Thrifty Car Rental 2006 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2006 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

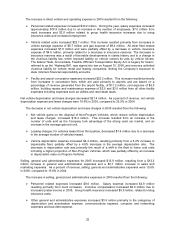

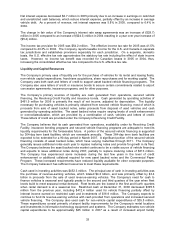

The Company also expects higher costs relating to commissions to continue in 2007, due to volume

increases on the third party Internet reservation channels and will increase its marketing initiatives and

will invest in IT systems and infrastructure to facilitate additional growth. Additionally, other costs, such as

interest costs due to higher interest rates, may continue to rise. These higher costs, including vehicle

depreciation, will negatively impact the Company’s profits unless they can be fully passed on to

customers through higher rental rates and by the Company achieving other cost reductions. The

Company has implemented several cost savings initiatives to reduce certain operating and administrative

costs in 2007.

In August 2006, the Company entered into an MSA with EDS. This MSA is a five-year, $150 million

agreement, commencing on October 1, 2006, wherein EDS will provide a range of IT services to the

Company, including applications development and maintenance, network, workplace and storage

management, back-up and recovery and mid-range hosting services. The MSA will provide significant

cost reductions to the Company over its term at current levels of IT development and support. The

Company continues to incur transition costs in 2007; however, it expects this arrangement to provide

ongoing cost savings in 2008 and beyond.

In February 2007, the Company announced it has signed an agreement to outsource a portion of its

reservation call center transactions to PRC, a global leader in the operation of outsourced call centers,

during the second quarter of 2007. This outsourcing arrangement is expected to provide cost savings in

the future, but is expected to reduce earnings slightly in 2007 due to transition and ramp up costs.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

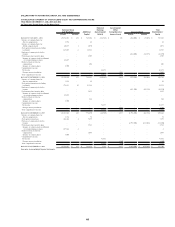

The table below provides information about the Company’s market sensitive financial instruments and

constitutes a “forward-looking statement.” The Company’s primary market risk exposure is changing

interest rates, primarily in the United States. The Company manages interest rates through use of a

combination of fixed and floating rate debt and interest rate swap agreements (see Note 11

of Notes to Consolidated Financial Statements). All items described are non-trading and are stated in

U.S. dollars. Because a portion of the Company’s debt is denominated in Canadian dollars, its carrying

value is impacted by exchange rate fluctuations. However, this foreign currency risk is mitigated by the

underlying collateral which is the Canadian fleet. The fair value and average receive rate of the interest

rate swaps is calculated using projected market interest rates over the term of the related debt

instruments as provided by the counter parties.

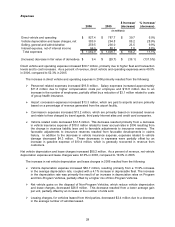

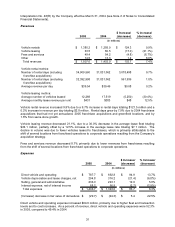

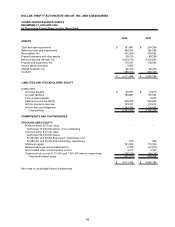

Fair Value

Expected Maturity Dates December 31,

as of December 31, 2006 2007 2008 2009 2010 2011 Total 2006

(in thousands)

Debt:

Vehicle debt and obligations-

floating rates (1) 1,138,491$ 500,000$ -$ 390,000$ 500,000$ 2,528,491$ 2,527,154$

Weighted average interest rates 6.02% 5.34% - 5.26% 5.39%

Vehicle debt and obligations-

fixed rates -$ -$ -$ 110,000$ -$ 110,000$ 107,794$

Weighted average interest rates - - - 4.59% -

Vehicle debt and obligations-

Canadian dollar denominated 107,130$ -$ -$ -$ -$ 107,130$ 107,130$

Weighted average interest rates 4.63% - - - -

Interest Rate Swaps:

Variable to Fixed 312,500$ 500,000$ -$ 390,000$ 500,000$ 1,702,500$ 1,690,960$

Average pay rate 3.64% 4.20% - 4.89% 5.27%

Average receive rate 5.25% 4.87% - 4.89% 4.98%

(1) Floating rate vehicle debt and obligations include the $313 million Series 2003 Notes, the $500 million Series 2004 Notes, $290 million relating to the

Series 2005 Notes and the $600 million Series 2006 Notes swapped from floating interest rates to fixed interest rates.

39