Thrifty Car Rental 2006 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2006 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

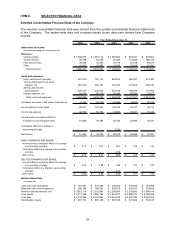

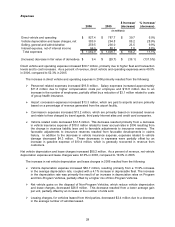

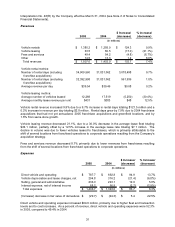

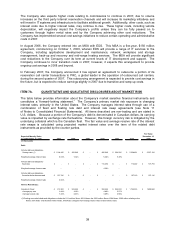

Expenses

$ Increase/ % Increase/

2006 2005 (decrease) (decrease)

Direct vehicle and operating 827.4$ 787.7$ 39.7$ 5.0%

Vehicle depreciation and lease charges, net 380.0 294.8 85.2 28.9%

Selling, general and administrative 259.5 236.0 23.5 9.9%

Interest expense, net of interest income 96.0 88.2 7.8 8.8%

Total expenses 1,562.9$ 1,406.7$ 156.2$ 11.1%

(Increase) decrease in fair value of derivatives 9.4$ (29.7)$ (39.1)$ (131.5%)

(in millions)

Direct vehicle and operating expense increased $39.7 million, primarily due to higher fleet and transaction

levels and to cost increases. As a percent of revenue, direct vehicle and operating expenses were 49.8%

in 2006, compared to 52.3% in 2005.

The increase in direct vehicle and operating expense in 2006 primarily resulted from the following:

¾ Personnel related expenses increased $19.8 million. Salary expenses increased approximately

$11.8 million due to higher compensation costs per employee and $10.8 million due to an

increase in the number of employees, partially offset by a reduction of $3.1 million related to costs

of group health insurance.

¾ Airport concession expenses increased $13.3 million, which are paid to airports and are primarily

based on a percentage of revenue generated from the airport facility.

¾ Commission expenses increased $13.2 million, which are primarily based on increased revenue

and relate to fees charged by travel agents, third party Internet sites and credit card companies.

¾ Vehicle related costs decreased $12.5 million. This decrease resulted primarily from a decrease

in vehicle insurance expense of $18.0 million related to lower accrual rates in 2006 resulting from

the change in vicarious liability laws and to favorable adjustments to insurance reserves. The

favorable adjustments to insurance reserves resulted from favorable developments in claims

history. In addition to the decrease in vehicle insurance expense, expenses related to vehicle

damage decreased $4.3 million. These decreases in expenses were partially offset by an

increase in gasoline expense of $10.4 million, which is generally recovered in revenue from

customers.

Net vehicle depreciation and lease charges increased $85.2 million. As a percent of revenue, net vehicle

depreciation expense and lease charges were 22.9% in 2006, compared to 19.6% in 2005.

The increase in net vehicle depreciation and lease charges in 2006 resulted from the following:

¾ Vehicle depreciation expense increased $60.7 million, resulting primarily from a 13.9% increase

in the average depreciation rate, coupled with a 4.1% increase in depreciable fleet. The increase

in the depreciation rate was primarily the result of an increase in depreciation rates on Program

and Non-Program Vehicles, partially offset by a higher mix of Non-Program Vehicles.

¾ Net vehicle gains on the disposal of Non-Program Vehicles, which reduce vehicle depreciation

and lease charges, decreased $26.9 million. This decrease resulted from a lower average gain

per unit, partially offset by an increase in the number of units sold.

¾ Leasing charges, for vehicles leased from third parties, decreased $2.4 million due to a decrease

in the average number of vehicles leased.

29