Thrifty Car Rental 2006 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2006 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

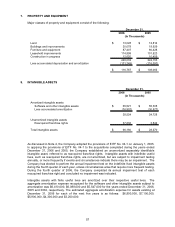

parties prior to the combination. Adoption of EITF No. 04-1 impacted the way in which the Company

accounts for certain business combination transactions through establishing identifiable intangibles,

other than goodwill, such as reacquired franchise rights through the Company’s acquisitions of

franchisee operations. At December 31, 2006, the Company had recognized an unamortized

intangible asset for reacquired franchise rights totaling $37,636,000 (Note 8).

The Company did not recognize any goodwill related to the acquisition transactions during 2006 or

2005. The goodwill recognized in the acquisition transactions completed during 2004 totaled

$75,549,000. Reacquired franchise rights and goodwill are both deductible for tax purposes. The

Company may have an adjustment or subsequent settlement to the purchase price of an acquisition

affecting the recorded amount of goodwill or reacquired franchise rights and the allocation of the

purchase price. Historically, these purchase price adjustments have not been material. Each of the

acquisitions has been accounted for using the purchase method of accounting and operating results

of the acquirees from the dates of acquisition are included in the consolidated statements of income

of the Company. Acquisitions made in each year are not material individually or collectively to

amounts presented for each of the years ended December 31, 2006, 2005 and 2004.

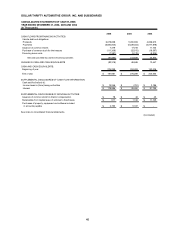

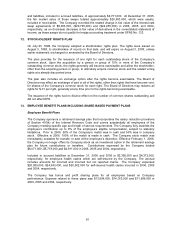

5. RECEIVABLES

Receivables consist of the following:

2006 2005

Trade accounts receivable 114,492$ 109,596$

Due from DaimlerChrysler 95,223 83,774

Car sales receivable 19,384 22,255

Fair value of interest rate swap 14,271 20,903

Other vehicle manufacturer receivables 7,781 1,182

Notes receivable 1,159 1,448

252,310 239,158

Less allowance for doubtful accounts (9,961) (20,606)

242,349$ 218,552$

December 31,

(In Thousands)

Trade accounts and notes receivable include primarily amounts due from rental customers,

franchisees and tour operators arising from billings under standard credit terms for services provided

in the normal course of business. Notes receivable are generally issued to certain franchisees at

current market interest rates with varying maturities and are generally guaranteed by franchisees.

Due from DaimlerChrysler is comprised primarily of amounts due under various guaranteed

residual, buyback, incentive and promotion programs, which are paid according to contract terms

and are generally received within 60 days.

Car sales receivable include primarily amounts due from car sale auctions for the sale of both

Program and Non-Program Vehicles.

Fair value of interest rate swap represents the fair market value on interest rate swap agreements

(Note 11).

Other vehicle manufacturer receivables include primarily amounts due under guaranteed

residual, buyback and incentive programs, which are paid according to contract terms and are

generally received within 60 days.

55