Thrifty Car Rental 2010 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2010 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

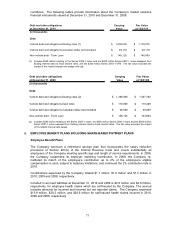

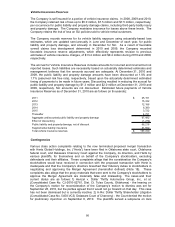

Vehicle Insurance Reserves

The Company is self insured for a portion of vehicle insurance claims. In 2008, 2009 and 2010,

the Company retained risk of loss up to $5.0 million, $7.5 million and $7.5 million, respectively,

per occurrence for public liability and property damage claims, including third-party bodily injury

and property damage. The Company maintains insurance for losses above these levels. The

Company retains the risk of loss on SLI policies sold to vehicle rental customers.

The Company records reserves for its vehicle liability exposure using actuarially-based loss

estimates, which are updated semi-annually in June and December of each year, for public

liability and property damage, and annually in December for SLI. As a result of favorable

overall claims loss development determined in 2010 and 2009, the Company recorded

favorable insurance reserve adjustments, which effectively represents revision to previous

estimates of vehicle insurance charges, of $13.4 million and $9.4 million during 2010 and 2009,

respectively.

The accrual for Vehicle Insurance Reserves includes amounts for incurred and incurred but not

reported losses. Such liabilities are necessarily based on actuarially determined estimates and

management believes that the amounts accrued are adequate. At December 31, 2010 and

2009, the public liability and property damage amounts have been discounted at 1.0% and

1.7% (assumed risk free rate), respectively, based upon the actuarially determined estimated

timing of payments to be made in future years. Discounting resulted in reducing the accrual for

public liability and property damage by $1.3 million and $2.0 million at December 31, 2010 and

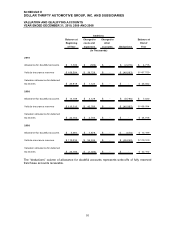

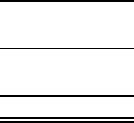

2009, respectively. SLI amounts are not discounted. Estimated future payments of Vehicle

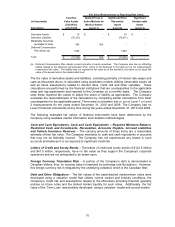

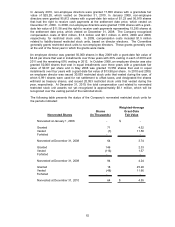

Insurance Reserves as of December 31, 2010 are as follows (in thousands):

2011 25,151$

2012 15,332

2013 12,186

2014 6,380

2015 3,722

Thereafter 4,721

Aggregate undiscounted public liability and property damage 67,492

Effect of discounting (1,274)

Public liability and property damage, net of discount 66,218

Supplemental liability insurance 41,502

Total vehicle insurance reserves 107,720$

Contingencies

Various class action complaints relating to the now terminated proposed merger transaction

with Hertz Global Holdings, Inc. (“Hertz”) have been filed in Oklahoma state court, Oklahoma

federal court, and Delaware Chancery Court against the Company, its directors, and Hertz by

various plaintiffs, for themselves and on behalf of the Company's stockholders, excluding

defendants and their affiliates. These complaints allege that the consideration the Company's

stockholders would have received in connection with the proposed transaction with Hertz is

inadequate and that the Company's directors breached their fiduciary duties to stockholders in

negotiating and approving the Merger Agreement (hereinafter defined) (Note 18). These

complaints also allege that the proxy materials that were sent to the Company's stockholders to

approve the Merger Agreement are materially false and misleading. The cases and their

current status are as follows: 1) Henzel v. Dollar Thrifty Automotive Group, Inc., et al.

(Consolidated Case No. CJ-2010-02761, Dist. Ct. Tulsa County, Oklahoma) - the hearing on

the Company’s motion for reconsideration of the Company’s motion to dismiss was set for

September 28, 2010, but the parties agreed that it would not go forward on that day. This case

has not been dismissed but is currently inactive; 2) In Re: Dollar Thrifty Shareholder Litigation

(Consolidated Case No. 5458-VCS, Delaware Court of Chancery) - the Court denied the motion

for preliminary injunction on September 8, 2010. The plaintiffs served a subpoena on Avis

86