Page 8

...digital strategy that will beneï¬t our customers and be responsive to their changing needs and habits while at the same time beneï¬t the Group by delivering incremental revenue and improving our operational efï¬ciency. million gross annual cost savings by end of 2012 What were the most important... -

Page 9

... of the brand repositioning work at Food Lion and the corresponding sales uplift we are seeing there. And of course there is the promising roll out of Bottom Dollar Food which we believe is a winning store format, responsive to the customer needs. in which we operate, but it is also good business... -

Page 10

... the East coast, from Maine down to Florida and covering 17 states. Performance Ã' READ MORE ON PAGE 27 NUMBER OF STORES 1 607 1 627 1 650 OPERATING PROFIT (in millions of USD) 1 016 998 742 2009 2010 2011 2009 2010 2011 REVENUES (in millions of USD) NUMBER OF ASSOCIATES 19 230 104 655... -

Page 11

... 792 805 821 185 333 368 OPERATING PROFIT (in millions of EUR) NUMBER OF STORES 937 OPERATING PROFIT (in millions of EUR) 236 243 80 68 58 2009 2010 2011 2009 2010 2011 2009 2010 2011 2009 2010 2011 REVENUES (in millions of EUR) NUMBER OF ASSOCIATES 4 845 17 058 17 207 16 857... -

Page 12

GROUP 10 // DELHAIZE GROUP ANNUAL REPORT '11 +4.6% revenue growth -

Page 13

... GROUP ANNUAL REPORT '11 // 11 Our Strategy Delhaize Group has a clear strategy, the New Game Plan , which seeks to deliver profitable revenue growth, achieve best-in-class execution and operate as a responsible citizen. We believe our success is based on a combination of our local go-to-market... -

Page 14

... newer markets. Last year, we accelerated our development in Romania where we opened no less than 33 new stores, increasing the network by 45%. In Indonesia the network expanded by almost 22%. elhaize Group closed the acquisition of Delta Maxi in July 2011. The acquisition provided Delhaize Group... -

Page 15

DELHAIZE GROUP ANNUAL REPORT '11 // 13 Maxi adds 5 new countries to our Group NUMBER OF STORES (AS OF DECEMBER 31, 2011) Serbia Bosnia & Herzegovina 113 231 10 12 19 17 6 2 Montenegro Bulgaria Albania Total 15 6 1 1 147 254 18 14 28 13 18 28 13 18 492 Total 366 44 22 42 18 -

Page 16

... prices. In 2010, Food Lion conducted extensive research among a large number of consumers, not just Food Lion customers, and developed a new strategy to reposition the Food Lion brand based directly on consumer feedback. The comprehensive plan focuses on several elements: Simple, Quality and Price... -

Page 17

... stocks approximately 7 000 items compared to the approximately 28 000 items customers would ï¬nd in a typical supermarket and the 1 000 offered by a traditional discount store. And we have found that the optimal size of a Bottom Dollar Food store is 18 000 square feet while our Food Lion stores... -

Page 18

... Southeastern United States? MH: We began Bottom Dollar Food in North Carolina in 2005. We initially converted 28 Food Lion stores to Bottom Dollar Food stores, and continued to reï¬ne our model. We have found that smaller size formats present our banner most appropriately. What makes Philadelphia... -

Page 19

DELHAIZE GROUP ANNUAL REPORT '11 // 17 Private Brands are internal growth accelerators Delhaize Group is viewed as a pioneer of private brand development. We were one of the first food retailers in Europe to offer customers quality at a good value through our own brands. We have built on this solid... -

Page 20

..., planning and execution, sourcing and procurement, private brand management and pricing expertise. The results of 2011 make us believe that we will be able to exceed our previously announced target of EUR 500 million in gross annual cost savings by the end of 2012. A SHARED SERvICE STRUCTURE... -

Page 21

... platform and centers-of-excellence allowing banners to focus on their go-to-market strategies even more than before. The launch of the Food Lion Brand repositioning and the Bottom Dollar Food expansion have beneï¬ted from the shared services and has allowed them to focus on the customer," explains... -

Page 22

...GROUP ANNUAL REPORT '11 Targeting efï¬ciencies From 2008 to 2010, Delhaize Belgium was able to significantly improve its operating profit and margin as a result of the successful implementation of the Excel Plan. In 2011, Delhaize Belgium built on that success, by introducing Target 2015. This new... -

Page 23

... efï¬cient and allows our associates to be more productive in other areas of the store including being able to focus more on the customer. In 2011, Delhaize Belgium announced the addition of two new distribution centers which are expected to be fully operational by 2015. "Logistics are key to the... -

Page 24

... of the three elements are important, in 2011 we had a significant number of initiatives related to product. Sustainability: Focus on Local Products C AWARD WINNING CR REPORT Delhaize Group won for the second time the prize for its "Corporate Responsibility Progress Report 2010," awarded by the... -

Page 25

...100 stores and supported with a special leaflet. Our sustainability strategy is centered on our three pillars; Products, People and Planet. Within this framework, we have identiï¬ed six Group level focus areas through our materiality process. Alongside these, the responsibility for resource use and... -

Page 26

... ANNUAL REPORT '11 Financial Review REVENUES (in billions of EUR) 19.9 20.8 21.1 Income Statement In 2011, Delhaize Group achieved revenues of EUR 21.1 billion. This represents an increase of 4.6% at identical exchange rates or 1.3% at actual exchange rates due to the weakening of the U.S. dollar... -

Page 27

... of a more new stores opened, including in Southeastern Europe following the acquisition of Maxi and the start of the construction of a new auto- 2009 2010 2011 CAPITAL EXPENDITURES (in millions of EUR) 762 660 520 Balance Sheet At the end of 2011, Delhaize Group's total assets amounted to... -

Page 28

... auditor. On January 12, 2012, Delhaize Group announced, following a thorough portfolio review of its stores, the decision to close one distribution center and 146 stores across its network: 126 stores in the U.S. (113 Food Lion, 7 Bloom and 6 Bottom Dollar Food) and 20 underperforming Maxi... -

Page 29

DELHAIZE GROUP ANNUAL REPORT '11 // 27 Delhaize America operates multiple banners and formats primarily along the Eastern seaboard of the United States. At the end of 2011, Delhaize America operated a total of 1 650 stores in 17 states. With EUR 13.8 billion (USD 19.2 billion) in revenues in 2011, ... -

Page 30

...- 42 000 Number of Stores by State (as of December 31, 2011) Delaware Florida Georgia Kentucky Maine Maryland Massachusetts New Hampshire Total Number of states 23 138 120 10 56 80 26 33 New Jersey New York North Carolina Pennsylvania South Carolina Tennessee Vermont Virginia West Virginia 5 47 511... -

Page 31

...a net increase of 23 stores compared to the prior year. In 2011, Delhaize Group re-launched 200 Food Lion stores located in the Raleigh and Chattanooga markets. This brand strategy work showed good results, especially in the Raleigh, North Carolina market. The trends in customer visits and number of... -

Page 32

... revenues generated I n 2011 Delhaize Belgium generated revenues of over EUR 4.8 billion, an increase of 0.9% compared to 2010. Consumers continued to trade down, as evidenced by the increase in the 365 value line private brand revenues and strong revenue growth at Red Market, the soft discount... -

Page 33

... hours. Low-cost supermarkets - Red Market Red Market supermarkets are new concept stores that combine high quality products, private brands as well as national brands, new technologies and ease of shopping with helpful associates and very low prices. The ï¬rst two Red Markets were opened in 2009... -

Page 34

REvIEW 32 // DELHAIZE GROUP ANNUAL REPORT '11 25.8% market share in Belgium REVENUES (in millions of EUR) 4 616 4 800 4 845 2009 2010 2011 As of December 31, 2011 Stores Average surface (sq.m.) Number of products (Total number of associates : 16 857) 141 1 900 17 000 228 1 125 12 000 18 500... -

Page 35

... of the New Game Plan with respect to pricing and assortment changes. In 2011, gross margin decreased by 22 basis points due to the lower gross margin of Maxi. Excluding Maxi, gross margin for the segment increased by 65 basis points as a result of better supplier terms. Selling, general and... -

Page 36

... bakery products and on great store locations. Albania With 18 stores, a mix of convenience stores and supermarkets, Delhaize Group maintaines its number one position in the Albanian food retail market. +32% revenue growth of the Southeastern Europe & Asia segment at actual exchange rates. Bosnia... -

Page 37

DELHAIZE GROUP ANNUAL REPORT '11 // 35 +46% new stores in Romania Albania (Number of associates : 481) Bosnia and Herzegovina (Number of associates : 1 245) Bulgaria (Number of associates : 2 442) As of December 31, 2011 v Stores Surface range (sq.ft.) Number of products 18 170 - 6 000 16 000... -

Page 38

... in Economics and Sociology Elected 2011 Former Chairman, President and CEO of New England Business Service Former EVP North Atlantic Group Gillette Former Board member of Hannaford Board member of LoJack Corp., The Hannover Insurance Group, IDEXX Corp., Tupperware Brands Corp. Bachelor of Science... -

Page 39

...EXECUTIVE COMMITTEE Pierre-Olivier Beckers (1960) Didier Smits (1962) Managing Director of Papeteries Aubry Former Manager of Advanced Technics Company Master in Economics and Financial Sciences Elected 1996 President and CEO Delhaize Group Belgium's Bel 20 CEO of the Year 2009 Manager of the Year... -

Page 40

... is reviewed and updated from time to time. The latest update of the Charter is available on the Company's website (www.delhaizegroup.com). The Corporate Governance Charter of Delhaize Group includes the rules and policies of the Company, which together with applicable law, the securities exchange... -

Page 41

... statements, Management's Report on the annual accounts and the consolidated ï¬nancial statements, and the annual report • Approval of revenues and earnings press releases • Approval of the publication of the Corporate Responsibility Report 2010 • Review and decision on possible acquisitions... -

Page 42

...President of Human Resources and Legal in 2004. Ms. Ballard then served as Executive vice President, Retail Channel Management of Best Buy, responsible for the Best Buy stores across the United States. In 2010, she assumed the role of CoPresident of the Americas and Executive vice President, leading... -

Page 43

...any off-balance sheet structures on the ï¬nancial statements •฀฀ Review of changes, as applicable, in accounting principles and valuation rules •฀฀ Review of the Internal Audit Plan •฀฀ Review of major ï¬nancial risk exposures and the steps taken by management to monitor, control... -

Page 44

...% above the highest closing stock market price of the Company's shares on Euronext Brussels during the twenty trading days preceding such acquisition. Such authorization has been granted for a period of ï¬ve years as from the date of the Extraordinary General Meeting of May 26, 2011 and extends to... -

Page 45

... mately 0.47% of the total number of outstanding shares of the Company as of that date. On December 31, 2011, the Company's Executive Management owned as a group 856 859 stock options, warrants and restricted stock units representing an equal number of existing or new ordinary shares or ADRs of the... -

Page 46

...the Company's year ended December 31, 2011 will be included in the Company's Annual Report on Form 20-F for such year, which is required to be ï¬led with the U.S. Securities and Exchange Commission by April 30, 2012. The Group's 2010 annual report ï¬led on Form20-F includes management's conclusion... -

Page 47

...within the company support risk management activities including: Legal, Compliance, Internal Audit, Quality Assurance and Food Safety, Insurance, Claims Management, Loss Prevention/Security, Health/Safety, Information Security, Accounting and Finance and Risk Management. These activities support our... -

Page 48

... Upon Change of Control over the Company as of December 31, 2011 Management associates of non-U.S. operating companies received stock options issued by the Board of Directors under the Stock Option Plans 2002 to 2007, granting to the beneï¬ciaries the right to acquire ordinary shares of the Company... -

Page 49

... the Performance Cash Plan provide for cash payments to the beneï¬ciaries at the end of a three-year period that are dependent on Company performance against Board-approved ï¬nancial targets that are closely correlated to building long-term shareholder value. The General Meeting of Shareholders... -

Page 50

...the results of the annual performance review for each executive into account. The Company's Executive vice President for Human Resources assists the Chief Executive Ofï¬cer in this process. Role of Outside Compensation Consultant During 2011, and as in years before, the Company hired an independent... -

Page 51

... Compensation Other Members of Executive Management by Component (in millions of EUR) 1.1 1.4 1.6 2009 2010 2011 LTI - Performance Cash Grants Annual bonus ï¬xed: 36.2% Variable Short-Term Long-Term (LTI) variable: 63.8% - Annual Bonus - Stock Options / Warrants - Restricted Stock Unit... -

Page 52

... before deduction of withholding taxes and social security levy). Performance during 2012 and following years As from performance 2012 the Annual Bonus for the management having the level of Director, vice President, Senior vice President, Executive vice President and CEO will be funded based on two... -

Page 53

... value of the stock option may vary from year to year. As a result, the total number of options granted can also be different from year to year. The following table shows the number of stock options granted to the CEO and the different members of the Executive Management team during the period 2009... -

Page 54

...1.1 2009 CEO 2010 Other Members of Executive Management * Including special signing grant as foreseen in his employment conditions. Other Beneï¬ts, Retirement and Postemployment Beneï¬ts Other beneï¬ts include the use of company-provided transportation, employee and dependent life insurance... -

Page 55

... in line with current market practice for its position and with the Company's Terms of Reference of Executive Management. Executive Management is required to abide by the Company's policies and procedures, including the Company's 2009 2010 2011 Retirement and Post-Employment Beneï¬ts Other... -

Page 56

... in market interest rates. Delhaize Group is exposed to interest rate risk due to working capital ï¬nancing and the overall ï¬nancing strategy. Daily working capital requirements are ï¬nanced with operational cash flows and through the use of various committed and uncommitted lines of credit and... -

Page 57

...and cash equivalents. Delhaize Group manages this risk by obtaining credit insurance for trade receivables and by requiring a minimum credit quality of its ï¬nancial investments (see Note 11 "Investments in Securities" and Note 14 "Receivables" in the Financial Statements). The Group's policy is to... -

Page 58

..."Employee Beneï¬t Plans" to the Financial Statements. Macro-economic Risk Major macro-economic risks of Delhaize Group are reduced consumer spending, cost inflation or deflation and possible consequences of the sovereign debt crisis in Europe. Economic conditions such as employment level, business... -

Page 59

... and diminish the value of our brand names. Risk related to the achievement of cost savings, which may reduce, delay or otherwise hinder our ability to implement our New Game Plan Effective February 1, 2010, the support functions for Food Lion, Bloom, Harveys, Bottom Dollar Food, Hannaford and... -

Page 60

... use, antitrust restrictions, work place safety, public health, environmental protection, community right-to-know, information security and date protection, alcoholic beverage sales and pharmaceutical sales. A number of jurisdictions regulate the licensing of supermarkets, including retail alcoholic... -

Page 61

...of ï¬nancial capacity in the insurance markets. The main risks covered by Delhaize Group's insurance programs are property, liability and health-care. The U.S. operations of Delhaize Group use selfinsured retention programs for workers' compensation, general liability, automotive accident, pharmacy... -

Page 62

Financial Statements -

Page 63

... 24. Expenses from Continuing Operations by Nature 25. Cost of Sales 26. Employee Benefit Expenses 27. Other Operating Income 28. Other Operating Expenses 29. Financial Result 30. Net Foreign Exchange Losses (Gains) 31. Earnings Per Share ("EPS") 32. Related Party Transactions 33. Commitments 34... -

Page 64

... assets Property, plant and equipment Investment property Investment in securities Other financial assets Deferred tax assets Derivative instruments Other non-current assets Total non-current assets Inventories Receivables Income tax receivables Investment in securities Other financial assets... -

Page 65

DELHAIZE GROUP FINANCIAL STATEMENTS '11 // 63 Consolidated Liabilities and Equity (in millions of EUR) Note 16 16 16 16 16 16 16 2011 51 2 785 (65) 3 731 (47) (1 039) 5 416 14 5 430 2010 51 2 778 (59) 3 426 (34) (1 094) 5 068 1 5 069 1 966 684 543 16 233 68 3 510 16 40 57 - 52 17 1 574 393 174... -

Page 66

... Revenues Cost of sales Gross profit Gross margin Other operating income Selling, general and administrative expenses Other operating expenses Operating profit Operating margin Finance costs Income from investments Profit before taxes and discontinued operations Income tax expense Net profit from... -

Page 67

... available for sale Reclassification adjustment to net profit Tax (expense) benefit Unrealized gain (loss) on financial assets available for sale, net of tax Actuarial gain (loss) on defined benefit plans Tax (expense) benefit Actuarial gain (loss) on defined benefit plans, net of tax Exchange gain... -

Page 68

... at January 1, 2009 Other comprehensive income Net profit Total comprehensive income for the period Capital increases Treasury shares purchased Treasury shares sold upon exercise of employee stock options Excess tax benefit (deficiency) on employee stock options and restricted shares Tax payment for... -

Page 69

... 31, 2010 Other comprehensive income Net profit Total comprehensive income for the period Capital increases Call option on own equity instruments Treasury shares purchased Treasury shares sold upon exercise of employee stock options Excess tax benefit (deficiency) on employee stock options and... -

Page 70

..., net Purchase of other financial assets Sale and maturity of other financial assets Settlement of derivatives instruments Net cash used in investing activities Cash flow before financing activities Financing activities Proceeds from the exercise of share warrants and stock options Purchase of call... -

Page 71

...affiliated stores in its sales network and independent wholesale customers and in retailing of non-food products such as pet products. The Company is a limited liability company incorporated and domiciled in Belgium, with its shares listed on NYSE Euronext Brussels and on the New York Stock Exchange... -

Page 72

... paid and the book value of the share of the net assets acquired is recognized as goodwill. Business Combinations and Goodwill Business combinations occurring prior to January 1, 2010, were accounted for using the purchase method. Under this method, the cost of an acquisition is measured as the... -

Page 73

DELHAIZE GROUP FINANCIAL STATEMENTS '11 // 71 Since January 1, 2010, following the revision of IFRS 3, business combinations are accounted for using the acquisition method, which is similar to the purchase method, but has certain significant differences. Under this method, the cost of an ... -

Page 74

... the closing exchange rate; and (c) the income statements are translated at the average daily exchange rate (i.e., the yearly average of exchange rates on each working day). The differences arising from the use of the average daily exchange rate for the income statement and the closing exchange rate... -

Page 75

... income statement. Residual values, useful lives and methods of depreciation are reviewed at each financial year-end and adjusted prospectively, if appropriate. Investment Property Investment property is defined as property (land or building - or part of a building - or both) held by Delhaize Group... -

Page 76

... incurred to bring each product to its present location and condition. Inventories are written down on a case-by-case basis if the anticipated net realizable value (anticipated selling price in the course of ordinary business less the estimated costs necessary to make the sale) declines below the... -

Page 77

DELHAIZE GROUP FINANCIAL STATEMENTS '11 // 75 The recoverable amount of an asset or cash-generating unit is the greater of its value in use and its fair value less costs to sell. In assessing value in use, the estimated future cash flows are discounted to their present value using a discount rate ... -

Page 78

...fair value through profit or loss, any directly attributable transaction costs. The fair value is determined by reference to quoted market bid prices at the close of business on the balance sheet date for financial liabilities actively traded in organized financial markets. • • • Financial... -

Page 79

... ratings at the reporting date. In the case of interest-bearing derivatives, the fair value corresponds to the dirty price or full fair value (i.e. including any interest accrued). Any gains or losses arising from changes in fair value on these derivatives are taken directly to the income statement... -

Page 80

... number of activities required by IFRS in order to appropriately reflect the value of assets and liabilities and related store closing costs, such as a review of net realizable value of inventory or review for impairment of assets or cash generating units (for both activities see accounting policies... -

Page 81

... service costs. The defined benefit obligation is calculated regularly by independent actuaries using the projected unit credit method. The present value of the defined benefit obligation is determined by discounting the estimated future cash outflows using interest rates of high-quality corporate... -

Page 82

... rights used. For certain products or services, such as the sale of lottery tickets, third-party prepaid phone cards, etc., Delhaize Group acts as an agent and consequently records the amount of commission income in its net sales. Rental income from investment property is recognized in profit... -

Page 83

... the purchase cost of products sold and all costs associated with getting the products into the retail stores including buying, warehousing and transportation costs. Finally, cost of sales includes appropriate vendor allowances (see also accounting policy for "Inventories" above). Selling, General... -

Page 84

... case they must be measured at fair value through profit or loss. Delhaize Group is in the process of reviewing the revised guidance in order to assess the full impact IFRS 9 might have on its consolidated financial statements. The Group believes that IFRS 9 will result in a change of the accounting... -

Page 85

... value interest rate risk, cash flow interest rate risk and price risk), credit risk and liquidity risk. Delhaize Group's principal financial liabilities, other than derivatives, comprise mainly debts and borrowings and trade and other payables. These financial liabilities are mainly held in order... -

Page 86

... business, based on the location of customers and stores, which matches the way Delhaize Group manages its operations. The Executive Committee reviews the performance of Delhaize Group's segments against a number of measures, of which operating profit represents the most important measure of profit... -

Page 87

DELHAIZE GROUP FINANCIAL STATEMENTS '11 // 85 The operating segments information for 2011, 2010 and 2009 is as follows: United States 13 815 (10 049) 3 766 27.3 % 67 (3 142) (157) 534 3.9 % - 7 752 2 765 416 410 130 11 Year ended December 31, 2011 (in millions of EUR) Belgium(2) 4 845 (3 825) 1 ... -

Page 88

... % - 897 550 70 36 - - Corporate - - - - - (28) (2) (30) - - 174 1 092 4 9 2 1 Total 19 938 (14 813) 5 125 25.7% 78 (4 192) (69) 942 4.7 % 1 9 748 5 339 520 515 22 20 Revenues (1) Cost of sales Gross profit Gross margin Other operating income Selling, general and administrative expenses Other... -

Page 89

...expects to complete the purchase price accounting during the allowed measurement period ending July 2012. Based on the information currently available, the provisional acquisition-date goodwill is EUR 467 million. The Group expects that goodwill will be deductible for income tax purposes. Once final... -

Page 90

...Schmëtt SA and Knauf Center Pommerlach SA for a total purchase price of EUR 25 million. Both stores, based in Luxembourg, were previously affiliated stores and as of the acquisition date were integrated into Delhaize Group's company operated sales network. The fair values of the identifiable assets... -

Page 91

... Image and represents buying and sales synergies. The consolidated 2009 financial statements include the revenues of the acquired stores of EUR 3 million and net profit of EUR 0.5 million for the six months from acquisition date. Acquisition of Koryfi SA On November 23, 2009, Delhaize Group acquired... -

Page 92

... a number of properties, mainly small shops, office buildings, pharmacies or bank branches, which it considered not being incremental to its retail operations. Subsequent to the closing of the transaction, Delhaize Group initiated actions to sell these assets and sold a number of properties already... -

Page 93

... EUR, except per share information) 2011 - - - - - - - - - - - - - - 2010 - - - - (1) (1) - (1) (0.01) (0.01) - - - - 2009 14 (11) (2) - 7 8 - 8 0.09 0.08 - (1) - (1) Revenues Cost of sales Selling, general and administrative expenses Other operating expenses Finance income (costs) Result before... -

Page 94

... calculations: 2011 United States Growth rate Europe Growth rates (1) 2010 2.3% 10.79%-11.71% 2.5%-2.9% 7.04%-7.77% 2009 2.0% 11.53%-11.65% 1.7%-2.0% 7.63%-8.95% (1) 2.3% 10.44% 2.5%-3.3% 10.25%-14.33% Pre-tax discount rate Pre-tax discount rates _____ (1) Weighted average growth rate used to... -

Page 95

... of 0.45% and 0.70% for Food Lion and Hannaford, respectively. The royalty rates for the various Maxi brands range from 0.33% to 1.13% depending on the individual local strengths of the different brands. No impairment loss of trade names was recorded or reversed in 2011, 2010 or 2009. See Note 8 for... -

Page 96

...following cash generating units: December 31, (in millions of EUR) 2011 200 167 367 128 21 2 151 518 2010 193 162 355 - - - - 355 2009 179 150 329 - - - - 329 Food Lion Hannaford Delhaize America Serbia Bulgaria Albania Maxi Total Amortization expenses are mainly charged to selling, general and... -

Page 97

... impairment at December 31, 2011 Net carrying amount at December 31, 2011 Cost at January 1, 2010 Additions Sales and disposals Acquisitions through business combinations Transfers (to) from other accounts Currency translation effect Balance at December 31, 2010 Accumulated depreciation at January... -

Page 98

..." to "Land and Buildings." Depreciation expense is included in the following line items of the income statement: (in millions of EUR) 2011 56 457 513 2010 56 447 503 2009 44 409 453 Cost of sales Selling, general and administrative expenses Total depreciation Property, plant and equipment can... -

Page 99

... to 126 stores in the U.S. (113 Food Lion, 7 Bloom and 6 Bottom Dollar stores) and one distribution center, while the underperformance of 20 Maxi stores (in Serbia, Bulgaria and Bosnia and Herzegovina) was already reflected in the fair values of the related assets in the opening balance sheet (see... -

Page 100

98 // DELHAIZE GROUP FINANCIAL STATEMENTS '11 The fair value of investment property amounted to EUR 116 million, EUR 92 million and EUR 69 million at December 31, 2011, 2010 and 2009, respectively. The fair values for disclosure purposes have been determined using either the support of qualified ... -

Page 101

..., 2010 Financial assets measured at amortized cost Financial assets measured at fair value Derivatives through profit or loss Derivatives through equity Available for sale through equity (in millions of EUR) Note Loans and Receivables Total Non-Current Investments in securities Other financial... -

Page 102

..., 2009 Financial assets measured at amortized cost Financial assets measured at fair value Derivatives through profit or loss Derivatives through equity Available for sale through equity (in millions of EUR) Note Loans and Receivables Total Non-Current Investments in securities Other financial... -

Page 103

...equity Current Available for sale - through equity Derivatives - through profit or loss Derivatives - through equity Total financial assets measured at fair value 11 19 19 11 19 19 124 - - 12 - - 136 2 96 - - - - 98 - - - - - - - 126 96 - 12 - - 234 During 2010 EUR 1 million of securities were... -

Page 104

...- current portion Obligations under finance leases Derivative instruments Accounts payable Total financial liabilities December 31, 2009 Financial liabilities being part of a fair value hedge relationship 543 - - - - - - - 543 Financial liabilities measured at fair value Derivatives through profit... -

Page 105

... sheet date, which are classified as current assets. The carrying amounts of the available-for-sale assets are as follows: December 31, (in millions of EUR) 2011 13 93 106 2010 125 43 168 2009 126 12 138 Non-current Current Total At December 31, 2011, the Group's investments in debt securities... -

Page 106

..., 2011) in order to satisfy future pension benefit payments for a limited number of employees, which however do not meet the definition of plan assets as per IAS 19. The maximum exposure to credit risk at the reporting date is the carrying value of the investments. The fair values of Delhaize Group... -

Page 107

... Total Trade receivables credit risk is managed by the individual operating entities and credit rating is continuously monitored either based on internal rating criteria or with the support of third party service providers and the requirement for an impairment is analyzed at each reporting date... -

Page 108

... share premium account. The Board of Directors of Delhaize Group may, for this increase in capital, limit or remove the preferential subscription rights of Delhaize Group's shareholders, within certain legal limits. In 2011, Delhaize Group issued 336 909 shares of common stock (2010: 684 655; 2009... -

Page 109

...'s shares or ADRs from time to time in the open market, in compliance with applicable law and subject to and within the limits of an outstanding authorization granted to the Board by the shareholders, to satisfy exercises under the stock option plans that Delhaize Group offers to its associates. No... -

Page 110

... exercises of stock options held by management of its non-U.S. operating companies. This mandate was renewed on March 15, 2010 and allows the institution to purchase up to 1 100 000 Delhaize Group ordinary shares on NYSE Euronext Brussels until December 31, 2013. This credit institution makes its... -

Page 111

... Stock Incentive Plan, the Group may have to issue new ordinary shares, to which payment in 2012 of the 2011 dividend is entitled, between the date of adoption of the annual accounts by the Board of Directors and the date of their approval by the Ordinary General Meeting of May 24, 2012. The Board... -

Page 112

...inter-bank offering rate at the borrowing date plus a pre-set margin. Delhaize Group also has a treasury notes program available. The carrying values of long-term debt (excluding finance leases, see Note 18.3), net of discounts and premiums, deferred transaction costs and hedge accounting fair value... -

Page 113

...the ordinary shares or other voting rights of Delhaize Group or if a majority of the members of the board of directors of Delhaize Group no longer are so-called continuing directors and (ii) 60 days after the change in control described under (i), there is a downgrade of the rating of Delhaize Group... -

Page 114

... (undiscounted) interest payments and repayments of principals of Delhaize Group's non-derivative financial liabilities, excluding any hedging effects and not taking premiums and discounts into account: (in millions of USD) 2012 - - 18 - - 29 - - 6 - - 24 - - 47 - - 1 - - - - - 1 113 1.25% 1 240... -

Page 115

... can be required to pay. Delhaize Group is managing its liquidity risk based on contractual maturities. Fair Value of Long-term Debt The fair value of the Group's long-term debt (excluding finance leases, see Note 18.3) is based on the current market quotes for publicly traded debt (multiplying... -

Page 116

... Under the credit facilities that were in place at the various reporting dates, Delhaize America, LLC had no average daily borrowings during 2011, USD 2 million (EUR 2 million) during 2010 and USD 3 million (EUR 2 million) during 2009. In addition to the New Facility Agreement, Delhaize America, LLC... -

Page 117

...and EUR 54 million at December 31, 2011, 2010 and 2009, respectively, representing the discounted value of remaining lease payments, net of expected sublease income, for closed stores, were included in "Closed Store Provisions" (see Note 20.1). The discount rate is based on the incremental borrowing... -

Page 118

... Lease Income As noted above, occasionally, Delhaize Group acts as a lessor for certain owned or leased property, mainly in connection with closed stores that have been sub-leased to other parties, retail units in Delhaize Group shopping centers or within a Delhaize Group store. Currently the... -

Page 119

... the rate prevailing at measurement date. Derivative instruments are carried at fair value, being the amount for which a resulting asset could be exchanged or a liability settled: December 31, 2011 (in millions of EUR) Interest rate swaps Cross currency swaps Total 2010 Assets 61 5 66 2009 Assets... -

Page 120

... using statistical methods in the form of a regression analysis. Changes in fair values were recorded in the income statement as finance costs as follows (see Note 29.1): December 31, (in millions of EUR) Note 29.1 29.1 2011 5 (5) - 2010 3 (3) - 2009 (8) 8 - Losses (gains) on Interest rate... -

Page 121

... of default and restrictions in terms of sale of assets, merger and rating. The maximum exposure of derivative financial instruments to credit risk at the reporting date equals their carrying values at balance sheet date (i.e., EUR 58 million at December 31, 2011). See Note 12 in connection with... -

Page 122

... FINANCIAL STATEMENTS '11 20. Provisions December 31, (in millions of EUR) Note 20.1 2011 37 9 2010 36 8 82 39 80 2 35 3 285 233 52 2009 44 10 75 33 81 2 28 7 280 228 52 Closed stores: Non-current Current Self-insurance: Non-current Current Pension benefit and other post-employment benefits... -

Page 123

... to closed store provisions were recorded in the income statement as follows: (in millions of EUR) Note 28 29.1 5.3 2011 8 4 - 12 2010 2 4 - 6 2009 17 4 - 21 Other operating expenses Interest expense included in "Finance costs" Results from discontinued operations Total 20.2 Self-insurance... -

Page 124

... The cost of defined benefit pension plans and other post-employment medical benefits and the present value of the pension obligations are determined using actuarial valuations. These valuations involve making a number of assumptions about, e.g., discount rate, expected rate of return on plan assets... -

Page 125

...sharing contributions are used to offset plan expenses. The profit-sharing contributions to the retirement plan are discretionary and determined by Delhaize America, LLC's Board of Directors. The profit-sharing plans also include a 401(k) feature that permits Food Lion and Sweetbay employees to make... -

Page 126

...balance sheet: Present value of funded obligation Fair value of plan assets Deficit for funded plans Present value of unfunded obligations Unrecognized past service cost Net liability Weighted average assumptions used to determine benefit obligations: Discount rate Rate of compensation increase Rate... -

Page 127

... the United States 2010 Plans Outside of the United States 2009 Plans Outside of the United States (in millions of EUR) United States Plans Total United States Plans Total United States Plans Total Component of pension cost: Amounts recognized in the income statement: Current service cost... -

Page 128

...79 United States Plans 32 9 2 (14) Total 69 17 9 (22) (1) 10 (2) 80 Balance sheet reconciliation: Balance sheet liability at January 1 Pension expense recognized in the income statement in the year Amounts recognized in OCI Employer contributions made in the year Benefits paid directly by company... -

Page 129

... trend rate Weighted-average actuarial assumptions used to determine benefit cost: Discount rate Current health care cost trend Ultimate health care cost trend Year of ultimate trend rate 2010 4.77% 9.00% 5.00% 2017 5.38% 9.25% 5.00% 2016 2009 5.38% 9.25% 5.00% 2016 5.80% 9.77% 5.00% 2015 3.80... -

Page 130

... payments made by the Group. The exercise price associated with stock options is dependent on the rules applicable to the relevant stock option plan. The exercise price is either the Delhaize Group share price on the date of the grant (US plans) or the Delhaize Group share price on the working day... -

Page 131

... FINANCIAL STATEMENTS '11 // 129 Delhaize Group stock options granted to associates of non-U.S. operating companies were as follows: Number of shares Underlying Award Issued 290 078 198 977 230 876 Plan 2011 grant under the 2007 Stock option plan 2010 grant under the 2007 Stock option plan 2009... -

Page 132

...: 2011 Share price (in EUR) Expected dividend yield (%) Expected volatility (%) Risk-free interest rate (%) Expected term (years) 2010 60.55 2.5 26.6 1.5 5.0 2009 49.41 2.5 28.5 2.8 5.0 49.99 2.6 25.9 2.3 5.3 U.S. Operating Entities Stock Options and Warrants Plans Since 2009, Delhaize Group... -

Page 133

... 2019 2018 2017 2016 2015 2014 2013 2012 Various Delhaize America 2000 Stock Incentive (1) Plan - Options _____ (1) Various Including the stock options granted under the 1996 Food Lion Plan and the 1998 Hannaford Plan. Activity related to the "Delhaize Group 2002 Stock Incentive Plan" and the... -

Page 134

... weighted average assumptions: 2011 Share price (in USD) Expected dividend yield (%) Expected volatility (%) Risk-free interest rate (%) Expected term (years) 2010 78.33 2.5 25.2 1.6 4.0 2009 70.27 2.6 26.3 2.3 4.0 78.42 2.9 26.0 1.2 4.0 U.S. Operating Entities Restricted Stock Unit Awards Plan... -

Page 135

... at end of year Shares 597 111 128 717 (185 549) (19 695) 520 584 Shares 716 350 123 917 (221 141) (22 015) 597 111 Shares 703 110 150 073 (117 756) (19 077) 716 350 The weighted average fair value at date of grant for restricted stock unit awards granted during 2011, 2010 and 2009 was USD 78... -

Page 136

... tax credits Derecognition of previously recorded deferred tax assets Deferred tax expense relating to changes in tax rates or the imposition of new taxes Total income tax expense from continuing and discontinued operations Net profit (2) - (1 226 ) 3 - 2 (1) 245 575 _____ (1) In 2010, current... -

Page 137

... on prior years Changes in tax rate or imposition of new taxes Other Effective tax rate (1) (2) In 2011, approximately 49% (whereas in 2010: 61% and in 2009: 73%) of Delhaize Group's consolidated profit before tax was attributable to Delhaize Group's U.S. operations, which had a tax rate of 35... -

Page 138

..., 2009 Charge (credit) to equity for the year Charge (credit) to profit or loss for the year Effect of change in tax rates Acquisition Transfers to/from other accounts Currency translation effect Net deferred tax liabilities at December 31, 2010 Charge (credit) to equity for the year Charge (credit... -

Page 139

... of EUR) 2011 15 145 611 15 756 2010 14 905 592 15 497 2009 14 255 558 14 813 Product cost, net of vendor allowances and cash discounts Purchasing, distribution and transportation costs Total Delhaize Group receives allowances and credits from suppliers mainly for in-store promotions, co... -

Page 140

... normal course of operating supermarkets. (in millions of EUR) 2011 8 135 13 13 169 2010 (2) 14 3 5 20 2009 36 22 9 2 69 Store closing and restructuring expenses Impairment Losses on sale of property, plant and equipment Other Total In 2011, Delhaize Group incurred store closing expenses of EUR... -

Page 141

... derivatives used for economic hedging purposes (included in the line item "Fair value losses (gains) on currency swaps"). Borrowing costs attributable to the construction or production of qualifying assets were capitalized using an average interest rate of 6.2%, 7.5% and 6.9% in 2011, 2010 and 2009... -

Page 142

... contracts Other investing income Total 30 No impairment losses on financial assets were incurred during 2011, 2010 and 2009. 30. Net Foreign Exchange Losses (Gains) The exchange differences charged (credited) to the income statement, excluding the impact of hedge accounting and economic hedges... -

Page 143

... Several of the Group's subsidiaries provide post-employment benefit plans for the benefit of employees of the Group. Payments made to these plans and receivables from and payables to these plans are disclosed in Note 21. The Company's Remuneration Policy for Directors and the Executive Management... -

Page 144

... Total compensation expense recognized in the income statement _____ (1) (2) (3) Short-term benefits include the annual bonus payable during the subsequent year for performance achieved during the respective years. The members of Executive Management benefit from corporate pension plans... -

Page 145

... Subsequent Events On January 12, 2012, Delhaize Group announced, following a thorough portfolio review of its stores, the decision to close one distribution center and 146 stores across its network: 126 stores in the U.S. (113 Food Lion, 7 Bloom and 6 Bottom Dollar Food) and 20 underperforming Maxi... -

Page 146

144 // DELHAIZE GROUP FINANCIAL STATEMENTS '11 36. List of Consolidated and Associated Companies and Joint Ventures A. Fully Consolidated Ownership Interest in % 2011 2010 2009 Alfa Beta Vassilopoulos S.A. Anadrasis S.A. Aniserco SA Athenian Real Estate Development, Inc. ATTM Consulting and ... -

Page 147

... Rue d'Olm 51, 8281 Kehlen, Grand-Duchy of Luxembourg 911 Highway 188, Ochlocknee, GA 31773, U.S.A. Everdongenlaan 21, 2300 Turnhout, Belgium 3735 Beam Rd, Unit B, Charlotte, NC 28217, U.S.A. 2110 Executive Drive, Salisbury, NC 28187, U.S.A. 145 Pleasant Hill Road, Scarborough, ME 04074, U.S.A. 145... -

Page 148

...Delimmo SA on August 31, 2010. Euromax SHPK was renamed into Delhaize Albania SHPK during 2011. Delta Maxi d.o.o. Banja Luka was renamed into Delhaize BH d.o.o. Banja Luka during 2011. Markant-Lux S.A. was renamed into Delhaize Distribution Luxembourg S.A.during 2011. Delta Maxi d.o.o. Podgorica was... -

Page 149

... Current liabilities Cash flows of Super Indo included in Delhaize Group's cash flow statements were: (in millions of EUR) 2011 6 (8) - 2010 6 (3) - 2009 6 (1) - Net cash provided by operating activities Net cash used in investing activities Net cash used in financing activities Revenue... -

Page 150

148 // DELHAIZE GROUP FINANCIAL STATEMENTS '11 Supplementary Information Quarterly Data (Unaudited) (in millions of EUR, except earnings per share) 2011 Full Year 21 119 5 363 25.4% (4 500) 21.3% 812 3.8% 475 475 1st Quarter 5 044 1 290 25.6% (1 090) 21.6% 218 4.3% 126 126 2nd Quarter 5 107 1 ... -

Page 151

... 2 2 559 Number of Associates (at year-end) 2011 Full-time Part-time FTE(1) Male Female Total 2010 61 617 77 005 103 051 68 294 70 328 138 622 2009 63 980 74 139 103 833 68 138 69 981 138 119 78 945 80 911 121 648 77 175 82 681 159 856 Geographical Split 2011 Total United States Belgium Greece... -

Page 152

150 // DELHAIZE GROUP FINANCIAL STATEMENTS '11 Organic Revenue Growth Reconciliation (in millions of EUR) 2011 21 119 693 21 812 - 2010 20 850 - 20 850 - % Change 1.3% 4.6% Revenues Effect of exchange rates Revenues at identical exchange rates Divestitures Acquisitions Organic revenue growth (... -

Page 153

DELHAIZE GROUP FINANCIAL STATEMENTS '11 // 151 Results at Identical Exchange Rates (in millions of EUR, except per share amounts) 2011 At Actual Rates Effect of Exchange Rates 693 26 13 13 0.14 0.14 28 2010 At Identical Rates 21 812 838 488 488 4.85 4.82 (203) 2011/2010 At Actual Rates +1.3% -20... -

Page 154

...Net dividend Pay-out ratio (net profit) Shareholders' equity(3) Share price (year-end) RATIOS (%) Operating margin Effective tax rate of continuing operations Net margin Net debt to equity(1) CURRENCY INFORMATION Average EUR per USD rate EUR per USD rate at year-end OTHER INFORMATION Number of sales... -

Page 155

... balance sheet shows total assets of EUR 12 242 million and the consolidated income statement shows a consolidated profit (group share) for the year then ended of EUR 475 million. The board of directors of the company is responsible for the preparation of the consolidated financial statements. This... -

Page 156

... requirements applicable in Belgium. Additional comment The preparation and the assessment of the information that should be included in the directors' report on the consolidated financial statements are the responsibility of the board of directors. Our responsibility is to include in our report... -

Page 157

... average of various traditional valuation methods can be used. Generally, the net equity method is applied and is adjusted with potential unrecognized capital gain if any. The measurement of foreign investments is calculated by using the year-end exchange rate. Once selected, the valuation method... -

Page 158

...acquisition cost of the purchased treasury shares. However, in case the option expires and it is not exercised, then the recognized premium is recorded as expense in the income statement. Summary of the net earnings (loss) per share of Delhaize Group SA: 2011 Net earnings (loss) per share 2.94 2010... -

Page 159

...STATEMENTS '11 // 157 Summary Company Accounts of Delhaize Group SA Assets (in millions of EUR) December, 31 2011 2010 7 697 12 111 387 7 187 908 216 493 42 148 9 8 605 Fixed assets Establishment costs Intangible fixed assets Tangible fixed assets Financial fixed assets Current assets Inventories... -

Page 160

... Stock Incentive Plan, the Company might have to issue new ordinary shares, to which coupon no. 50 entitling to the payment of the 2011 dividend is attached, between the date of adoption of the annual accounts by the Board of Directors and the date of their approval by the Ordinary General Meeting... -

Page 161

... end of the financial year Analysis of share capital Class of shares Ordinary shares of no nominal value Registered shares or bearer shares Registered Bearer Treasury shares held by The company itself Its subsidiaries Commitments to issue new shares On the exercise of subscription rights Number of... -

Page 162

...) and the New york Stock Exchange (www.nyse.com). Detailed information on trading activity and share prices can also be found in the financial section of many newspapers. (2011 - in EUR) 60 Share Performance in 2011 On December 30, 2011, the closing price of Delhaize Group's ordinary share on NySE... -

Page 163

... (EUR 1.29 the prior year). The net dividend of EUR 1.32 per share will be payable to owners of ordinary shares against coupon no. 50. The Delhaize Group shares will start trading ex-coupon on May 29, 2012 (opening of the market). The record date (i.e. the date at which shareholders are entitled... -

Page 164

...rst time purchasers the opportunity to make purchases, reinvest dividends, deposit certiï¬cates for safekeeping and sell shares. For further information on Citibank's International Direct Investment Program for Delhaize Group, please visit www.citi. com/dr or contact Citibank Shareholder Services... -

Page 165

...The next Ordinary General Meeting will take place on Thursday, May 24, 2012 at Delhaize Group's Corporate Support Ofï¬ce, Square Marie Curie 40, 1070 EUR 1.32 net dividend per share INFORMATION DELHAIZE GROUP SHARE 2011 Share price (in EUR) Price: year-end average (close) highest (intraday) lowest... -

Page 166

...growth excluding sales from acquisitions and divestitures at identical currency exchange rates, and adjusted for calendar effects. Direct goods Goods sold to customers. Company-operated store A store operated directly by Delhaize Group. Enterprise value Market capitalization plus net debt. Other... -

Page 167

... Revenues include the sale of goods and point of sale services to customers, including wholesale and afï¬liated customers, relating to the normal activity of the Company (the sale of groceries and pet products), net of discounts, allowances and rebates granted to those customers. Selling, general... -

Page 168

...through the email alert service to receive other information: agendas of the general meetings, press releases, projects of modiï¬cations of Articles of Association, special reports from the Board of Directors, publication of annual report, statutory accounts, dividend payment, number of outstanding...