Thrifty Car Rental 2006 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2006 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

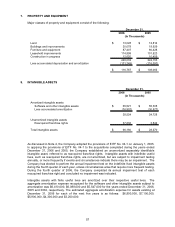

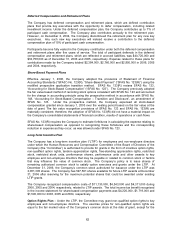

7. PROPERTY AND EQUIPMENT

Major classes of property and equipment consist of the following:

2006 2005

Land 13,028$ 12,814$

Buildings and improvements 20,078 18,929

Furniture and equipment 87,407 80,428

Leasehold improvements 114,899 101,523

Construction in progress 12,620 10,459

248,032 224,153

Less accumulated depreciation and amortization (131,245) (116,091)

116,787$ 108,062$

December 31,

(In Thousands)

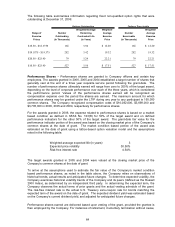

8. INTANGIBLE ASSETS

2006 2005

Amortized intangible assets

Software and other intangible assets 65,521$ 55,305$

Less accumulated amortization (36,997) (30,577)

28,524 24,728

Unamortized intangible assets

Reacquired franchise rights 37,636 3,542

Total intangible assets 66,160$ 28,270$

December 31,

(In Thousands)

As discussed in Note 4, the Company adopted the provisions of EITF No. 04-1 on January 1, 2005.

In applying the provisions of EITF No. 04-1 to the acquisitions completed during the years ended

December 31, 2006 and 2005, the Company established an unamortized separately identifiable

intangible asset, referred to as reacquired franchise rights. Intangible assets with indefinite useful

lives, such as reacquired franchise rights, are not amortized, but are subject to impairment testing

annually, or more frequently if events and circumstances indicate there may be an impairment. The

Company has elected to perform the annual impairment test on the indefinite lived intangible assets

during the fourth quarter of each year, unless circumstances arise that require more frequent testing.

During the fourth quarter of 2006, the Company completed its annual impairment test of each

reacquired franchise right and concluded no impairment was indicated.

Intangible assets with finite useful lives are amortized over their respective useful lives. The

aggregate amortization expense recognized for the software and other intangible assets subject to

amortization was $6,410,000, $6,088,000 and $5,547,000 for the years ended December 31, 2006,

2005 and 2004, respectively. The estimated aggregate amortization expense for assets existing at

December 31, 2006 for each of the next five years is as follows: $6,800,000, $7,100,000,

$5,900,000, $4,300,000 and $3,200,000.

57