Thrifty Car Rental 2006 Annual Report Download

Download and view the complete annual report

Please find the complete 2006 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages

listed below, or by using the keyword search tool below to find specific information within the annual report.

-

1

-

2

-

3

-

4

-

5

-

6

-

7

-

8

-

9

-

10

-

11

-

12

-

13

-

14

-

15

-

16

-

17

-

18

-

19

-

20

-

21

-

22

-

23

-

24

-

25

-

26

-

27

-

28

-

29

-

30

-

31

-

32

-

33

-

34

-

35

-

36

-

37

-

38

-

39

-

40

-

41

-

42

-

43

-

44

-

45

-

46

-

47

-

48

-

49

-

50

-

51

-

52

-

53

-

54

-

55

-

56

-

57

-

58

-

59

-

60

-

61

-

62

-

63

-

64

-

65

-

66

-

67

-

68

-

69

-

70

-

71

-

72

-

73

-

74

-

75

-

76

-

77

-

78

-

79

-

80

-

81

-

82

-

83

-

84

-

85

-

86

-

87

-

88

-

89

-

90

-

91

-

92

-

93

-

94

-

95

-

96

-

97

-

98

-

99

-

100

-

101

-

102

-

103

-

104

-

105

-

106

-

107

-

108

-

109

-

110

-

111

-

112

Table of contents

-

Page 1

-

Page 2

-

Page 3

-

Page 4

-

Page 5

FORM 10 -K

Dollar Thrifty Automotive Group, Inc.

-

Page 6

...of principal executive offices and zip code) Registrant's telephone number, including area code: (918) 660-7700 Securities registered pursuant to Section 12(b) of the Act: Title of each class: Common Stock, $.01 par value Name of each exchange on which registered: New York Stock Exchange

Securities...

-

Page 7

... closing price of the stock on the New York Stock Exchange on such date was $1,094,783,697. The number of shares outstanding of the registrant's Common Stock as of February 28, 2007 was 23,699,081. DOCUMENTS INCORPORATED BY REFERENCE Portions of the definitive Proxy Statement for the Annual Meeting...

-

Page 8

......SELECTED FINANCIAL DATA...MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION...QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK...FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA...CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL...

-

Page 9

...and competitive conditions in markets and countries where the companies' customers reside and where the companies and their franchisees operate; natural hazards or catastrophes; incidents of terrorism; airline travel patterns; changes in capital availability or cost; costs and other terms related to...

-

Page 10

... operates a franchised retail used car sales network. The Company has two additional subsidiaries, Rental Car Finance Corp. and Dollar Thrifty Funding Corp., which are special purpose financing entities and have been appropriately consolidated in the financial statements of the Company. Dollar Rent...

-

Page 11

... Relations" department. The annual Chief Executive Officer certification required by the New York Stock Exchange Listed Company Manual was submitted to the New York Stock Exchange on May 19, 2006. Industry Overview The U.S. daily vehicle rental industry has two principal markets: the airport market...

-

Page 12

... States, the Dollar and Thrifty brands remain separate, but operate corporately under a single management structure and share vehicles, back-office employees and facilities, where possible. The Company also operates company-owned stores in the eight largest airport markets in Canada under DTG Canada...

-

Page 13

... using a single management team for both brands. In addition, this operating model included sharing vehicles, back-office employees and service facilities, where possible. As of December 31, 2006, the Company operates the Dollar brand in 58 and the Thrifty brand in 53 of the top 75 airport markets...

-

Page 14

... loss damage waivers and insurance products related to the vehicle rental.

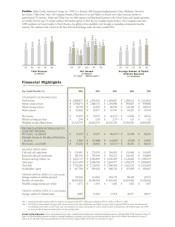

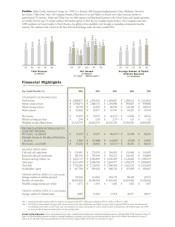

Summary of Corporate Operations Data 2006 Year Ended December 31, 2005 (in thousands) 2004

Rental revenues: United States - Dollar United States - Thrifty Total U.S. rental revenues Canada - Dollar and Thrifty Total rental...

-

Page 15

...market while leveraging fixed costs. Dollar and Thrifty license to franchisees the use of their respective brand service marks in the vehicle rental and leasing and parking businesses. Franchisees of Dollar and Thrifty pay an initial franchise fee generally based on the population, number of airline...

-

Page 16

... service business development center, a nationally supported Internet strategy and website, operational and marketing support, vehicle supply services, customized retail and wholesale financing programs as well as national accounts and supplies programs. As of December 31, 2006, Thrifty Car Sales...

-

Page 17

... Dollar and Thrifty are among the leading car rental companies in direct-connect technology, which bypasses global distribution systems and reduces reservation costs. Dollar and Thrifty have entered into direct-connect relationships with certain airline and other travel partners. In addition, Dollar...

-

Page 18

... the Company's worldwide reservations centers, the automated counter system produces rental agreements and provides the Company and its franchisees with customer and vehicle inventory information as well as financial and operating reports. Supplies and National Account Programs. The Company makes...

-

Page 19

... not set any terms or conditions on the resale of Non-Program Vehicles other than requiring minimum holding periods. For the 2006 model year, approximately 32% of all vehicles acquired by DTG Operations were Non-Program Vehicles. Vehicle depreciation is the largest single cost element in the Company...

-

Page 20

... them to corporate operations, leasing revenue will continue to decline. DTG Operations sets lease rates after considering depreciation rates for Program Vehicles, estimated Non-Program Vehicle depreciation rates, interest costs, model mix, administrative costs and market conditions. Average monthly...

-

Page 21

... for damage to the vehicle or cap the price charged for loss damage waivers. Adoption of national or additional state legislation affecting or limiting the sale, or capping the rates, of loss damage waivers could result in the loss of this revenue and could increase costs to Dollar, Thrifty and...

-

Page 22

...to federal, state and local laws and regulations relating to taxing and licensing of vehicles, franchise sales, franchise relationships, vehicle liability, used vehicle sales, insurance, telecommunications, vehicle rental transactions and labor matters. The Company believes that Dollar's and Thrifty...

-

Page 23

... agreements as of December 31, 2006. The Company believes its relationship with its employees is good. ITEM 1A. RISK FACTORS

Expanding upon the factors discussed in the Forward-Looking Statements section provided at the beginning of this Annual Report on Form 10-K, the following are important...

-

Page 24

... agreements that are outside the vehicle supply agreement. Vehicle manufacturers, including DaimlerChrysler, have recently stated their intent to reduce vehicle supply to the rental car industry and have significantly increased industry vehicle costs by increasing Program Vehicle depreciation rates...

-

Page 25

... party Internet sites could result in reduced reservations from one or more of these sites and less revenue. Liability Insurance Risk We are exposed to claims for personal injury, death and property damage resulting from accidents involving our rental customers and the use of our cars. In March 2006...

-

Page 26

...future environmental liabilities will not be material to the Company's consolidated financial position or results of operations or cash flows. Vehicle Financing We depend on the capital markets for financing our vehicles using primarily asset backed financing programs. We use our cash and letters of...

-

Page 27

... parties. As of December 31, 2006, the Company's company-owned operations were carried on at 407 locations in the United States and Canada, the majority of which are leased. Dollar and Thrifty each operate company-owned stores under concession agreements with various governmental authorities charged...

-

Page 28

... limits and increase the level of spending for non-vehicle capital assets. See "Management's Discussion and Analysis of Financial Condition and Results of Operation - Liquidity and Capital Resources". Equity Compensation Plan Information The following table sets forth certain information for the...

-

Page 29

... announced that its Board of Directors had authorized a new $300 million share repurchase program to replace the existing $100 million program of which $44.7 million had been used to repurchase shares. In 2006, the Company repurchased 2,558,900 shares of common stock at an average price of $43.50...

-

Page 30

...Company records.

2006 Statements of Income:

(in thousands except per share amounts)

2005

Year Ended December 31, 2004 2003

2002

Revenues: Vehicle rentals Vehicle leasing Fees and services Other Total revenues Costs and expenses: Direct vehicle and operating Vehicle depreciation and lease charges...

-

Page 31

... S. and Canada

2006 2005 Year Ended December 31, 2004 2003 2002

System-wide Data:

Rental locations: Company-owned stores Franchisee locations Total rental locations Average number of vehicles operated during the period by company-owned stores and franchisees Peak number of vehicles operated during...

-

Page 32

... FINANCIAL CONDITION AND RESULTS OF OPERATION

The Company operates two value rental car brands, Dollar and Thrifty. The majority of its customers pick up their vehicles at airport locations. Both brands are value priced and the Company seeks to be the industry's low cost provider. Leisure customers...

-

Page 33

... following table sets forth the percentage of total revenues in the Company's consolidated statements of income:

2006 Revenues: Vehicle rentals Vehicle leasing Fees and services Other Total revenues Costs and expenses: Direct vehicle and operating Vehicle depreciation and lease charges, net Selling...

-

Page 34

... to the shift of several locations from franchised operations to corporate operations, and the lease rates increased as a result of higher vehicle depreciation and financing costs. Fees and services revenue decreased 5.3% primarily due to lower revenues from franchisees resulting from the...

-

Page 35

... revenue and relate to fees charged by travel agents, third party Internet sites and credit card companies. Vehicle related costs decreased $12.5 million. This decrease resulted primarily from a decrease in vehicle insurance expense of $18.0 million related to lower accrual rates in 2006 resulting...

-

Page 36

...an increase in the rate received on interest reimbursements relating to vehicle programs. As a percent of revenue, net interest expense was 5.8% in 2006 and 2005. The change in fair value of the Company's interest rate swap agreements was a decrease of $9.4 million in 2006 compared to an increase of...

-

Page 37

... lease rate totaling $7.1 million. The decline in volume was due to fewer vehicles leased to franchisees, which is primarily attributable to the shift of several locations from franchised operations to corporate operations resulting from the Company's acquisition strategy. Fees and services revenue...

-

Page 38

... the disposal of Non-Program Vehicles, which reduce vehicle depreciation and lease charges, increased $18.4 million. This increase resulted from an increase in the number of units sold as the Company took advantage of the strong used car market, and an increase in the average gain per unit. Leasing...

-

Page 39

..., share repurchases and for working capital. The Company uses both cash and letters of credit to support asset backed vehicle financing programs. The Company also uses letters of credit or insurance bonds to secure certain commitments related to airport concession agreements, insurance programs...

-

Page 40

...10b5-1 trading plans allow repurchases of the Company's common stock during black-out periods by establishing a prearranged written plan to buy a specified number of shares of the Company's common stock over a set period of time. The Company expects to continue to use such plans from time to time to...

-

Page 41

... and short-term borrowings outstanding for vehicle purchases, airport concession fee and operating lease commitments related to airport and other facilities, technology contracts, and vehicle purchases. The Company expects to fund these commitments with cash generated from operations, sales proceeds...

-

Page 42

... working capital borrowings. The Company uses letters of credit to support insurance programs, asset backed vehicle financing programs and airport concession and lease agreements. As of December 31, 2006, the Company was in compliance with all covenants. Debt Servicing Requirements The Company will...

-

Page 43

...of operations. The more significant items include: Vehicle insurance reserves - The Company does self-insure or retain a portion of the exposure for losses related to bodily injury and property damage liability claims along with the risk retained for the supplemental liability insurance program. The...

-

Page 44

...in 2006 and the Company expects continued growth in rental rates into 2007 due to efforts by the industry to offset increased fleet costs. The Company is continuing to pursue franchise acquisitions to facilitate growth. Vehicle manufacturers are reducing total capacity and reducing vehicle supply to...

-

Page 45

... Canadian fleet. The fair value and average receive rate of the interest rate swaps is calculated using projected market interest rates over the term of the related debt instruments as provided by the counter parties.

Expected Maturity Dates as of December 31, 2006 (in thousands) Debt: Vehicle debt...

-

Page 46

... interest rates Vehicle debt and obligationsfixed rates Weighted average interest rates Vehicle debt and obligationsCanadian dollar denominated Weighted average interest rates Interest Rate Swaps: Variable to Fixed Average pay rate Average receive rate $

2006

2007

2008

2009

2010

Total

Fair...

-

Page 47

... in accordance with the standards of the Public Company Accounting Oversight Board (United States), the effectiveness of the Company's internal control over financial reporting as of December 31, 2006, based on the criteria established in Internal Control-Integrated Framework issued by the Committee...

-

Page 48

... 2004 (In Thousands Except Per Share Data) 2006 REVENUES: Vehicle rentals Vehicle leasing Fees and services Other Total revenues COSTS AND EXPENSES: Direct vehicle and operating Vehicle depreciation and lease charges, net Selling, general and administrative Interest expense, net of interest income...

-

Page 49

...' EQUITY LIABILITIES: Accounts payable Accrued liabilities Income taxes payable Deferred income tax liability Vehicle insurance reserves Vehicle debt and obligations Total liabilities COMMITMENTS AND CONTINGENCIES STOCKHOLDERS' EQUITY: Preferred stock, $.01 par value: Authorized 10,000,000 shares...

-

Page 50

... Issuance of common shares for 401(k) company match Stock option transactions, including tax benefit Purchase of common stock for the treasury Performance share incentive plan Issuance of common stock in settlement of vested performance shares Restricted stock for director compensation Issuance of...

-

Page 51

... expenses and other assets Accounts payable Accrued liabilities Vehicle insurance reserves Other Net cash provided by operating activities CASH FLOWS FROM INVESTING ACTIVITIES: Revenue-earning vehicles: Purchases Proceeds from sales Net change in restricted cash and investments Property, equipment...

-

Page 52

DOLLAR THRIFTY AUTOMOTIVE GROUP, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS YEAR ENDED DECEMBER 31, 2006, 2005 AND 2004 (In Thousands)

2006 CASH FLOWS FROM FINANCING ACTIVITIES: Vehicle debt and obligations: Proceeds Payments Issuance of common shares Purchase of common stock for ...

-

Page 53

... business and leisure customers through company-owned stores. The Company also leases vehicles to franchisees for use in the daily vehicle rental business, sells vehicle rental franchises worldwide and provides sales and marketing, reservations, data processing systems, insurance and other services...

-

Page 54

... over the term of the related debt using the effective interest method. Revenue-Earning Vehicles - Revenue-earning vehicles are stated at cost, net of related discounts. The Company generally purchases 65% to 80% of its vehicles for which residual values are determined by depreciation rates that are...

-

Page 55

... under the related rental contracts with customers. Revenues from leasing vehicles to franchisees are principally under operating leases with fixed monthly payments and are recognized as earned over the lease terms. Revenues from fees and services include providing sales and marketing, reservations...

-

Page 56

... services are negotiated on an annual basis between the Company's management and designated franchisee members of Thrifty National Ad. Environmental Costs - The Company's operations include the storage of gasoline in underground storage tanks at certain company-owned stores. Liabilities incurred...

-

Page 57

... 2004, the Company began consolidating the operating results of Thrifty National Ad with its operating results. Thrifty National Ad is established for the limited purpose of collecting and disbursing funds for advertising and promotion programs for the benefit of the Thrifty Car Rental corporate and...

-

Page 58

... a material effect on the consolidated financial statements of the Company. Under SFAS No. 123, the Company used the closing market price of the Company's common shares on the date of grant to estimate the fair value of restricted stock and performance shares. No options were granted after January...

-

Page 59

...as of December 31, 2006, as required. Adoption of SAB No. 108 did not have a material impact on the Company's consolidated financial position or results of operations. In February 2007, the FASB issued SFAS No. 159, "The Fair Value Option for Financial Assets and Financial Liabilities - including an...

-

Page 60

... EPS because no exercise price was greater than the average market price of the common shares. 4. ACQUISITIONS In 2006, the Company acquired certain assets and assumed certain liabilities relating to 35 locations from former franchisees in Little Rock, Arkansas; Providence, Rhode Island; Cincinnati...

-

Page 61

...239,158 (20,606) 218,552 2005

$

Trade accounts and notes receivable include primarily amounts due from rental customers, franchisees and tour operators arising from billings under standard credit terms for services provided in the normal course of business. Notes receivable are generally issued to...

-

Page 62

...% will be Non-Program. In September 2006, the VSA was amended to enable the Company to acquire vehicles through the 2011 model year. Under the terms of the VSA, Dollar and Thrifty will advertise and promote DaimlerChrysler products exclusively, and the Company will receive promotional payments from...

-

Page 63

... during the fourth quarter of each year, unless circumstances arise that require more frequent testing. During the fourth quarter of 2006, the Company completed its annual impairment test of each reacquired franchise right and concluded no impairment was indicated. Intangible assets with finite...

-

Page 64

...on January 1, 2005 which impacts the way in which the Company accounts for business combination transactions through establishing a separately identifiable intangible asset, other than goodwill, for reacquired franchise rights. 10. VEHICLE DEBT AND OBLIGATIONS Vehicle debt and obligations consist of...

-

Page 65

... to the asset backed notes, restricted cash and investments, and certain receivables related to revenue-earning vehicles are available to satisfy the claims of its creditors. Dollar and Thrifty lease vehicles from RCFC under the terms of a master lease and servicing agreement. The asset backed note...

-

Page 66

... enterprise risk management program, by striving to reduce the potentially adverse effects that the potential volatility of the financial markets may have on the Company's operating results. In 2001, the Company began entering into interest rate swap agreements, in conjunction with each related new...

-

Page 67

... the related voting rights at a steeply discounted price. The plan also includes an exchange option after the rights become exercisable. The Board of Directors may effect an exchange of part or all of the rights, other than rights that have become void, for shares of the Company's common stock for...

-

Page 68

... 2006, 2005 and 2004, respectively. Option Rights Plan - Under the LTIP, the Committee may grant non-qualified option rights to key employees and non-employee directors. The exercise prices for non-qualified option rights are equal to the fair market value of the Company's common stock at the date...

-

Page 69

...made at the initial public offering price. The non-qualified option rights vest in three equal annual installments commencing on the first anniversary of the grant date and have a term not exceeding ten years from the date of grant. The maximum number of shares for which option rights may be granted...

-

Page 70

... Risk-free interest rate

3 30.50% 4.54%

The target awards granted in 2005 and 2004 were valued at the closing market price of the Company's common shares at the date of grant. To arrive at the assumptions used to estimate the fair value of the Company's market condition based performance shares...

-

Page 71

... stock units to non-employee directors. These grants generally vest at the end of the fiscal year in which the grants were made. For the awards granted in 2006, 2005 and 2004, the grant-date fair value of the award was based on the closing market price of the Company's common shares at the date...

-

Page 72

...(25) 28 (28) -

Weighted-Average Grant-Date Fair Value $ 24.75 24.75 34.45 34.45 38.06 38.06 $ -

14.

SHARE REPURCHASE PROGRAM In July 2003, the Company announced that its Board of Directors had authorized spending up to $30 million to repurchase the Company's shares of common stock over a two-year...

-

Page 73

...: Vehicle insurance reserves Allowance for doubtful accounts and notes receivable Other accrued liabilities Federal and state NOL carryforwards AMT credit carryforward Canadian NOL carryforwards Canadian depreciation Valuation allowance Total Deferred tax liabilities: Depreciation Interest rate swap...

-

Page 74

... estimated fair values of financial instruments have been determined by the Company using available market information and valuation methodologies. Cash and Cash Equivalents, Restricted Cash and Investments, Receivables, Accounts Payable, Accrued Liabilities and Vehicle Insurance Reserves - The...

-

Page 75

... to pay insurance and maintenance costs and additional rents generally based on revenues earned at the location. Certain of the airport locations are operated by franchisees who are obligated to make the required rent and concession fee payments under the terms of their franchise arrangements...

-

Page 76

... for losses above these levels. The Company continues to retain the risk of loss on supplemental liability insurance ("SLI") policies sold to vehicle rental customers. The accrual for Vehicle Insurance Reserves includes amounts for incurred and incurred but not reported losses. Such liabilities are...

-

Page 77

... reporting period in which an adjustment of the estimated liability is recorded, the Company believes that any resulting liability should not materially affect its consolidated financial position. Other The Company is party to a data processing services agreement which requires annual payments...

-

Page 78

Included in the consolidated financial statements are the following amounts relating to geographic locations:

Year Ended December 31, 2005 (In Thousands)

2006

2004

Revenues: United States Foreign countries

$

1,552,902 107,775 1,660,677

$

1,413,541 94,013 1,507,554

$

1,324,601 79,246 1,403,...

-

Page 79

... 12, 2007, the Company entered into a waiver agreement to the Revolving Credit Facility due to the Company's prior announcement regarding non-reliance on previously issued financial statements. The Company filed a Form 10-K/A for 2005 and a Form 10-Q/A for each quarter of 2006 on February 26, 2007...

-

Page 80

SCHEDULE II

DOLLAR THRIFTY AUTOMOTIVE GROUP, INC. AND SUBSIDIARIES

VALUATION AND QUALIFYING ACCOUNTS YEAR ENDED DECEMBER 31, 2006, 2005 AND 2004

Balance at Beginning of Year

Additions Charged to Income Deductions (In Thousands)

Balance at End of Year

2006 Allowance for doubtful accounts Vehicle...

-

Page 81

...Control Over Financial Reporting The management of the Company is responsible for establishing and maintaining adequate internal control over financial reporting. The internal control system was designed to provide reasonable assurance to the Company's management and board of directors regarding the...

-

Page 82

... REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors and Stockholders of Dollar Thrifty Automotive Group, Inc.: We have audited management's assessment, included in the accompanying Management's Annual Report on Internal Control Over Financial Reporting, that Dollar Thrifty Automotive...

-

Page 83

... internal control over financial reporting is a process designed by, or under the supervision of, the company's principal executive and principal financial officers, or persons performing similar functions, and effected by the company's board of directors, management, and other personnel to provide...

-

Page 84

... Information Regarding Director Nominees and Named Executive Officers", "Independence, Meetings, Committees and Compensation of the Board of Directors - Audit Committee", "Section 16(a) Beneficial Ownership Reporting Compliance" and "Code of Ethics" in the Company's definitive Proxy Statement which...

-

Page 85

... DTG, Rental Car Finance Corp., Thrifty, Dollar and Bankers Trust Company, filed as the same numbered exhibit with DTG's Form 8-K, filed March 16, 1998, Commission File No. 1-13647* Master Motor Vehicle Lease and Servicing Agreement dated as of March 4, 1998 among DTG, Dollar, Thrifty and Rental Car...

-

Page 86

..., 2001, Commission File No. 1-13647* Amendment No. 3 to Master Motor Vehicle Lease and Servicing Agreement dated as of December 14, 2000 among Rental Car Finance Corp., Dollar, Thrifty and DTG, filed as the same numbered exhibit with DTG's Form 10-K for the fiscal year ended December 31, 2000, filed...

-

Page 87

... Vehicle Lease and Servicing Agreement dated as of December 31, 2001 among Rental Car Finance Corp., Dollar, Thrifty, DTG, Bankers Trust Company, Bank One, NA, The Bank of Nova Scotia, Dollar Thrifty Funding Corp. and Credit Suisse First Boston, filed as the same numbered exhibit with DTG's Form...

-

Page 88

... Motor Vehicle Lease and Servicing Agreement dated as of January 31, 2002 among Rental Car Finance Corp., Dollar, Thrifty, DTG, Bankers Trust Company, Bank One, NA, The Bank of Nova Scotia, Dresdner Bank AG, Dollar Thrifty Funding Corp. and Credit Suisse First Boston, filed as the same numbered...

-

Page 89

... and Restated Collateral Assignment of Exchange Agreement dated as of April 16, 2002 by and among Rental Car Finance Corp., Dollar, Thrifty, and Deutsche Bank Trust Company Americas, formerly known as Bankers Trust Company, filed as the same numbered exhibit with DTG's Form 10-Q for the quarterly...

-

Page 90

... Agency Agreement dated as of December 12, 2002 among DTG, Rental Car Finance Corp., Thrifty, DTG Operations, Inc., formerly known as Dollar Rent A Car Systems, Inc., and Deutsche Bank Trust Company Americas, formerly known as Bankers Trust Company, filed as the same numbered exhibit with DTG's Form...

-

Page 91

... Vehicle Lease and Servicing Agreement dated as of December 12, 2002 among Rental Car Finance Corp., DTG Operations, Inc., formerly known as Dollar Rent A Car Systems, Inc., Thrifty, DTG, Ambac Assurance Corporation and Credit Suisse First Boston, filed as the same numbered exhibit with DTG's Form...

-

Page 92

... Vehicle Lease and Servicing Agreement dated as of March 25, 2003 among Rental Car Finance Corp., DTG Operations, Inc., formerly known as Dollar Rent A Car Systems, Inc., DTG, Deutsche Bank Trust Company Americas, formerly known as Bankers Trust Company, Ambac Assurance Corporation, MBIA Insurance...

-

Page 93

... No. 8 to Master Motor Vehicle Lease and Servicing Agreement dated as of March 24, 2004 among Rental Car Finance Corp., DTG Operations, Inc., formerly known as Dollar Rent A Car Systems, Inc., DTG, Deutsche Bank Trust Company Americas, formerly known as Bankers Trust Company, ABN AMRO Bank N.V., The...

-

Page 94

... Agreement dated as of April 1, 2004 among DTG, DTG Operations, Inc., formerly known as Dollar Rent A Car Systems, Inc., Thrifty, Various Financial Institutions named therein, Credit Suisse First Boston, The Bank of Nova Scotia and Dresdner Bank AG, filed as the same numbered exhibit with DTG's Form...

-

Page 95

...New York Branch, filed as the same numbered exhibit with DTG's Form 8-K, filed March 28, 2005, Commission File No. 1-13647* Amendment No. 10 to Master Motor Vehicle Lease and Servicing Agreement dated as of March 22, 2005 among Rental Car Finance Corp., DTG Operations, Inc., formerly known as Dollar...

-

Page 96

... Agreement dated as of April 21, 2005 among DTG Operations, Inc., Rental Car Finance Corp., Dollar Thrifty Automotive Group, Inc. and Credit Suisse First Boston, filed as the same numbered exhibit with DTG's Form 8-K, filed April 26, 2005, Commission No. 1-13647* Financial Guaranty Insurance Policy...

-

Page 97

... Corp. and Deutsche Bank Trust Company Americas, filed as the same numbered exhibit with DTG's Form 8-K, filed April 3, 2006, Commission No. 1-13647* Master Motor Vehicle Lease and Servicing Agreement dated as of March 28, 2006 among Rental Car Finance Corp., DTG Operations, Inc., Dollar Thrifty...

-

Page 98

... Application and Agreement dated as of March 28, 2006 among DTG Operations, Inc., Rental Car Finance Corp., Dollar Thrifty Automotive Group, Inc. and Credit Suisse, filed as the same numbered exhibit with DTG's Form 8-K, filed April 3, 2006, Commission No. 1-13647* Note Guaranty Insurance Policy No...

-

Page 99

... No. 1-13647* Dollar Thrifty Automotive Group, Inc., Executive Option Plan effective June 1, 2002, filed as the same numbered exhibit with DTG's Form 10-Q for the quarterly period ended June 30, 2002, filed August 13, 2002, Commission File No. 1-13647* Vehicle Supply Agreement dated as of October 31...

-

Page 100

... Long-Term Incentive Plan and Director Equity Plan dated as of March 23, 2005 and Adopted by Shareholders on May 20, 2005, filed as the same numbered exhibit with DTG's Form 8-K, filed May 25, 2005, Commission File No. 1-13647* Form of Performance Shares Grant Agreement between Dollar Thrifty...

-

Page 101

... non-employee director, filed as the same numbered exhibit with DTG's Form 8-K, filed May 25, 2005, Commission File No. 1-13647* Indemnification Agreement dated as of May 20, 2005 between Dollar Thrifty Automotive Group, Inc. and Gary L. Paxton, President, Chief Executive Officer and director, filed...

-

Page 102

... Motors Company, LLC and Dollar Thrifty Automotive Group, Inc., filed as the same numbered exhibit with DTG's Form 8-K, filed September 20, 2005, Commission File No. 113647* Notice of Election Regarding Payment of Director's Fees (As Amended and Restated) dated December 2, 2005 executed by...

-

Page 103

... Share Grant Agreement between Dollar Thrifty Automotive Group, Inc. and the applicable employee, filed as the same numbered exhibit with DTG's Form 8-K, filed February 7, 2006, Commission File No. 1-13647* Notice of Election Regarding Payment of Director's Fees dated February 20, 2006 executed...

-

Page 104

... No. 1-13647* Dollar Thrifty Automotive Group, Inc. Employee Stock Purchase Plan, filed as the same numbered exhibit with DTG's Form 8-K, filed May 24, 2006, Commission File No. 1-13647* Deferral Agreement regarding 2006 annual incentive compensation plan dated June 30, 2006 between Gary L. Paxton...

-

Page 105

...* Second Amended and Restated Data Processing Services Agreement dated as of August 1, 2006 by and among Dollar Thrifty Automotive Group, Inc., Electronic Data Systems Corporation and EDS Information Services L.L.C., filed as the same numbered exhibit with DTG's Form 10-Q for the quarterly period...

-

Page 106

... Retirement Plan Employee Enrollment Form - Retirement Contribution dated December 29, 2006 between Yves Boyer and Dollar Thrifty Automotive Group, Inc.** Letter from Deloitte & Touche LLP to the Securities and Exchange Commission regarding statements included in Form 8-K, filed as the same numbered...

-

Page 107

... Sartain & Sartain LLP regarding Registration Statement on Form S-8, Registration No. 333-89189, filed as the same numbered exhibit with Dollar Thrifty Automotive Group, Inc. Retirement Savings Plan's Form 11-K for the fiscal year ended December 31, 2005, filed June 27, 2006* Consent of Hall, Estill...

-

Page 108

... duly authorized. Date: March 16, 2007 DOLLAR THRIFTY AUTOMOTIVE GROUP, INC. By: /s/ GARY L. PAXTON Name: Gary L. Paxton Title: President and Principal Executive Officer Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on...

-

Page 109

... TO EXHIBITS Exhibit Number 10.131 Description

Deferred Compensation Plan Employee Enrollment Form - Salary dated December 29, 2006 between Gary L. Paxton and Dollar Thrifty Automotive Group, Inc. Deferred Compensation Plan Employee Enrollment Form - Salary dated December 29, 2006 between Steven...

-

Page 110

10.140

2007 Retirement Plan Employee Enrollment Form - Retirement Contribution dated December 29, 2006 between Yves Boyer and Dollar Thrifty Automotive Group, Inc. Subsidiaries of DTG Consent of Deloitte & Touche LLP regarding DTG's Forms S-8, Registration No. 333-79603, Registration No. 333-89189,...

-

Page 111

-

Page 112