Thrifty Car Rental 2010 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2010 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

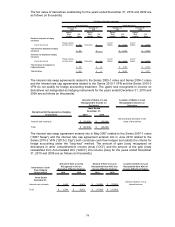

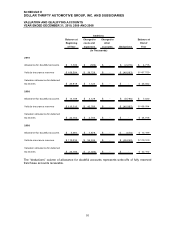

14. INCOME TAXES

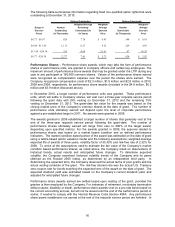

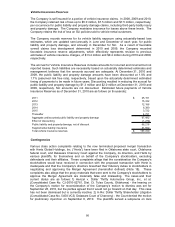

Income tax expense consists of the following:

Year Ended December 31,

2010 2009 2008

Current:

Federal 79$ 4,867$ 201$

State and local 12,535 13,417 989

Foreign 631 848 834

13,245 19,132 2,024

Deferred:

Federal 70,968 19,365 (93,259)

State and local 5,989 (2,511) (18,848)

76,957 16,854 (112,107)

90,202$ 35,986$ (110,083)$

(In Thousands)

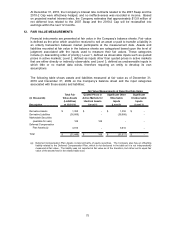

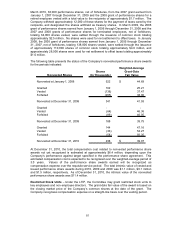

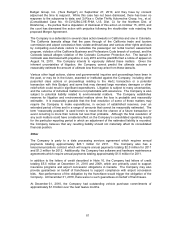

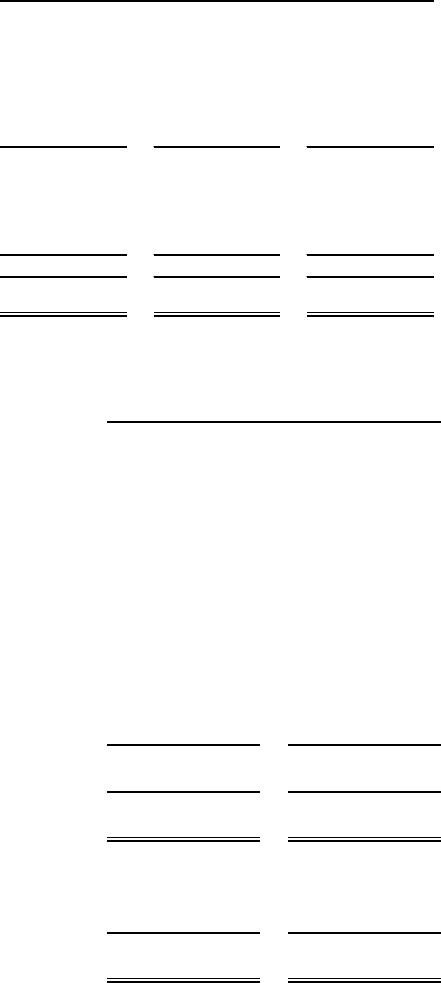

Deferred tax assets and liabilities consist of the following:

2010 2009

Deferred tax assets:

Intangible asset amortization 37,176$ 43,255$

Vehicle insurance reserves 38,456 38,741

Other accrued liabilities 33,621 32,790

Interest rate swap 15,267 30,707

AMT credit carryforward 7,252 17,670

Canadian NOL carryforwards 17,650 16,609

Other Canadian temporary differences 6,462 7,419

Federal and state NOL carryforwards 5,723 5,759

Allowance for doubtful accounts and notes receivable 1,729 2,768

Canadian depreciation 1,862 795

165,198 196,513

Valuation allowance (26,042) (24,918)

Total 139,156$ 171,595$

Deferred tax liabilities:

Depreciation 381,078$ 332,991$

Other 1,008 1,527

Total 382,086$ 334,518$

December 31,

(In Thousands)

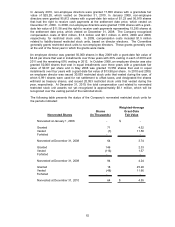

For the year ended December 31, 2010, the change in the net deferred tax liabilities constituted

$77.0 million of deferred tax expense, $3.4 million of other comprehensive income that relates

to the interest rate swap and foreign currency translation, and ($0.4 million) of tax benefit of

equity compensation recognized as an increase to paid-in capital.

The Company utilizes a like-kind exchange program for its vehicles whereby tax basis gains on

disposal of eligible revenue-earning vehicles are deferred (the “Like-Kind Exchange Program”).

To qualify for Like-Kind Exchange Program treatment, the Company exchanges (through a

83