Thrifty Car Rental 2010 Annual Report Download - page 46

Download and view the complete annual report

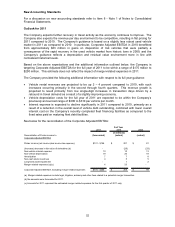

Please find page 46 of the 2010 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.investments. Non-vehicle capital expenditures were $15.5 million. These expenditures consisted

primarily of airport facility improvements for the Company’s rental locations and investments in IT

equipment and systems.

Cash used in investing activities was $198.4 million for 2008. The principal use of cash in investing

activities was the purchase of revenue-earning vehicles, which totaled $2.2 billion. This use of cash

offset $2.5 billion in proceeds from the sale of used revenue-earning vehicles. Restricted cash at

December 31, 2008 increased $463.6 million from the previous year, including $454.7 million

available for vehicle purchases or debt service, coupled with $8.9 million of interest income earned

on restricted cash and investments. Non-vehicle capital expenditures were $28.9 million. These

expenditures consisted primarily of airport facility improvements for the Company’s rental locations

and investments in IT equipment and systems. In addition, the Company used cash for franchise

acquisitions of $2.1 million in 2008.

Financing Activities

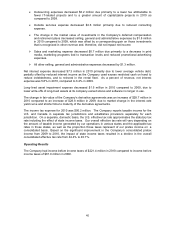

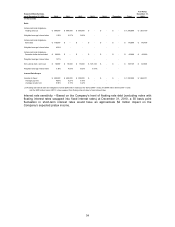

Cash used in financing activities was $340.1 million in 2010, primarily due to $400 million of

scheduled debt repayments on the Series 2005-1 notes and $100 million of scheduled debt

repayments on the Series 2006-1 notes, as well as a net reduction in Canadian debt of $20 million

and a $10 million scheduled repayment of the Term Loan. The Company also paid $11.8 million in

deferred financing costs associated with the issuance of the Series 2010-1 VFN, Series 2010-2 VFN

and Series 2010-3 VFN. These uses of cash were partially offset by the issuance of the Series

2010-1 VFN totaling $200 million.

Cash used in financing activities was $644.1 million in 2009, primarily due to the repayment of

amounts outstanding under the liquidity facility and the conduit facility in the amount of $274.9 million

and $215.0 million, respectively. Additionally, due to the non-renewal of its vehicle manufacturer and

bank lines of credit, the Company repaid $233.7 million of debt outstanding under these

arrangements. The Company also prepaid $20 million of the Term Loan and paid $6.6 million in

deferred financing cost associated with amendments to the Senior Secured Credit Facilities. The

Company also paid $6.6 million in fees related to the issuance of an additional 6.6 million shares of

common stock in November 2009. These uses of cash were partially offset by $129.6 million of

proceeds from the issuance of common stock.

Cash used in financing activities was $180.2 million in 2008 primarily due to the maturity of the 2004

Series asset-backed medium-term notes totaling $500 million, a $70.6 million repayment of the Term

Loan and a decrease of $49.0 million in the Company’s limited partner interest in the Canadian

funding limited partnership (the Company’s Canadian fleet financing facility), partially offset by a net

increase in the issuance of commercial paper, including the liquidity facility of $249.1 million and an

increase of $203.0 million under the conduit facility.

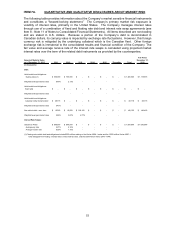

Contractual Obligations and Commitments

The Company has various contractual commitments primarily related to asset-backed medium-term

notes, asset-backed VFNs and short-term borrowings outstanding for vehicle purchases, a non-

vehicle related term loan, airport concession fee and operating lease commitments related to airport

and other facilities, technology contracts, and vehicle purchases. The Company expects to fund

these commitments with existing cash resources, cash generated from operations, sales proceeds

from disposal of used vehicles and future issuances of asset-backed notes as existing medium-term

notes mature.

45