Thrifty Car Rental 2010 Annual Report Download - page 64

Download and view the complete annual report

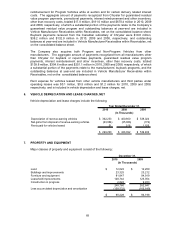

Please find page 64 of the 2010 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.depreciation rates accordingly, on a prospective basis. Differences between actual residual

values and those estimated by the Company result in a gain or loss on disposal and are

recorded as an adjustment to depreciation expense. Actual timing of disposal either shorter or

longer than the life used for depreciation purposes could result in a loss or gain on sale.

Vehicle rental companies bear residual value risk for these vehicles, which are referred to as

“Non-Program Vehicles”. Generally, the average holding term for Non-Program Vehicles is

approximately 18 to 20 months.

The Company is required to depreciate the vehicle according to the terms of the guaranteed

depreciation or repurchase program (“Program Vehicles”) and in doing so is guaranteed to

receive the full net book value in proceeds upon the sale of the vehicle. In some cases, the

sales proceeds are received directly from auctions, with any shortfall in value being paid by the

vehicle manufacturer. With certain other vehicle manufacturers, the entire balance of proceeds

from vehicle sales comes directly from the manufacturer. In either case, the Company bears

the risk of collectability on the receivable from the vehicle manufacturer. The Company

monitors its vehicle manufacturer receivables based on time outstanding, manufacturer

strength and length of the relationship. Generally, the average holding term for Program

Vehicles is approximately six to eight months.

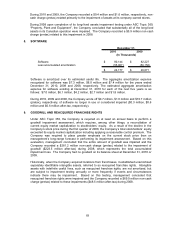

Property and Equipment – Property and equipment are recorded at cost and are depreciated

using principally the straight-line method over the estimated useful lives of the related assets.

Estimated useful lives generally range from ten to thirty years for buildings and improvements

and two to seven years for furniture and equipment. Leasehold improvements are amortized

over the estimated useful lives of the related assets or leases, whichever is shorter.

Software – Software is recorded at cost and amortized using the straight-line method generally

ranging from three to five years. The remaining useful life of software is evaluated annually to

assess whether events and circumstances warrant a revision to the remaining amortization

period.

Website Development Costs – The Company capitalizes qualifying internal-use software

development, including Website development, incurred subsequent to the completion of the

preliminary project stage. Development costs are amortized over the shorter of the expected

useful life of the software or five years. Costs related to planning, maintenance, and minor

upgrades are expensed as incurred.

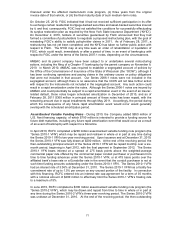

Long–Lived Assets – The Company reviews the value of long-lived assets, including software,

for impairment whenever events or changes in circumstances indicate that the carrying amount

of an asset may not be recoverable based upon estimated future cash flows and records an

impairment charge, equaling the excess of the carrying value over the estimated fair value, if

the carrying value exceeds estimated future cash flows.

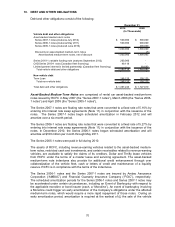

Accounts Payable – Book overdrafts of $17.0 million and $20.5 million, which represent

outstanding checks not yet presented to the bank, are included in accounts payable at

December 31, 2010 and 2009, respectively. These amounts do not represent bank overdrafts,

which would constitute checks presented in excess of cash on hand, and would be effectively a

loan to the Company.

Derivative Instruments – The Company records all derivatives on the balance sheet as either

assets or liabilities measured at their fair value and changes in the derivatives’ fair value are

recognized currently in earnings unless specific hedge accounting criteria are met. The

Company has entered into interest rate swap and cap agreements, which do not qualify for

hedge accounting treatment; therefore, the changes in the interest rate swap and cap

agreements’ fair values have been recognized as an (increase) decrease in fair value of

derivatives in the consolidated statement of operations. The Company has also entered into

interest rate swap and cap agreements which constitute cash flow hedges and qualify for

63