Thrifty Car Rental 2006 Annual Report Download - page 59

Download and view the complete annual report

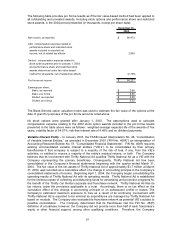

Please find page 59 of the 2006 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In June 2006, the FASB issued FASB Interpretation No. 48, “Accounting for Uncertainty in Income

Taxes” (“FIN No. 48”), an interpretation of SFAS No. 109, “Accounting for Income Taxes”. FIN No.

48 clarifies the accounting for uncertainty in income taxes by prescribing a recognition threshold for

tax positions taken or expected to be taken in a tax return. FIN No. 48 is effective for fiscal years

beginning after December 15, 2006. The Company adopted the provisions of FIN No. 48 as required

on January 1, 2007 and is currently evaluating the impact, if any, FIN No. 48 will have on its

consolidated financial position or results of operations. Management does not believe the adoption

of FIN No. 48 will have a material impact on the Company’s consolidated financial position or results

of operations.

In September 2006, the FASB issued SFAS No. 157, “Fair Value Measurements” (“SFAS No. 157”),

which is effective for fiscal years beginning after November 15, 2007. This statement defines fair

value, establishes a framework for measuring fair value and expands the related disclosure

requirements. The Company plans to adopt the provisions of SFAS No. 157 as required on January

1, 2008. The Company is currently evaluating the impact SFAS No. 157 will have on its consolidated

financial position and results of operations.

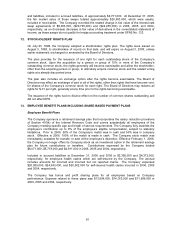

In September 2006, the FASB issued SFAS No. 158, “Employers’ Accounting for Defined Benefit

Pension and Other Postretirement Plans, an amendment of FASB Statements No. 87, 88, 106 and

132(R)” (“SFAS No. 158”). This statement requires an entity to recognize on its balance sheet an

asset for a defined benefit postretirement plan’s overfunded status or a liability for a plan’s

underfunded status, measure a plan’s assets and obligations as of the end of the employer’s fiscal

year, recognize changes in the funded status of a plan in comprehensive income in the year in

which the changes occur and expands the disclosure requirements associated with defined benefit

postretirement plans. SFAS No. 158 is effective for fiscal years ending after December 15, 2006,

except for the provision that a plan’s assets and obligations be measured as of the end of the

employer’s fiscal year, which is effective for fiscal years ending after December 15, 2008. SFAS No.

158 will have no impact on the Company’s consolidated financial position or results of operations as

the Company does not have defined benefit pension or other postretirement plans.

In September 2006, the Staff of the Securities and Exchange Commission issued Staff Accounting

Bulletin No. 108, “Considering the Effects of Prior Year Misstatements when Quantifying

Misstatements in Current Year Financial Statements” (“SAB No. 108”). SAB No. 108 provides

guidance on the consideration of the effects of prior year misstatements in quantifying current year

misstatements for the purpose of determining whether the current year’s financial statements are

materially misstated. SAB No. 108 is effective for fiscal years ending after November 15, 2006. The

Company adopted the provisions of SAB No. 108 as of December 31, 2006, as required. Adoption

of SAB No. 108 did not have a material impact on the Company’s consolidated financial position or

results of operations.

In February 2007, the FASB issued SFAS No. 159, “The Fair Value Option for Financial Assets and

Financial Liabilities – including an amendment of FASB Statement No. 115” (“SFAS No. 159”). This

statement permits entities to make an irrevocable election to measure certain financial instruments

and other assets and liabilities at fair value on an instrument-by-instrument basis. Unrealized gains

and losses on items for which the fair value option has been elected should be recognized in

earnings at each subsequent reporting date. SFAS No. 159 is effective for fiscal years beginning

after November 15, 2007. The Company plans to adopt the provisions of SFAS No. 159 as required

on January 1, 2008 and is currently evaluating the impact SFAS No. 159 will have on its

consolidated financial position and results of operations.

53