Thrifty Car Rental 2010 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2010 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.and liabilities. A valuation allowance is recorded for deferred income tax assets when

management determines it is more likely than not that such assets will not be realized. The

Company has established a valuation allowance related to DTG Canada and a portion of the

Company’s net operating losses for state tax purposes. The Company evaluates its tax

policies quarterly under ASC Topic 740, “Income Taxes” (“ASC Topic 740”) to identify uncertain

tax positions.

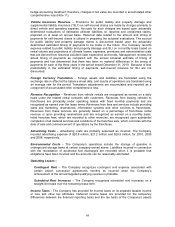

Earnings Per Share – Basic earnings per share (“EPS”) is computed by dividing net income

(loss) by the weighted average number of common shares outstanding during the period.

Diluted EPS is based on the combined weighted average number of common shares and

common share equivalents outstanding which include, where appropriate, the assumed

exercise of options. In computing diluted EPS, the Company has utilized the treasury stock

method.

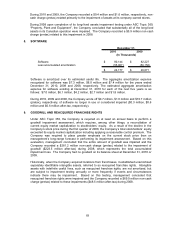

Stock-Based Compensation – The Company uses the fair value-based method of accounting

for stock-based compensation. All performance share, restricted stock and stock option

awards are accounted for using the fair value-based method for the 2010, 2009 and 2008

periods. The Company issued common shares to its Board of Directors for attendance at

Board of Director committee meetings in 2008. Payment for attendance at Board of Directors

committee meetings was paid in cash in 2009 and 2010. The fair value of these common

shares is determined based on the closing market price of the Company’s common shares at

the specific date on which the shares were earned and is recorded as a liability on the

Company’s books until they are issued. In 2010, the Company did not issue any stock options.

In 2009 and 2008, the Company issued approximately 1,120,000 and 1,258,000 stock options

at a weighted average grant-date fair value per share of $4.44 and $7.58, respectively.

New Accounting Standards –

In May 2009, the Financial Accounting Standards Board (“FASB”) issued guidance related to

subsequent events, which is included in Accounting Standards Codification (“ASC”) topic 855,

“Subsequent Events” ("ASC Topic 855”) and is effective for interim periods ending after June

15, 2009. In February 2010, the FASB amended ASC Topic 855 for clarification of disclosure

requirements for subsequent events. The provisions require Company management to

evaluate events or transactions occurring subsequent to the balance sheet date but prior to the

issuance of the financial statements for potential recognition or disclosure in the financial

statements and to disclose the results of management’s findings in the financial statements. In

addition, the provisions identify the circumstances under which an entity shall recognize events

or transactions occurring after the balance sheet date in its financial statements and the

required disclosures of such events. The Company adopted the provisions as required

beginning with the period ended June 30, 2009. See Note 19 for required disclosure.

In December 2009, the FASB issued Accounting Standards Update (“ASU”) 2009-17,

“Consolidations (ASC Topic 810): Improvements to Financial Reporting by Enterprises

Involved with Variable Interest Entities” (“ASU 2009-17”), which is effective for annual periods

beginning after November 15, 2009. ASU 2009-17 requires Company management to

consider the other entity’s purpose and design and the reporting entity’s ability to direct the

activities of the other entity that most significantly impact the other entity’s economic

performance when determining whether a variable interest entity should be consolidated. The

Company adopted the provisions of ASU 2009-17 as required on January 1, 2010. The

provisions had no impact on the Company’s consolidated financial statements upon adoption.

In January 2010, the FASB issued ASU 2010-06, “Fair Value Measurements and Disclosures

(ASC Topic 820): Improving Disclosures about Fair Value Measurements” which amends ASC

Subtopic 820, “Fair Value Measurements and Disclosures” (“ASU 2010-06”) to add new

requirements for disclosures about transfers into and out of Levels 1 and 2 and separate

disclosures about purchases, sales, issuances, and settlements relating to Level 3

measurements. ASU 2010-06 also clarifies existing fair value disclosures about the level of

65