Thrifty Car Rental 2006 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2006 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

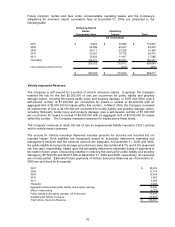

of the asset backed notes with fixed interest rates of $107,794,000 was less than the carrying value

of $110,000,000 by approximately $2,206,000.

Letters of Credit and Surety Bonds – The letters of credit and surety bonds of $167,558,000 and

$37,161,000, respectively, have no fair value as they support the Company's corporate operations

and are not anticipated to be drawn upon.

Foreign Currency Translation Risk – A portion of the Company’s debt is denominated in

Canadian dollars, thus, its carrying value is impacted by exchange rate fluctuations. However, this

foreign currency risk is mitigated by the underlying collateral, which is represented by the Canadian

fleet.

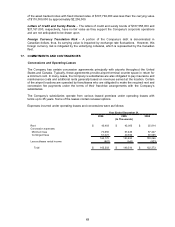

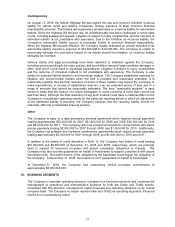

17. COMMITMENTS AND CONTINGENCIES

Concessions and Operating Leases

The Company has certain concession agreements principally with airports throughout the United

States and Canada. Typically, these agreements provide airport terminal counter space in return for

a minimum rent. In many cases, the Company’s subsidiaries are also obligated to pay insurance and

maintenance costs and additional rents generally based on revenues earned at the location. Certain

of the airport locations are operated by franchisees who are obligated to make the required rent and

concession fee payments under the terms of their franchise arrangements with the Company’s

subsidiaries.

The Company’s subsidiaries operate from various leased premises under operating leases with

terms up to 25 years. Some of the leases contain renewal options.

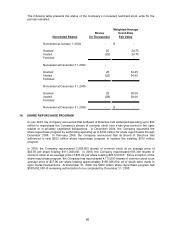

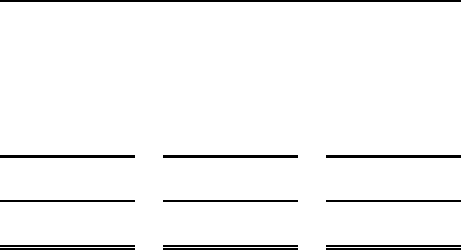

Expenses incurred under operating leases and concessions were as follows:

Year Ended December 31,

2006 2005 2004

(In Thousands)

Rent 42,493$ 42,092$ 35,914$

Concession expenses:

Minimum fees 70,656 67,426 57,247

Contingent fees 51,021 40,932 39,935

164,170 150,450 133,096

Less sublease rental income (867) (940) (823)

Total 163,303$ 149,510$ 132,273$

69