Thrifty Car Rental 2010 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2010 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

March 2010, 36,000 performance shares, net of forfeitures, from the 2007 grant earned from

January 1, 2007 through December 31, 2009 and the 2008 grant of performance shares for a

retired employee vested with a total value to the recipients of approximately $1.7 million. The

Company withheld approximately 12,000 of these shares for the payment of taxes owed by the

recipients, and designated the shares withheld as treasury shares. In March 2009, the 2006

grant of performance shares earned from January 1, 2006 through December 31, 2008 and the

2007 and 2008 grants of performance shares for terminated employees, net of forfeitures,

totaling 64,000 shares vested, were settled through the issuance of common stock totaling

approximately $2.5 million. No shares were used for net settlement to offset taxes. In January

2008, the 2005 grant of performance shares earned from January 1, 2005 through December

31, 2007, net of forfeitures, totaling 138,000 shares vested, were settled through the issuance

of approximately 110,000 shares of common stock totaling approximately $4.0 million, and

approximately 28,000 shares were used for net settlement to offset taxes totaling approximately

$1.0 million.

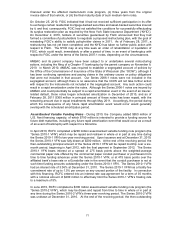

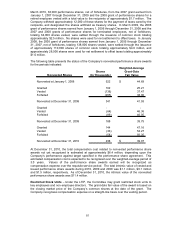

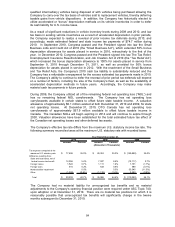

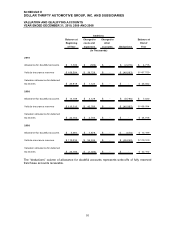

The following table presents the status of the Company’s nonvested performance share awards

for the periods indicated:

Weighted-Average

Shares Grant-Date

Nonvested Shares (In Thousands) Fair Value

Nonvested at January 1, 2008 522 44.69$

Granted 162 25.21

Vested (138) 37.47

Forfeited (205) 38.00

Nonvested at December 31, 2008 341 41.93

Granted - -

Vested (64) 46.36

Forfeited (89) 46.05

Nonvested at December 31, 2009 188 39.75

Granted 144 47.16

Vested (36) 54.27

Forfeited (58) 56.35

Nonvested at December 31, 2010 238 39.07$

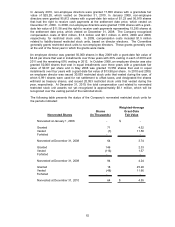

At December 31, 2010, the total compensation cost related to nonvested performance share

awards not yet recognized is estimated at approximately $6.4 million, depending upon the

Company’s performance against target specified in the performance share agreement. This

estimated compensation cost is expected to be recognized over the weighted-average period of

3.0 years. Values of the performance share awards earned will be recognized as

compensation expense over the requisite service period. The total intrinsic value of vested and

issued performance share awards during 2010, 2009 and 2008 was $1.1 million, $0.1 million

and $1.5 million, respectively. As of December 31, 2010, the intrinsic value of the nonvested

performance share awards was $11.4 million.

Restricted Stock Units – Under the LTIP, the Committee may grant restricted stock units to

key employees and non-employee directors. The grant-date fair value of the award is based on

the closing market price of the Company’s common shares at the date of the grant. The

Company recognizes compensation expense on a straight-line basis over the vesting period.

81