Thrifty Car Rental 2006 Annual Report Download - page 40

Download and view the complete annual report

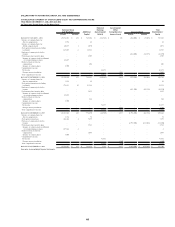

Please find page 40 of the 2006 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.projects and more significant upgrades in information technology equipment and systems. In addition,

the Company used cash for franchisee acquisitions of $34.5 million in 2006 and will continue to pursue

the acquisition of certain franchisee operations, subject to Revolving Credit Facility restrictions. Future

franchisee acquisition expenditures are expected to be financed with available cash and cash to be

provided from future operations.

Cash used in financing activities was $91.9 million primarily due to a net decrease in the issuance of

commercial paper totaling $382.2 million, the maturity of asset backed notes totaling $295.8 million and

share repurchases totaling $111.3 million, partially offset by the issuance of $600.0 million in asset

backed notes in March 2006, an increase of $50.0 million under the asset backed Variable Funding Note

Purchase Facility (the “Conduit Facility”), and an increase of $47.4 million in other existing bank vehicle

lines of credit.

In March of 2002, Congress passed the Job Creation and Worker Assistance Act of 2002, which includes

a provision allowing bonus depreciation on certain depreciable assets, including vehicles, acquired after

September 10, 2001 and before September 11, 2004. In May 2003, Congress passed the Jobs and

Growth Tax Relief Reconciliation Act of 2003, which increased the rate of bonus depreciation for assets

acquired after May 5, 2003 and extended the benefit of this increased rate to assets acquired through

December 31, 2004. The Acts significantly increase the amount of tax basis depreciation that can be

claimed on the Company’s federal and some state tax returns. The Company utilizes a like-kind

exchange program for its vehicles whereby tax basis gains on disposal of eligible revenue-earning

vehicles are deferred (the “Like-Kind Exchange Program”). To qualify for Like-Kind Exchange Program

treatment, the Company exchanges (through a qualified intermediary) vehicles being disposed of with

vehicles being purchased allowing the Company to carry-over the tax basis of vehicles sold to

replacement vehicles, with certain adjustments.

The Acts have minimized the payment of most cash income taxes and have allowed the Company to

carry back benefits to obtain refunds of taxes paid in prior years. The Acts improve the Company’s

liquidity position by increasing cash and cash equivalents due to significantly reduced cash required for

tax payments and from refunds of taxes paid in prior years. The Like-Kind Exchange Program has

extended the period in which the Company expects to pay reduced cash income taxes beyond when the

bonus depreciation provision included in the Acts expired. The Like-Kind Exchange Program has

significantly increased the amount of cash and investments restricted for the purchase of replacement

vehicles, especially during seasonally reduced fleet periods. At December 31, 2006, restricted cash and

investments totaled $389.8 million and are restricted for the acquisition of revenue-earning vehicles and

other specified uses as defined under the asset backed note program, the Canadian fleet securitization

partnership program and the Like-Kind Exchange Program. The majority of the restricted cash and

investments balance is normally utilized in the second and third quarters for seasonal purchases.

Share Repurchase Program

On February 9, 2006, the Company announced that its Board of Directors had authorized a new $300

million share repurchase program, which will extend through December 31, 2008, to replace the existing

$100 million program of which $44.7 million had been used to repurchase shares. In 2006, the Company

repurchased 2,558,900 shares of common stock at an average price of $43.50 per share totaling $111.3

million. Since inception of the share repurchase program through December 31, 2006, the Company has

repurchased 4,110,500 shares of common stock at an average price of $37.96 per share totaling

approximately $156.0 million, all of which were made in open market transactions. At December 31,

2006, the $300 million share repurchase program had $188.7 million of remaining authorization to be

completed by December 31, 2008.

To augment its share repurchase program, the Company has used trading plans in accordance with Rule

10b5-1 of the Securities Exchange Act of 1934 (“Rule 10b5-1”). Rule 10b5-1 trading plans allow

repurchases of the Company’s common stock during black-out periods by establishing a prearranged

written plan to buy a specified number of shares of the Company’s common stock over a set period of

time. The Company expects to continue to use such plans from time to time to repurchase its shares.

34