Thrifty Car Rental 2006 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2006 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

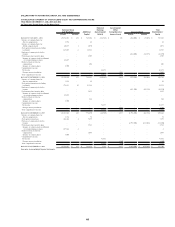

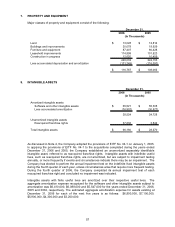

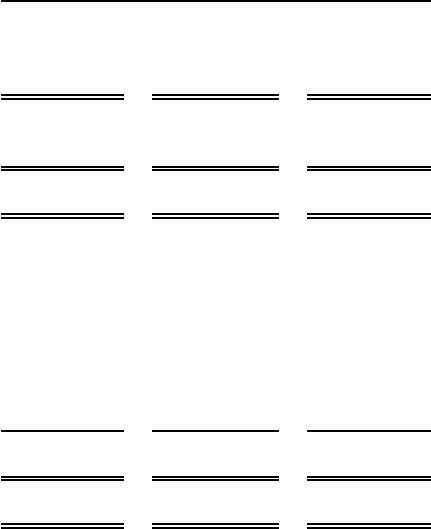

3. EARNINGS PER SHARE

The computation of weighted average common and common equivalent shares used in the

calculation of basic and diluted EPS is shown below:

2006 2005 2004

(In Thousands, Except Share and Per Share Data)

Income before cumulative effect of a

change in accounting principle 51,692$ 76,355$ 62,743$

Basic EPS:

Weighted average common shares 24,195,933 25,120,617 24,947,791

Basic EPS 2.14$ 3.04$ 2.51$

Diluted EPS:

Weighted average common shares 24,195,933 25,120,617 24,947,791

Shares contingently issuable:

Stock options 264,098 351,260 432,985

Performance awards 419,313 613,616 561,641

Shares held for compensation plans 270,085 181,747 175,888

Director compensation shares deferred 169,370 138,230 104,480

Shares applicable to diluted 25,318,799 26,405,470 26,222,785

Diluted EPS 2.04$ 2.89$ 2.39$

Year Ended December 31,

At December 31, 2006, 2005 and 2004, all options to purchase shares of common stock were

included in the computation of diluted EPS because no exercise price was greater than the average

market price of the common shares.

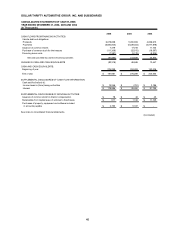

4. ACQUISITIONS

In 2006, the Company acquired certain assets and assumed certain liabilities relating to 35 locations

from former franchisees in Little Rock, Arkansas; Providence, Rhode Island; Cincinnati, Columbus

and Dayton, Ohio; Milwaukee and Madison, Wisconsin; Pensacola, Florida; Phoenix, Arizona; Reno,

Nevada; El Paso and San Antonio, Texas for the Thrifty brand and in Nashville, Tennessee;

Oklahoma City and Tulsa, Oklahoma; Minneapolis, Minnesota; Madison, Wisconsin; and El Paso,

Texas for the Dollar brand. During 2005, the Company acquired certain assets and assumed

certain liabilities relating to 12 locations from former franchisees in Jacksonville, Melbourne and

Cape Canaveral, Florida; San Jose, California; Baton Rouge and New Orleans, Louisiana and

Albuquerque and Santa Fe, New Mexico for the Thrifty brand. During 2004, the Company acquired

certain assets and assumed certain liabilities relating to 24 locations from former franchisees in

Aspen, Colorado; Greensboro and Raleigh-Durham, North Carolina; Ft. Myers, Orlando and Tampa,

Florida; Chicago, Illinois; Corpus Christi, Texas; Los Angeles, San Diego, and Orange County,

California and Boise, Idaho for the Thrifty brand and in Aspen, Colorado; Boise, Idaho; and

Vancouver, British Columbia, Canada, for the Dollar brand. Total cash paid, net of cash acquired,

for these acquisitions was $34,475,000, $5,224,000 and $77,789,000 in 2006, 2005 and 2004,

respectively.

Beginning January 1, 2005, the Company adopted the provisions of EITF No. 04-1. EITF No. 04-1

affirms that a business combination between two parties that have a preexisting relationship should

be accounted for as a multiple element transaction. This includes determining how the cost of the

combination should be allocated after considering the assets and liabilities that existed between the

54