Tesco 2015 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2015 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

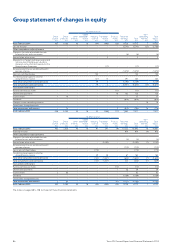

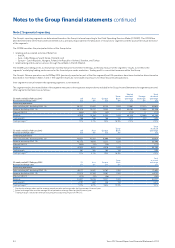

All other reserves

Share

capital

£m

Share

premium

£m

Other

reserves

£m

Capital

redemption

reserve

£m

Hedging

reserve

£m

Translation

reserve

£m

Treasur y

shares

£m

Retained

earnings

£m

Total

£m

Non-

controlling

interests

£m

Total

equity

£m

At 22 February 2014 405 5,080 40 16 (44) (490) (20) 9,728 14,715 714,722

Loss for the year –––––––(5,741) (5,741) (25) (5,766)

Other comprehensive (loss)/income

Change in fair value of available-for-sale

financial assets and investments –––––––(8) (8) –(8)

Retranslation of net assets – – – – – 5 – – 5 – 5

Movements in foreign exchange reserve and

net investment hedging on subsidiary

disposed, reclassified and reported in the

Group Income Statement – – – – – (17) – – (17) –(17)

Remeasurement losses on defined benefit

pension schemes –––––––(1,473) (1,473) –(1,473)

Gains on cash flow hedges – – – – 100 – – – 100 –100

Tax relating to components of other

comprehensive income – – – – (21) 14 –291 284 –284

Total other comprehensive (loss)/income – – – – 79 2 – (1,190) (1,109) –(1,109)

Total comprehensive (loss)/income – – – – 79 2 – (6 ,931) (6,850) (25) (6,875)

Transactions with owners

Purchase of treasury shares – – – – – – (15) –(15) –(15)

Share-based payments – – – – – – 18 102 120 –120

Issue of shares 114 – – – – – – 15 –15

Dividends –––––––(914) (914) –(914)

Changes in non-controlling interests –––––––––18 18

Tax on items charged to equity –––––––––––

Total transactions with owners 114 – – – – 3 (812) (794) 18 (776)

At 28 February 2015 406 5,094 40 16 35 (488) (17) 1,985 7,071 –7,071

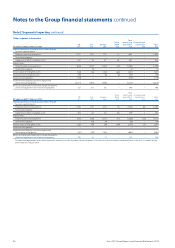

All other reserves

Share

capital

£m

Share

premium

£m

Other

reserves

£m

Capital

redemption

reserve

£m

Hedging

reserve

£m

Translation

reserve

£m

Treasur y

shares

£m

Retained

earnings

£m

Total

£m

Non-

controlling

interests

£m

Total

equity

£m

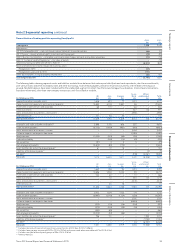

At 23 February 2013 403 5,020 40 16 91 547 (9) 10,535 16,643 18 16,661

Profit for the year –––––––974 974 (4) 970

Other comprehensive (loss)/income

Change in fair value of available-for-sale

financial assets and investments –––––––(4) (4) –(4)

Retranslation of net assets –––––(1,095) – – (1,095) (7) (1,102)

Remeasurement losses on defined benefit

pension schemes –––––––(713) (713) –(713)

Losses on cash flow hedges – – – – (174) –––(174) –(174)

Tax relating to components of other

comprehensive income – – – – 39 58 –67 164 –164

Total other comprehensive (loss)/income – – – – (135) (1,037) –(650) (1,822) (7) (1,829)

Total comprehensive (loss)/income – – – – (135) (1,037) –324 (848) (11) (859)

Transactions with owners

Purchase of treasury shares – – – – – – (12) –(12) –(12)

Share-based payments – – – – – – 1 58 59 – 59

Issue of shares 260 ––––––62 –62

Dividends –––––––(1,189) (1,189) –(1,189)

Tax on items charged to equity –––––––––––

Total transactions with owners 260 – – – – (11) (1,131) (1,080) –(1,080)

At 22 February 2014 405 5,080 40 16 (44) (490) (20) 9,728 14,715 714,722

The notes on pages 88 to 138 form part of these financial statements.

86 Tesco PLC Annual Report and Financial Statements 2015

Group statement of changes in equity