Thrifty Car Rental 2010 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2010 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

$14.2 million for Canadian enhancement and $63.0 million in general purpose enhancements,

with remaining available capacity of $114.3 million at December 31, 2010.

The Term Loan had $148.1 million outstanding at December 31, 2010. In 2010, the Company

made quarterly principal payments of $2.5 million on its Term Loan and expects to continue to

make minimum quarterly principal payments of $2.5 million until the maturity of the Term Loan

on June 15, 2013, at which time the remaining principal balance will be repaid.

During 2010, the Company paid $11.8 million in financing issuance costs primarily related to

the issuance of its asset-backed variable funding notes.

See Note 19 for discussion of the amendment to the Senior Secured Credit Facilities that

significantly revised applicable restrictions and covenants effective February 9, 2011.

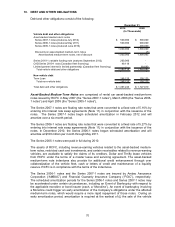

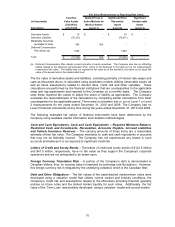

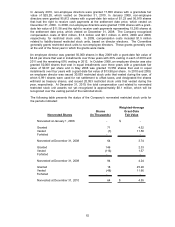

Expected maturities of debt and other obligations outstanding at December 31, 2010 are as

follows:

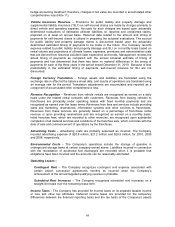

2011 2012 2013 Thereafter

Asset-backed medium-term notes 500,000$ 500,000$ -$ -$

Asset-backed variable funding note - 200,000 - -

CAD Series 2010-1 note (CAD fleet financing) 49,118 - - -

Term Loan 10,000 10,000 128,125 -

Total 559,118$ 710,000$ 128,125$ -$

(In Thousands)

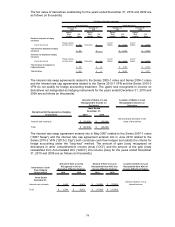

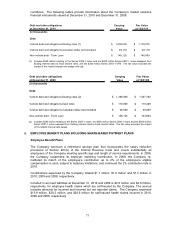

11. DERIVATIVE FINANCIAL INSTRUMENTS

The Company is exposed to market risks, such as changes in interest rates. Consequently, the

Company manages the financial exposure as part of its risk management program, by striving

to reduce the potentially adverse effects that the volatility of the financial markets may have on

the Company’s operating results. The Company has used interest rate swap agreements, for

each related asset-backed medium-term note issuance in 2006 and 2007, to effectively convert

variable interest rates on a total of $1.0 billion in asset-backed medium-term notes to fixed

interest rates. These swaps have termination dates through July 2012. The Company has also

used interest rate cap agreements for its Series 2010-1 VFN, Series 2010-2 VFN and Series

2010-3 VFN, to effectively limit the variable interest rate on a total of $950 million in asset-

backed variable funding notes. These caps have termination dates through December 2013.

73