Thrifty Car Rental 2006 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2006 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Company has net operating loss carryforwards available in certain states to offset future state

taxable income. At December 31, 2006, the Company has federal net operating loss carryforwards

of approximately $435,000,000 available to offset future taxable income in the U.S., which expire

beginning in 2022 through 2024. A valuation allowance of $1,200,000 was established in 2006 for

state net operating losses. At December 31, 2006, DTG Canada has net operating loss

carryforwards of approximately $49,000,000 available to offset future taxable income in Canada,

which expire beginning in 2008 through 2026. Valuation allowances have been established for the

total estimated future tax effect of the Canadian net operating losses and other deferred tax assets.

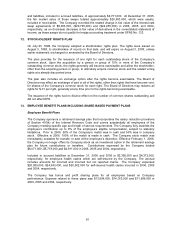

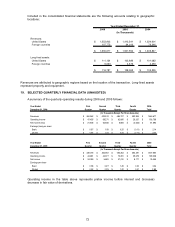

The Company’s effective tax rate differs from the maximum U.S. statutory income tax rate. The

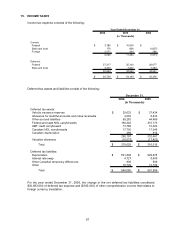

following summary reconciles taxes at the maximum U.S. statutory rate with recorded taxes:

A

mount Percent

A

mount Percent Amount Percent

(Amounts in Thousands)

Tax expense computed at the

maximum U.S. statutory rate 30,947$ 35.0% 45,691$ 35.0% 36,797$ 35.0%

Difference resulting from:

State and local taxes, net of

federal income tax benefit 2,528 2.9% 5,631 4.3% 3,526 3.3%

Foreign losses 1,614 1.8% 1,892 1.4% 1,606 1.5%

Foreign taxes 1,345 1.5% 424 0.4% 286 0.3%

Other 295 0.3% 552 0.4% 175 0.2%

Total 36,729$ 41.5% 54,190$ 41.5% 42,390$ 40.3%

Year Ended December 31,

2006 2005 2004

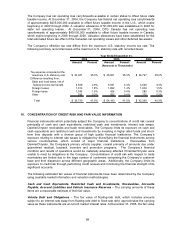

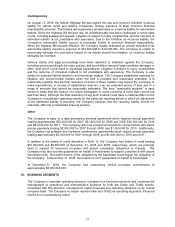

16. CONCENTRATION OF CREDIT RISK AND FAIR VALUE INFORMATION

Financial instruments which potentially subject the Company to concentrations of credit risk consist

principally of cash and cash equivalents, restricted cash and investments, interest rate swaps,

DaimlerChrysler receivables and trade receivables. The Company limits its exposure on cash and

cash equivalents and restricted cash and investments by investing in highly rated funds and short-

term time deposits with a diverse group of high quality financial institutions. The Company’s

exposure relating to interest rate swaps is mitigated by diversifying the financial instruments among

various counterparties, which consist of major financial institutions. Receivables from

DaimlerChrysler, the Company's primary vehicle supplier, consist primarily of amounts due under

guaranteed residual, buyback, incentive and promotion programs. The Company’s financial

condition and results of operations would be materially adversely affected if DaimlerChrysler were

unable to meet its obligations to the Company. Concentrations of credit risk with respect to trade

receivables are limited due to the large number of customers comprising the Company’s customer

base and their dispersion across different geographic areas. Additionally, the Company limits its

exposure to credit risk through performing credit reviews and monitoring the financial strength of its

significant accounts.

The following estimated fair values of financial instruments have been determined by the Company

using available market information and valuation methodologies.

Cash and Cash Equivalents, Restricted Cash and Investments, Receivables, Accounts

Payable, Accrued Liabilities and Vehicle Insurance Reserves – The carrying amounts of these

items are a reasonable estimate of their fair value.

Vehicle Debt and Obligations – The fair value of floating-rate debt, which includes amounts

subject to an interest rate swap from floating-rate debt to fixed-rate debt, approximates the carrying

value as these instruments are at current market interest rates. At December 31, 2006, the fair value

68