Thrifty Car Rental 2010 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2010 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

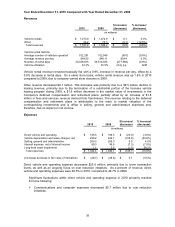

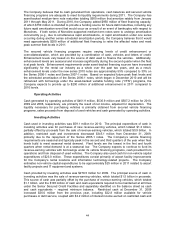

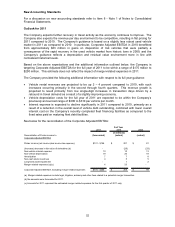

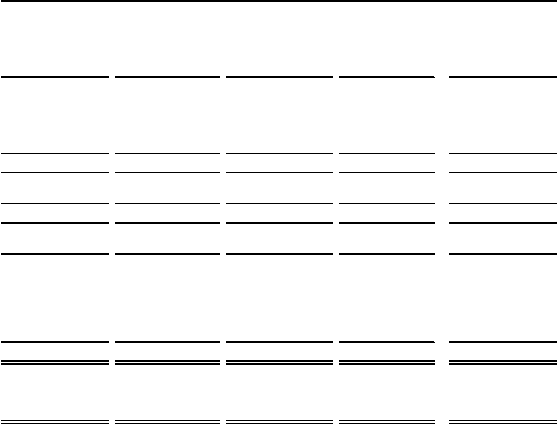

The following table provides details regarding the Company’s contractual cash obligations and other

commercial commitments subsequent to December 31, 2010:

Beyond

2011 2012-2013 2014-2015 2015 Total

Contractual cash obligations:

Asset-backed medium-term notes (1) 532,009$ 509,312$ -$ -$ 1,041,321$

Asset-backed variable funding notes (1) 14,079 212,557 226,636

Other short-term borrowings (1) 51,718 - - - 51,718

Subtotal - Vehicle debt and obligations 597,806 721,869 - - 1,319,675

Term Loan 14,143 145,730 - - 159,873

Subtotal - Non-vehicle debt 14,143 145,730 - - 159,873

Total debt and other obligations 611,949 867,599 - - 1,479,548

Operating lease commitments 42,266 62,363 36,577 56,752 197,958

Airport concession fee commitments 94,645 156,206 81,431 131,822 464,104

Vehicle purchase commitments 1,028,724 - - - 1,028,724

Other commitments 26,101 1,167 - - 27,268

Total contractual cash obligations 1,803,685$ 1,087,335$ 118,008$ 188,574$ 3,197,602$

Other commercial commitments:

Letters of credit 82,765$ 39,750$ -$ -$ 122,515$

Payments due or commitment expiration by period

(in thousands)

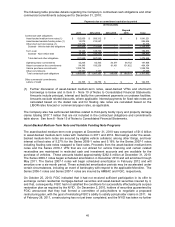

(1) Further discussion of asset-backed medium-term notes, asset-backed VFNs and short-term

borrowings is below and in Item 8 - Note 10 of Notes to Consolidated Financial Statements.

Amounts include principal, interest and facility fee commitment payments on undrawn facilities.

Amounts exclude related discounts, where applicable. Interest payments for fixed rate notes are

calculated based on the stated rate and for floating rate notes are calculated based on the

LIBOR rates forecast or commercial paper rates, as applicable.

The Company also has self-insured liabilities related to third-party bodily injury and property damage

claims totaling $107.7 million that are not included in the contractual obligations and commitments

table above. See Item 8 - Note 15 of Notes to Consolidated Financial Statements.

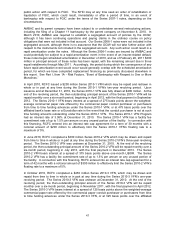

Asset-Backed Medium-Term Note and Variable Funding Note Programs

The asset-backed medium-term note program at December 31, 2010 was comprised of $1.0 billion

in asset-backed medium-term notes with maturities in 2011 and 2012. Borrowings under the asset-

backed medium-term notes are secured by eligible vehicle collateral, among other things, and bear

interest at fixed rates of 5.27% for the Series 2006-1 notes and 5.16% for the Series 2007-1 notes

including floating rate notes swapped to fixed rates. Proceeds from the asset-backed medium-term

notes and the Series 2010-1 VFN that are not utilized for vehicle financing and certain related

receivables are maintained in restricted cash and investment accounts and are available for the

purchase of vehicles. These amounts totaled approximately $262.6 million at December 31, 2010.

The Series 2006-1 notes began scheduled amortization in December 2010 and will amortize through

May 2011. The Series 2007-1 notes will begin scheduled amortization in February 2012 and will

amortize over a six-month period. These scheduled amortization periods may be accelerated under

certain circumstances, including an event of bankruptcy with respect to the applicable Monoline. The

Series 2006-1 notes and Series 2007-1 notes are insured by AMBAC and FGIC, respectively.

On October 25, 2010, FGIC indicated that it had not received sufficient participation in its offer to

exchange certain residential mortgage-backed securities and asset-backed securities insured by it,

and that, consequently, FGIC had not satisfied the conditions for successfully effectuating its surplus

restoration plan as required by the NYID. On December 2, 2010, holders of securities guaranteed by

FGIC announced that they had formed a committee of policyholders to negotiate a proposed

restructuring plan, with the goal of reinstating FGIC’s ability to satisfy policyholder claims in 2011. As

of February 28, 2011, a restructuring has not yet been completed, and the NYID has taken no further

46