Thrifty Car Rental 2006 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2006 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

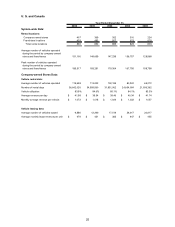

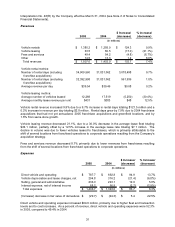

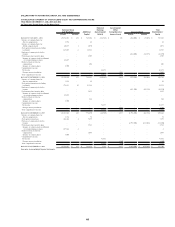

Contractual Obligations and Commitments

The Company has various contractual commitments primarily related to asset backed notes, commercial

paper and short-term borrowings outstanding for vehicle purchases, airport concession fee and operating

lease commitments related to airport and other facilities, technology contracts, and vehicle purchases.

The Company expects to fund these commitments with cash generated from operations, sales proceeds

from disposal of used vehicles, the renewal of its 364-day bank facilities and continuation of asset backed

note issuances as existing notes mature. The following table provides details regarding the Company’s

contractual cash obligations and other commercial commitments subsequent to December 31, 2006:

Beyond

2007 2008-2009 2010-2011 2011 Total

Contractual cash obligations:

Asset backed notes (1) 386,634$ 606,751$ 1,043,002$ -$ 2,036,387$

Commercial paper outstanding (1) 189,902 - - - 189,902

Other short-term borrowings (1) 798,248 - - - 798,248

Subtotal - Vehicle debt and obligations 1,374,784 606,751 1,043,002 - 3,024,537

Operating lease commitments 42,983 52,937 28,172 89,580 213,672

Airport concession fee commitments 70,260 91,855 58,290 104,617 325,022

Vehicle purchase commitments 2,459,346 - - - 2,459,346

Other commitments 42,196 71,694 56,057 - 169,947

Total contractual cash obligations 3,989,569$ 823,237$ 1,185,521$ 194,197$ 6,192,524$

Other commercial commitments:

Letters of credit 126,081$ 41,477$ -$ -$ 167,558$

Payments due or commitment expiration by period

(in thousands)

(1) Further discussion of asset backed notes, commercial paper outstanding and short-term borrowings

is below and in Note 10 of Notes to Consolidated Financial Statements. Amounts include both principal

and interest payments. Amounts exclude related discounts, where applicable.

Asset Backed Notes

The asset backed note program is comprised of $1.81 billion in asset backed notes with maturities

ranging from 2007 to 2011. Borrowings under the asset backed notes are secured by eligible vehicle

collateral and bear interest at fixed rates ranging from 3.64% to 5.27% including certain floating rate notes

swapped to fixed rates. Proceeds from the asset backed notes that are temporarily not utilized for

financing vehicles and certain related receivables are maintained in restricted cash and investment

accounts, which were approximately $359.6 million at December 31, 2006.

On March 28, 2006, RCFC issued $600 million of five-year asset backed notes (the “2006 Series Notes”)

to replace maturing asset backed notes and provide for growth in the Company’s fleet. The 2006 Series

Notes consist of $600 million floating rate notes at LIBOR plus 0.18%. In conjunction with the issuance of

the 2006 Series Notes, the Company also entered into interest rate swap agreements to convert this

floating rate debt to fixed rate debt at a 5.27% interest rate.

Conduit Facility

On March 28, 2006, the Company renewed its Variable Funding Note Purchase Facility (the “Conduit

Facility”) for another 364-day period with a capacity of $425 million. Proceeds are used for financing of

vehicle purchases and for a periodic refinancing of asset backed notes. The Conduit Facility generally

bears interest at market-based commercial paper rates and is renewed annually. In March 2007, the

Conduit Facility is expected to be extended for a 90-day period at existing levels.

Commercial Paper Program and Liquidity Facility

At December 31, 2006, the Company’s commercial paper program (the “Commercial Paper Program”)

had a maximum capacity of $649 million supported by a $560 million, 364-day liquidity facility (the

35