Thrifty Car Rental 2006 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2006 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

included the creation of a limited partnership (TCL Funding Limited Partnership, the “Partnership”).

DTG Canada is the General Partner of the Partnership. The purpose of the Partnership is to

facilitate financing of Canadian vehicles. The Partnership Agreement of the Partnership expires on

May 31, 2010. The Limited Partner has committed to funding CND$300,000,000 (approximately

US$257,000,000 at December 31, 2006), which is funded through issuance and sale of notes in the

Canadian commercial paper market.

DTG Canada, as General Partner, is allocated the remainder of the Partnership net income after

distribution of the income share of the Limited Partner. The income share of the Limited Partner,

which amounted to $6,718,000, $4,219,000 and $3,018,000 for the years ended December 31,

2006, 2005 and 2004, respectively, is included in interest expense. Due to the nature of the

relationship between DTG Canada and the Partnership, the accounts of the Partnership are

appropriately consolidated with the Company. The Partnership Agreement requires the maintenance

of certain letters of credit and contains various restrictive covenants. DTG Canada was in

compliance with all such covenants and requirements at December 31, 2006.

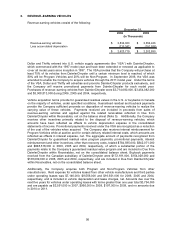

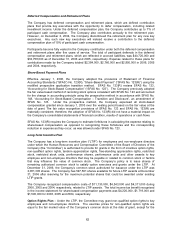

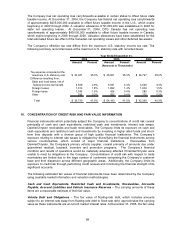

Expected repayments of vehicle debt and obligations outstanding at December 31, 2006 are as

follows:

2007 2008 2009 2010 2011

Asset backed notes 312,500$ 500,000$ -$ 500,000$ 500,000$

Conduit Facility 425,000 - - - -

Commercial paper 180,256 - - - -

Other vehicle debt 220,735 - - - -

Limited partner interest 107,130 - - - -

Total 1,245,621$ 500,000$ -$ 500,000$ 500,000$

(In Thousands)

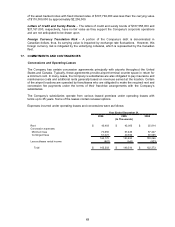

Revolving Credit Facility

The Company has a $300 million five-year, senior secured revolving credit facility (the “Revolving

Credit Facility”) that expires April 1, 2009. The Revolving Credit Facility provides up to $300,000,000

for letters of credit and a sublimit of up to $100,000,000 for working capital borrowings. As of

December 31, 2006, the Company is required to pay a 0.30% commitment fee on the unused

available line, a 1.75% letter of credit fee on the aggregate amount of outstanding letters of credit

and a 0.125% letter of credit issuance fee. Interest rates on loans under the Revolving Credit Facility

are, at the option of the Company, based on the prime, federal funds or Eurodollar rates and are

payable quarterly. The Revolving Credit Facility is collateralized by a first priority lien on substantially

all material non-vehicle assets of the Company. The Revolving Credit Facility contains various

restrictive covenants, including maintenance of certain financial ratios consisting of fixed charge and

leverage ratios and certain limitations on cash dividends and share repurchases. As of December

31, 2006, the Company is in compliance with all covenants. The Company had letters of credit of

$156,566,000 and $135,805,000 and no working capital borrowings outstanding under the

Revolving Credit Facility at December 31, 2006 and 2005, respectively.

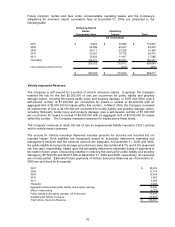

11. DERIVATIVE FINANCIAL INSTRUMENTS

The Company is exposed to market risks, such as changes in interest rates. Consequently, the

Company manages the financial exposure as part of its enterprise risk management program, by

striving to reduce the potentially adverse effects that the potential volatility of the financial markets

may have on the Company’s operating results. In 2001, the Company began entering into interest

rate swap agreements, in conjunction with each related new asset backed note issuance in 2001

through 2006, to convert variable interest rates on a total of $1.7 billion in asset backed notes to

fixed interest rates. These swaps have termination dates through May 2011. The Company reflects

these swaps on its balance sheet at fair market value, which totaled approximately $11,540,000 at

December 31, 2006, comprised of assets, included in receivables, of approximately $14,271,000

60