Thrifty Car Rental 2006 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2006 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

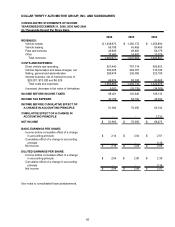

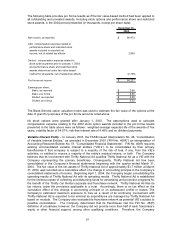

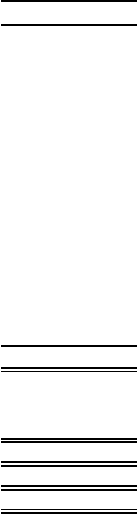

The following table provides pro forma results as if the fair value-based method had been applied to

all outstanding and unvested awards, including stock options and performance share and restricted

stock awards, in the 2004 period presented (in thousands, except per share data):

December 31,

2004

Net income, as reported 66,473$

Add: compensation expense related to

performance share and restricted stock

awards included in reported net

income, net of related tax effects 2,509

Deduct: compensation expense related to

stock options granted prior to January 1, 2003

and performance share and restricted stock

awards determined under fair value-based

method for all awards, net of related tax effects (2,755)

Pro forma net income 66,227$

Earnings per share:

Basic, as reported 2.66$

Basic, pro forma 2.65$

Diluted, as reported 2.53$

Diluted, pro forma 2.53$

The Black-Scholes option valuation model was used to estimate the fair value of the options at the

date of grant for purposes of the pro forma amounts noted above.

No stock options were granted after January 1, 2003. The assumptions used to calculate

compensation expense relating to the 2002 stock option awards included in the pro forma results

presented in the table above were as follows: weighted-average expected life of the awards of five

years, volatility factor of 54.57%, risk-free interest rate of 4.46% and no dividend payments.

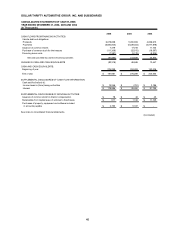

Variable Interest Entity – In January 2003, the FASB issued Interpretation No. 46, “Consolidation

of Variable Interest Entities,” as amended in December 2003 (“FIN No. 46(R)”) an interpretation of

Accounting Research Bulletin No. 51, "Consolidated Financial Statements". FIN No. 46(R) requires

existing unconsolidated variable interest entities (“VIE’s”) to be consolidated by their primary

beneficiaries if that company is subject to a majority of the risk of loss, if any, from the VIE’s

activities, or entitled to receive a majority of the entity’s residual returns, or both. The Company

believes that its involvement with Thrifty National Ad qualifies Thrifty National Ad as a VIE with the

Company representing the primary beneficiary. Consequently, Thrifty National Ad has been

consolidated in the Company’s financial statements beginning with the quarter ended March 31,

2004. The fair value of the net assets of Thrifty National Ad of approximately $3.7 million at March

31, 2004, was recorded as a cumulative effect of a change in accounting principle in the Company’s

consolidated statements of income. Beginning April 1, 2004, the Company began consolidating the

operating results of Thrifty National Ad with its operating results. Thrifty National Ad is established

for the limited purpose of collecting and disbursing funds for advertising and promotion programs for

the benefit of the Thrifty Car Rental corporate and franchisee network. Thrifty National Ad files its

tax returns under the provisions applicable to a trust. Accordingly, there is no tax effect on the

cumulative effect of the change in accounting principle or on subsequent profits or losses. The

Company’s estimated maximum exposure to loss as a result of its continuing involvement with

Thrifty National Ad is expected to be minimal as expenditures are managed by Thrifty National Ad

based on receipts. The Company also evaluated its franchisee network as potential VIE’s subject to

possible consolidation. The Company determined that its franchisees met the FIN No. 46(R)

definition of a business; however, the Company did not provide more than half of each franchisee’s

equity or other financial support, among other qualifying conditions. Therefore, the Company

51