Thrifty Car Rental 2010 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2010 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

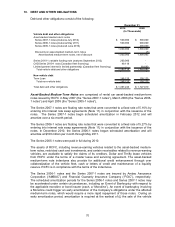

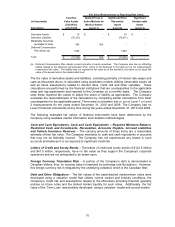

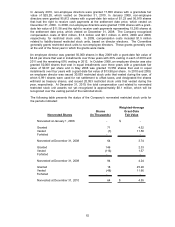

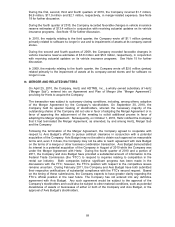

The following table summarizes information regarding fixed non-qualified option rights that were

outstanding at December 31, 2010:

Weighted-Average Weighted- Weighted-

Range of Number Remaining Average Number Average

Exercise Outstanding Contractual Life Exercise Exercisable Exercise

Prices (In Thousands) (In Years) Price (In Thousands) Price

$0.77 - $0.97 829 7.78 0.95$ 548 0.95$

$4.44 - $11.45 1,113 8.27 4.52 229 4.83

$13.98 - $24.38 335 4.94 21.61 47 18.29

$0.77 - $24.38 2,277 7.61 5.73$ 824 3.02$

Options Outstanding Options Exercisable

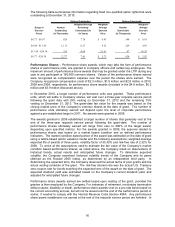

Performance Shares – Performance share awards, which may take the form of performance

shares or performance units, are granted to Company officers and certain key employees. The

maximum amount of performance share awards that may be granted under the LTIP during any

year to any participant is 160,000 common shares. Values of the performance shares earned

were recognized as compensation expense over the period the shares were earned. The

Company recognized compensation costs of $2.3 million, $1.9 million and $2.8 million in 2010,

2009 and 2008, respectively, for performance share awards (included in the $4.8 million, $6.2

million and $3.9 million discussed above).

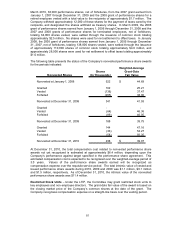

In December 2010, a target number of performance units was granted. These performance

units, which will settle in Company shares, will vest over a three-year requisite service period

following the grant date with 25% vesting on December 31, 2012 and the remaining 75%

vesting on December 31, 2013. The grant-date fair value for the awards was based on the

closing market price of the Company’s common shares at the date of grant. The number of

performance units ultimately earned will depend upon the level of corporate performance

against a pre-established target in 2011. No awards were granted in 2009.

The awards granted in 2008 established a target number of shares that generally vest at the

end of the three-year requisite service period following the grant-date. The number of

performance shares ultimately earned will range from zero to 200% of the target award,

depending upon specified metrics. For the awards granted in 2008, the expense related to

performance shares was based on a market based condition and on defined performance

indicators. The market condition based portion of the award was estimated on the date of grant

using a lattice-based option valuation model and the following assumptions: weighted-average

expected life of awards of three years, volatility factor of 35.30% and risk-free rate of 2.32% for

2008. To arrive at the assumptions used to estimate the fair value of the Company’s market

condition based performance shares, as noted above, the Company relied on observations of

historical trends, actual results and anticipated future changes. To determine expected

volatility, the Company examined historical volatility trends of the Company and its peers

(defined as the Russell 2000 Index), as determined by an independent third party. In

determining the expected term, the Company observed the actual terms of prior grants and the

actual vesting schedule of the grant. The risk-free interest rate was the actual U.S. Treasury

zero-coupon rate for bonds matching the expected term of the award on the date of grant. The

expected dividend yield was estimated based on the Company’s current dividend yield, and

adjusted for anticipated future changes.

Performance share awards earned are settled based upon vesting of the grant, provided the

grantee is then employed by the Company. For instances of retirement, involuntary termination

without cause, disability or death, performance share awards vest on a pro-rata basis based on

the current accounting accrual, but will not be issued until the end of the performance period or

earlier, if needed to comply with the Internal Revenue Code Section 409A. Any performance

share award installments not earned at the end of the requisite service period are forfeited. In

80