Thrifty Car Rental 2006 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2006 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATION

Overview

The Company operates two value rental car brands, Dollar and Thrifty. The majority of its customers pick

up their vehicles at airport locations. Both brands are value priced and the Company seeks to be the

industry’s low cost provider. Leisure customers typically rent vehicles for longer periods than business

customers, on average, providing lower transaction costs. The Company believes its vehicle utilization is

consistently higher than that of its competitors.

Both Dollar and Thrifty operate through a network of company-owned stores and franchisees. The

majority of the Company’s revenue is generated from renting vehicles to customers through company-

owned stores, with lesser amounts generated through vehicle leasing, royalty fees and services provided

to franchisees.

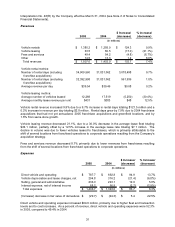

In 2006, the Company’s revenues were positively impacted by franchise acquisitions and stronger rental

demand due to increased travel. Total rental day volume increased 5.0% with same store volume

increasing by 1.1%. In addition, year over year revenue growth was positively impacted by a 6.2%

increase in revenue per day. Airline passenger enplanements, an important driver for airport rental car

demand, were down slightly in 2006.

During 2006, the Company had higher vehicle depreciation expenses due to higher average depreciation

rates resulting from vehicle manufacturers increasing industry vehicle costs. These increases in vehicle

depreciation expense were partially mitigated by a higher mix of lower cost Non-Program Vehicles.

The Company continued to benefit from lower vehicle-related insurance costs in 2006, due to reduced

insurance reserves resulting from net favorable developments in claims history and to the benefits of the

change in the vicarious liability laws in 2005.

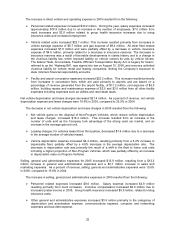

Additionally, during 2006, the Company implemented various cost savings initiatives, including

information technology outsourcing and streamlining the organization, to reduce costs going forward.

The Company uses mark-to-market accounting for its interest rate swap agreements. This accounting

treatment results in significant volatility to the Company’s operating results but does not impact cash flow.

In 2006, the change in fair value of these interest rate swap agreements was a decrease of $9.4 million

compared to an increase of ($29.7) million in 2005.

The Company continues to make significant progress in its long term strategy to operate both brands as

corporate stores in the top 75 U.S. airport markets, the top eight Canadian airport markets and in other

key leisure destinations, and to operate through franchisees in the smaller markets and in markets

outside the U.S. and Canada. During 2006, the Company acquired franchise operations for Dollar and

Thrifty in 16 U.S. markets and rental day volume increased approximately 3.9% in company-owned stores

as a result of these acquisitions. The Company generally expects to continue to fund all remaining

franchisee acquisitions with cash from operations.

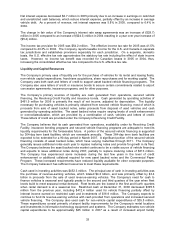

The Company’s profitability is primarily a function of the volume and pricing of rental transactions,

utilization of the vehicles and the volume and pricing of vehicles leased to franchisees. Significant

changes in the purchase or disposal price of vehicles or interest rates can also have a significant effect

on the Company’s profitability, depending on the ability of the Company to adjust pricing and lease rates

for these changes. The Company’s business requires significant expenditures for vehicles and,

consequently, requires substantial liquidity to finance such expenditures.

The Company expects its ongoing cash flow to exceed cash required to operate the business. In 2006,

the Company repurchased 2,558,900 shares for a total of $111.3 million. The Company has repurchased

4,110,500 shares at a cost of $156.0 million since announcing the share repurchase program in July

2003. The Company expects to continue its share repurchases in 2007 and 2008 as its share repurchase

program extends through December 31, 2008.

26