Thrifty Car Rental 2010 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2010 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In January 2010, non-employee directors were granted 17,800 shares with a grant-date fair

value of $25.28, which vested on December 31, 2010. In January 2009, non-employee

directors were granted 95,812 shares with a grant-date fair value of $1.23 and 56,910 shares

that had the right to receive cash payments at the settlement date price, which vested on

December 31, 2009. In 2008, non-employee directors were granted 7,000 shares with a grant-

date fair value of $11.58 and the right to receive cash payments representing 15,295 shares at

the settlement date price, which vested on December 31, 2008. The Company recognized

compensation costs of $0.6 million, $1.6 million and $0.1 million in 2010, 2009 and 2008,

respectively, for restricted stock units. In 2009, compensation costs included $1.5 million

related to liability-based restricted stock units, based on director elections. The Committee

generally grants restricted stock units to non-employee directors. These grants generally vest

at the end of the fiscal year in which the grants were made.

An employee director was granted 50,000 shares in May 2009 with a grant-date fair value of

$4.44 per share that vest in installments over three years with 20% vesting in each of 2010 and

2011 and the remaining 60% vesting in 2012. In October 2008, an employee director was also

granted 50,000 shares that vest in equal installments over three years with a grant-date fair

value of $0.97 per share and in May 2008 was granted 13,550 shares that vest in equal

installments over four years with a grant-date fair value of $13.98 per share. In 2010 and 2009,

an employee director was issued 30,053 restricted stock units that vested during the year, of

which 6,991 shares were used for net settlement to offset taxes, and designated the shares

withheld as treasury shares, and issued 20,053 restricted stock units that vested during the

year, respectively. At December 31, 2010, the total compensation cost related to nonvested

restricted stock unit awards not yet recognized is approximately $0.1 million, which will be

recognized over the vesting period of the restricted stock.

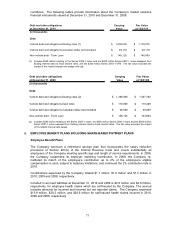

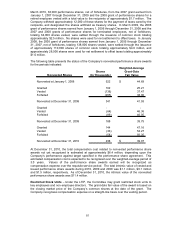

The following table presents the status of the Company’s nonvested restricted stock units for

the periods indicated:

Weighted-Average

Shares Grant-Date

Nonvested Shares (In Thousands) Fair Value

Nonvested at January 1, 2008 - -$

Granted 71 4.52

Vested (7) 11.58

Forfeited - -

Nonvested at December 31, 2008 64 3.74

Granted 146 2.33

Vested (116) 1.57

Forfeited - -

Nonvested at December 31, 2009 94 4.24

Granted 18 25.28

Vested (48) 11.66

Forfeited - -

Nonvested at December 31, 2010 64 4.55$

82