Thrifty Car Rental 2006 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2006 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.“Liquidity Facility”). Borrowings under the Commercial Paper Program are secured by eligible vehicle

collateral and bear interest at market-based commercial paper rates. At December 31, 2006, the

Company had $179.0 million in commercial paper outstanding under the Commercial Paper Program.

The Commercial Paper Program and the Liquidity Facility are renewable annually. The Commercial

Paper Program peaked in size on March 28, 2006 when it reached $636.2 million.

In March 2007, the Commercial Paper Program is expected to be extended for a 90-day period at existing

levels, backed by an extension of the Liquidity Facility.

Vehicle Debt and Obligations

The Company finances its Canadian vehicle fleet through a fleet securitization program. Under this

program, DTG Canada can obtain vehicle financing up to CND$300 million funded through a bank

commercial paper conduit which expires May 31, 2010. At December 31, 2006, DTG Canada had

approximately CND$124.9 million (US$107.1 million) funded under this program.

Vehicle manufacturer and bank lines of credit provided $312 million in capacity at December 31, 2006, an

increase of $14.3 million from December 31, 2005. This increase is due to an increase in bank lines of

credit, partially offset by a decrease in vehicle manufacturer lines of credit. Borrowings of $220.7 million

were outstanding under these lines at December 31, 2006. These lines of credit are secured by the

vehicles financed under these facilities and are primarily renewable annually. The Company expects to

continue using these sources of vehicle financing in 2007 and future years.

Revolving Credit Facility

The Company has a $300 million senior secured, revolving credit facility (the “Revolving Credit Facility”)

that expires on April 1, 2009. The Revolving Credit Facility is used to provide working capital borrowings

and letters of credit. The availability of funds under the Revolving Credit Facility is subject to the

Company’s continued compliance with certain covenants, including a covenant that sets the maximum

amount the Company can spend annually on the acquisition of non-vehicle capital assets, and certain

financial covenants including a maximum leverage ratio, a minimum fixed charge coverage ratio and a

limitation on cash dividends and share repurchases. The Revolving Credit Facility permits letter of credit

usage of up to $300 million and working capital borrowings of up to $100 million. At December 31, 2006,

the Company had letters of credit outstanding under the Revolving Credit Facility of approximately $156.6

million and no working capital borrowings. The Company uses letters of credit to support insurance

programs, asset backed vehicle financing programs and airport concession and lease agreements. As of

December 31, 2006, the Company was in compliance with all covenants.

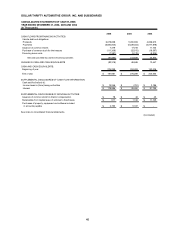

Debt Servicing Requirements

The Company will continue to have substantial debt and debt service requirements under its financing

arrangements. As of December 31, 2006, the Company’s total consolidated debt and other obligations

were approximately $2.7 billion, all of which was secured debt for the purchase of vehicles. The majority

of the Company’s vehicle debt is issued by special purpose finance entities as described herein all of

which are fully consolidated into the Company’s financial statements. The Company has scheduled

annual principal payments of approximately $1.2 billion in 2007, $500 million in 2008, $500 million in 2010

and $500 million in 2011.

The Company intends to use cash generated from operations and from the sale of vehicles for debt

service and, subject to restrictions under its debt instruments, to make capital investments and

repurchase its shares. The Company has historically repaid its debt and funded its capital investments

(aside from growth in its rental fleet) with cash provided from operations and from the sale of vehicles.

The Company has funded growth in its vehicle fleet by incurring additional secured vehicle debt and with

cash generated from operations. The Company expects to incur additional debt from time to time to the

extent permitted under the terms of its debt instruments.

The Company has significant requirements for bonds and letters of credit to support its insurance

programs and airport concession obligations. At December 31, 2006, various insurance companies had

$37.2 million in surety bonds and various banks had $72.5 million in letters of credit to secure these

obligations. At December 31, 2006, these surety bonds and letters of credit had not been drawn upon.

36