Thrifty Car Rental 2010 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2010 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

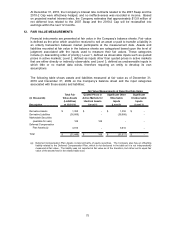

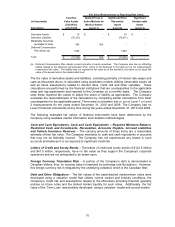

disaggregation and about inputs and valuation techniques used to measure fair value. The

Company adopted the provisions of ASU 2010-06 as required on January 1, 2010. See Note

12 for required disclosure.

2. PUBLIC STOCK OFFERING

On October 28, 2009, the Company entered into a terms agreement with certain underwriters

to issue and sell 5,750,000 shares of the Company’s common stock, par value $0.01 per

share, at a price to the public of $19.25 per share. The Company also granted the underwriters

an option to purchase up to an additional 862,500 shares of common stock. The sale was

made pursuant to the Company’s registration statement on Form S-3 filed with the Securities

and Exchange Commission. The sale of the initial shares closed on November 3, 2009, and

the sale of the additional shares pursuant to the underwriters’ option to purchase additional

shares closed on November 11, 2009. The 6,612,500 shares issued resulted in $120.6 million

of net proceeds to the Company after deducting underwriting discounts, commissions and

expenses of the offering of $6.6 million.

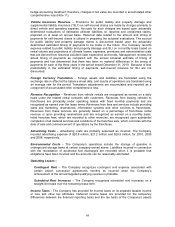

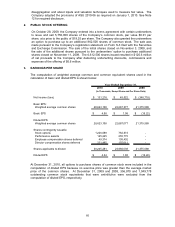

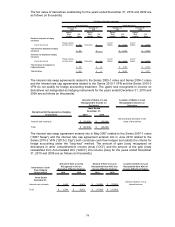

3. EARNINGS PER SHARE

The computation of weighted average common and common equivalent shares used in the

calculation of basic and diluted EPS is shown below:

2010 2009 2008

(In Thousands, Except Share and Per Share Data)

Net income (loss) 131,216$ 45,022$ (346,718)$

Basic EPS:

Weighted average common shares 28,623,108 22,687,077 21,375,589

Basic EPS 4.58$ 1.98$ (16.22)$

Diluted EPS:

Weighted average common shares 28,623,108 22,687,077 21,375,589

Shares contingently issuable:

Stock options 1,226,089 762,673 -

Performance awards 125,225 255,775 -

Employee compensation shares deferred 49,374 105,402 -

Director compensation shares deferred 221,485 155,611 -

Shares applicable to diluted 30,245,281 23,966,538 21,375,589

Diluted EPS 4.34$ 1.88$ (16.22)$

Year Ended December 31,

At December 31, 2010, all options to purchase shares of common stock were included in the

computation of diluted EPS because no exercise price was greater than the average market

price of the common shares. At December 31, 2009 and 2008, 356,970 and 1,049,778

outstanding common stock equivalents that were anti-dilutive were excluded from the

computation of diluted EPS, respectively.

66