Thrifty Car Rental 2006 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2006 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Contingencies

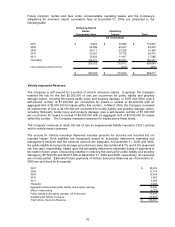

On August 10, 2005, the federal Highway Bill was signed into law and removed unlimited vicarious

liability for vehicle rental and leasing companies, limiting exposure to state minimum financial

responsibility amounts. This federal law supersedes all state laws on vicarious liability for automobile

lessors. Since the Highway Bill became law, its constitutionality has been challenged in some state

courts, including subsequent appeals. Litigation is subject to many uncertainties, and the outcome of

individual matters is not predictable with assurance. Due to the limitation on vicarious liability, the

Company’s automobile liability accrual is principally limited to minimum financial responsibility.

When the Highway Bill became effective, the Company initially estimated an annual reduction in its

automobile liability insurance expense of $12,000,000 to $14,000,000. The Company is unable to

reasonably estimate the cumulative impact on its results should the limitation on vicarious liability

ultimately be reversed.

Various claims and legal proceedings have been asserted or instituted against the Company,

including some purporting to be class actions, and some which demand large monetary damages or

other relief which could result in significant expenditures. Litigation is subject to many uncertainties

and the outcome of individual matters is not predictable with assurance. The Company is also

subject to potential liability related to environmental matters. The Company establishes reserves for

litigation and environmental matters when the loss is probable and reasonably estimable. It is

reasonably possible that the final resolution of some of these matters may require the Company to

make expenditures, in excess of established reserves, over an extended period of time and in a

range of amounts that cannot be reasonably estimated. The term “reasonably possible” is used

herein to mean that the chance of a future transaction or event occurring is more than remote but

less than likely. Although the final resolution of any such matters could have a material effect on the

Company’s consolidated operating results for the particular reporting period in which an adjustment

of the estimated liability is recorded, the Company believes that any resulting liability should not

materially affect its consolidated financial position.

Other

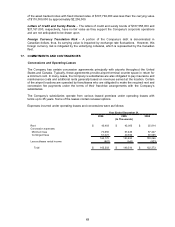

The Company is party to a data processing services agreement which requires annual payments

totaling approximately $35,000,000 for 2007, $31,000,000 for 2008 and 2009, $30,000,000 for 2010

and $23,000,000 for 2011. The Company also has a telecommunications contract which will require

annual payments totaling $2,000,000 for 2007 through 2009, and $1,000,000 for 2010. Additionally,

the Company has software and hardware maintenance agreements which require annual payments

totaling approximately $2,000,000 for 2007 through 2009, and $1,000,000 for 2010 and 2011.

In addition to the letters of credit described in Note 10, the Company had letters of credit totaling

$10,992,000 and $8,554,000 at December 31, 2006 and 2005, respectively, which are primarily

used to support its insurance programs and airport concession obligations in Canada. The

Company may also provide guarantees on behalf of franchisees to support compliance with airport

concession bids. Non-performance of the obligation by the franchisee would trigger the obligation of

the Company. At December 31, 2006, there were no such guarantees on behalf of franchisees.

At December 31, 2006, the Company had outstanding vehicle purchase commitments of

approximately $2,459,346,000.

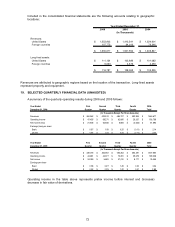

18. BUSINESS SEGMENTS

The Company’s corporate operating structure, is based on a functional structure and combines the

management of operations and administrative functions for both the Dollar and Thrifty brands.

Consistent with this structure, management makes business and operating decisions on an overall

company basis. The Company no longer reports Dollar and Thrifty as operating segments. Financial

results are not available by brand.

71