Thrifty Car Rental 2006 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2006 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.scope and related charges for these services are negotiated on an annual basis between the

Company’s management and designated franchisee members of Thrifty National Ad.

Environmental Costs – The Company’s operations include the storage of gasoline in underground

storage tanks at certain company-owned stores. Liabilities incurred in connection with the

remediation of accidental fuel discharges are recorded when it is probable that obligations have

been incurred and the amounts can be reasonably estimated.

Contingent Rent – The Company recognizes contingent rent expense associated with certain

airport concession agreements monthly as incurred since the Company’s achievement of the annual

targeted qualifying revenues is probable.

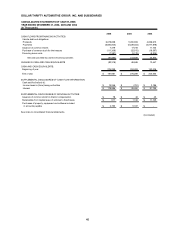

Income Taxes – U.S. operating results are included in the Company’s consolidated U.S. income tax

returns. The Company has provided for income taxes on its separate taxable income or loss and

other tax attributes. Deferred income taxes are provided for the temporary differences between the

financial reporting basis and the tax basis of the Company’s assets and liabilities. A valuation

allowance is recorded for deferred income tax assets related to DTG Canada losses since

management has not determined it is more likely than not that such assets will be realized.

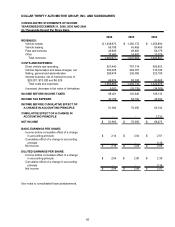

Earnings Per Share – Basic earnings per share (“EPS”) is computed by dividing net income by the

weighted average number of common shares outstanding during the period. Diluted EPS is based

on the combined weighted average number of common shares and common share equivalents

outstanding which include, where appropriate, the assumed exercise of options. In computing

diluted EPS, the Company has utilized the treasury stock method.

Stock-Based Compensation – The Company previously adopted the provisions of SFAS No. 123,

“Accounting for Stock-Based Compensation,” ("SFAS No. 123") changing from the intrinsic value-

based method to the fair value-based method of accounting for stock-based compensation, and

elected the prospective treatment option, which requires recognition as compensation expense for

all future employee awards granted, modified or settled as allowed under SFAS No. 148,

“Accounting for Stock-Based Compensation – Transition and Disclosure” ("SFAS No. 148"), an

amendment of SFAS No. 123. The Company did not issue stock options in 2006, 2005 or 2004.

At the end of 2004, all stock options became fully vested. Therefore, the disclosure of the pro forma

results as if the fair value-based methods of SFAS No. 123 had been applied is not presented for

the year ended December 31, 2006 and 2005. All performance share and restricted stock awards

are accounted for using the fair value-based method in accordance with SFAS No. 123 for the 2006,

2005 and 2004 periods.

The Company adopted SFAS No. 123(R), “Share-Based Payment,” (“SFAS No. 123(R)”) as

required on January 1, 2006 (See "New Accounting Standards").

50