Thrifty Car Rental 2006 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2006 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Interest Rate Risk

The Company’s results of operations depend significantly on prevailing levels of interest rates because of

the large amount of debt it incurs to purchase vehicles. In addition, the Company is exposed to increases

in interest rates because a portion of its debt bears interest at floating rates. The Company estimates that,

in 2007, approximately 40% of its average debt will bear interest at floating rates. The amount of the

Company’s financing costs affects the amount the Company must charge its customers to be profitable.

See Note 10 of Notes to Consolidated Financial Statements.

Inflation

The increased acquisition cost of vehicles is the primary inflationary factor affecting the Company. Many

of the Company’s other operating expenses are also expected to increase with inflation. Management

does not expect that the effect of inflation on the Company’s overall operating costs will be greater for the

Company than for its competitors.

Critical Accounting Policies and Estimates

As with most companies, the Company must exercise judgment due to the level of subjectivity used in

estimating certain costs included in its results of operations. The more significant items include:

Vehicle insurance reserves – The Company does self-insure or retain a portion of the exposure

for losses related to bodily injury and property damage liability claims along with the risk retained

for the supplemental liability insurance program. The obligation for Vehicle Insurance Reserves

represents an estimate of both reported accident claims not yet paid and claims incurred but not

yet reported, up to the Company’s risk retention level. The Company records expense related to

Vehicle Insurance Reserves on a monthly basis based on rental volume in relation to historical

accident claim experience and trends, projections of ultimate losses, expenses, premiums and

administrative costs. Management monitors the adequacy of the liability and monthly accrual

rates based on actuarial analysis of the development of the claim reserves, the accident claim

history and rental volume. Since the ultimate disposition of the claims is uncertain, the likelihood

of materially different results is possible. However, the potential volatility of these estimates is

reduced due to the frequency of actuarial reviews and significant historical data available for

similar claims.

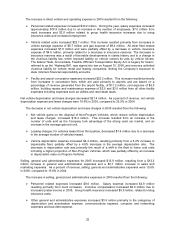

Vehicle depreciation expense – The Company generally purchases 65% to 80% of its vehicles as

Program Vehicles for which residual values are determined by depreciation rates that are

established and guaranteed by the manufacturers. The remaining 20% to 35% of the Company’s

vehicles are purchased without the benefit of a manufacturer residual value guaranty program.

For these Non-Program Vehicles, the Company must estimate what the residual values of these

vehicles will be at the expected time of disposal to determine monthly depreciation rates by

reviewing the projected market value for the vehicles at expected date of disposition as well as

the overall outlook for the used car market. The Company continually evaluates estimated

residual values. Differences between actual residual values and those estimated by the

Company result in a gain or loss on disposal and are recorded as an adjustment to depreciation

expense. The average life of the Non-Program Vehicles is seven to nine months and the

Company has generally experienced gains on disposal. Many factors affect the market value of

used cars including increasing use of incentives by automobile manufacturers for new vehicles,

limited or excess supply of used vehicles and overall economic conditions. The likelihood that the

Company’s estimates could materially change is possible due to the volatility of the used car

market. A one percent change in the expected residual value of Non-Program Vehicles sold

during 2006 would have impacted vehicle depreciation expense, net by $8.8 million.

Income taxes – The Company estimates its consolidated effective state income tax rate using a

process that estimates state income taxes by entity and by tax jurisdiction. Changes in the

Company’s operations in these tax jurisdictions may have a material impact on the Company’s

effective state income tax rate and deferred state income tax assets and liabilities. Additionally,

the Company records deferred income tax assets and liabilities based on the temporary

differences between the financial reporting basis and the tax basis of the Company’s assets and

37