Thrifty Car Rental 2010 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2010 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

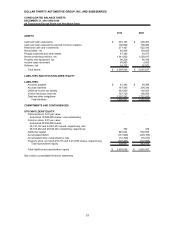

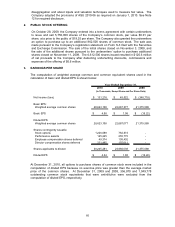

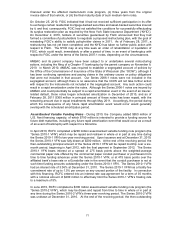

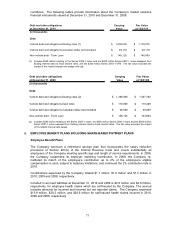

4. RECEIVABLES

Receivables consist of the following:

2010 2009

Trade accounts receivable and other 68,528$ 76,304$

Vehicle manufacturer receivables 4,543 30,194

Car sales receivable 1,100 5,677

74,171 112,175

Less allowance for doubtful accounts (4,715) (7,530)

69,456$ 104,645$

December 31,

(In Thousands)

Trade accounts receivable and other include primarily amounts due from rental customers,

franchisees and tour operators arising from billings under standard credit terms for services

provided in the normal course of business.

Vehicle manufacturer receivables include primarily amounts due under guaranteed residual,

buyback and Non-Program Vehicle incentive programs, which are paid according to contract

terms and are generally received within 60 days. This receivable does not include expected

payments on Program Vehicles remaining in inventory as those residual value guarantee

obligations are not triggered until the vehicles are sold.

Car sales receivable include primarily amounts due from car sale auctions for the sale of both

Program and Non-Program Vehicles.

Allowance for doubtful accounts represents potentially uncollectible amounts owed to the

Company from franchisees, tour operators, corporate account customers and others.

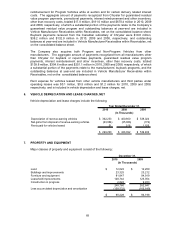

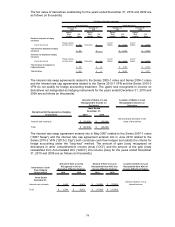

5. REVENUE–EARNING VEHICLES

Revenue-earning vehicles consist of the following:

2010 2009

Revenue-earning vehicles 1,668,473$ 1,608,855$

Less accumulated depreciation (326,651) (380,218)

1,341,822$ 1,228,637$

December 31,

(In Thousands)

The Company has vehicle supply agreements with both Chrysler and Ford Motor Company

covering vehicle purchases through the 2012 model year, and has a vehicle purchase

agreement with General Motors Company covering vehicle purchases through the 2011 model

year. See Note 15 for the amount of outstanding vehicle purchase commitments.

Prior to 2009, the Company used Chrysler as its primary vehicle supplier and has made

significant purchases and received significant payments from Chrysler. Purchases of revenue-

earning vehicles from Chrysler were $0.5 billion, $0.3 billion and $1.7 billion during 2010, 2009

and 2008, respectively.

Additionally, the Company receives promotional payments under the Chrysler vehicle supply

agreement, incentives primarily related to the disposal of revenue-earning vehicles and interest

67