Thrifty Car Rental 2010 Annual Report Download - page 63

Download and view the complete annual report

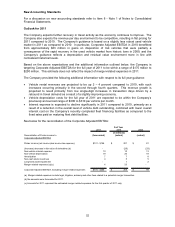

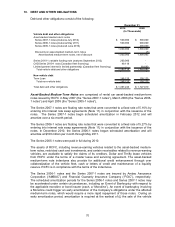

Please find page 63 of the 2010 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.of this amendment, the Company is required to maintain a minimum of $100 million at all times

with $60 million in separate accounts with the Collateral Agent pledged to secure payment of

amounts outstanding under the Term Loan (hereinafter defined) and letters of credit issued

under the Revolving Credit Facility (hereinafter defined) (Note 10). Due to the minimum cash

requirement covenant, the Company has separately identified the $100 million of cash on the

face of the Consolidated Balance Sheet. See Note 19 for disclosure related to elimination of the

required minimum balance pursuant to the subsequent amendment of the Senior Secured

Credit Facilities. These funds are primarily held in highly rated money market funds with

investments primarily in government and corporate obligations. Interest earned on these funds

is included in Cash and Cash Equivalents on the face of the Consolidated Balance Sheet.

Restricted Cash and Investments – Restricted cash and investments are restricted for the

acquisition of vehicles and other specified uses under the rental car asset-backed note

indenture and other agreements (Note 10). A portion of these funds is restricted due to the

Like-Kind Exchange Program (hereinafter defined) for deferred tax gains on eligible vehicle

remarketing. These funds are held in highly rated money market funds with investments

primarily in government and corporate obligations, as permitted by the indenture. Restricted

cash and investments are excluded from cash and cash equivalents. Interest earned on

restricted cash and investments was $0.7 million, $3.2 million and $8.9 million, for 2010, 2009

and 2008, respectively, and remains in restricted cash and investments.

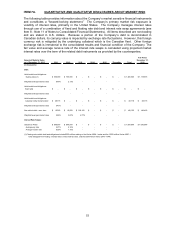

Concentration of Credit Risk – Financial instruments which potentially subject the Company

to concentrations of credit risk consist principally of cash and cash equivalents, cash and cash

equivalents – required minimum balance, restricted cash and investments, interest rate swaps

and caps, vehicle manufacturer receivables and trade receivables. The Company limits its

exposure on cash and cash equivalents, cash and cash equivalents – required minimum

balance and restricted cash and investments by investing in Aaa or P-1 rated funds and short-

term time deposits with a diverse group of high quality financial institutions. The Company’s

exposure relating to interest rate swaps and caps is mitigated by diversifying the financial

instruments among various counterparties, which consist of major financial institutions.

Receivables from vehicle manufacturers consist primarily of amounts due under guaranteed

residual, buyback, incentive and promotion programs. The Company’s financial condition and

results of operations could be adversely affected if one or more of its primary vehicle

manufacturers were unable to meet their obligations to the Company. Concentrations of credit

risk with respect to trade receivables are limited due to the large number of customers

comprising the Company’s customer base and their dispersion across different geographic

areas. Additionally, the Company limits its exposure to credit risk through performing credit

reviews and monitoring the financial strength of its significant accounts.

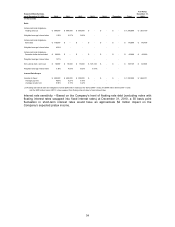

Allowance for Doubtful Accounts – An allowance for doubtful accounts is generally

established during the period in which receivables are recorded. The allowance is maintained

at a level deemed appropriate based on loss experience and other factors affecting

collectability.

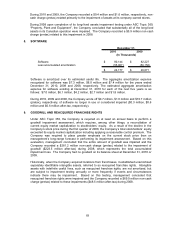

Financing Issue Costs – Financing issue costs related to vehicle debt and the Senior Secured

Credit Facilities are deferred and amortized to interest expense over the term of the related

debt using the effective interest method.

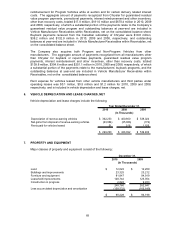

Revenue-Earning Vehicles and Related Vehicle Depreciation Expense – Revenue-earning

vehicles are stated at cost, net of related discounts. At December 31, 2010, Non-Program

Vehicles accounted for approximately 98% of the Company’s total fleet.

For these Non-Program Vehicles, the Company must estimate what the residual values of

these vehicles will be at the expected time of disposal to determine monthly depreciation rates.

The estimation of residual values requires the Company to make assumptions regarding the

age and mileage of the car at the time of disposal, as well as the general used vehicle auction

market. The Company evaluates estimated residual values periodically, and adjusts

62