Thrifty Car Rental 2010 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2010 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Company files income tax returns in the U.S. federal and various state, local and foreign

jurisdictions. In the Company’s significant tax jurisdictions, the tax years 2007 and later are

subject to examination by federal taxing authorities and the tax years 2006 and later are subject

to examination by state and foreign taxing authorities.

The Company accrues interest and penalties on underpayment of income taxes related to

unrecognized tax benefits as a component of income tax expense in the consolidated

statement of operations. No material amounts were recognized for interest and penalties under

ASC Topic 740 during the years ended December 31, 2010, 2009 and 2008.

15. COMMITMENTS AND CONTINGENCIES

Concessions and Operating Leases

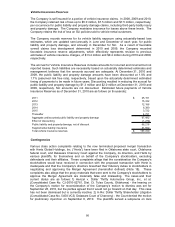

The Company has certain concession agreements principally with airports throughout the U.S.

and Canada. Typically, these agreements provide airport terminal counter space in return for a

minimum rent. In many cases, the Company’s subsidiaries are also obligated to pay insurance

and maintenance costs and additional rents generally based on revenues earned at the

location. Certain of the airport locations are operated by franchisees who are obligated to make

the required rent and concession fee payments under the terms of their franchise arrangements

with the Company’s subsidiaries.

The Company’s subsidiaries operate from various leased premises under operating leases with

terms up to 25 years. Some of the leases contain renewal options.

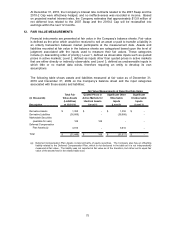

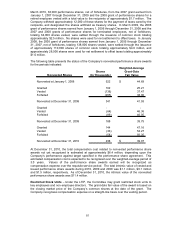

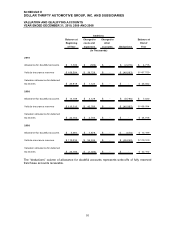

Expenses incurred under operating leases and concessions were as follows:

Year Ended December 31,

20102009200

(In Thousands)

Rent 47,915$ 49,543$ 51,535$

Concession expenses:

Minimum fees 102,080 101,938 94,678

Contingent fees 31,711 32,263 40,866

181,706 183,744 187,079

Less sublease rental income (574) (785) (1,078)

Total 181,132$ 182,959$ 186,001$

8

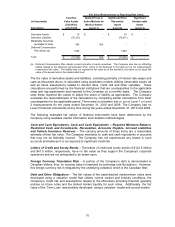

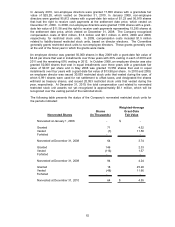

Future minimum rentals and fees under noncancelable operating leases and the Company’s

obligations for minimum airport concession fees at December 31, 2010 are presented in the

following table:

Company-Owned

Stores Operating

Concession Fees Leases Total

(In Thousands)

2011 94,645$ 42,266$ 136,911$

2012 83,958 34,604 118,562

2013 72,248 27,759 100,007

2014 52,242 21,598 73,840

2015 29,189 14,979 44,168

Thereafter 131,822 56,752 188,574

464,104 197,958 662,062

Less sublease rental income - (1,337) (1,337)

464,104$ 196,621$ 660,725$

85