Tesco 2015 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2015 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

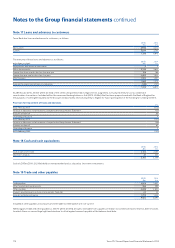

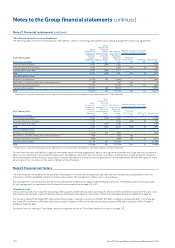

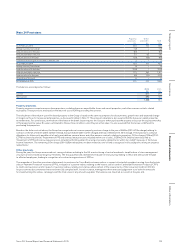

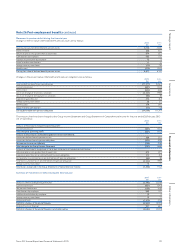

Note 22 Financial risk factors continued

The table below presents an analysis of credit exposure by impairment status across the different exposure classes. The table predominantly relates to

banking assets; the retail instalment lending applies to credit agreements in the insurance business.

Credit quality of loans and advances

As at 28 February 2015

Retail

unsecured

lending

£m

Retail

mortgage

lending

£m

Retail

instalment

lending

£m

Total

£m

Past due and defaulted

Less than 90 days past due 39 – – 39

90–179 days past due 35 – – 35

180 days plus past due 70 – – 70

Past due but not defaulted

Less than 29 days past due 34 2 – 36

30–59 days past due 9 – – 9

60–119 days past due 6 – – 6

Neither past due nor defaulted

Low risk* 6,234 1,195 154 7, 583

High risk** 76 6 – 82

Total 6,503 1,203 154 7,860

* Low risk is defined as an asset with a probability of default of less than 10%.

** High risk is defined as an asset with a probability of default of 10% or more.

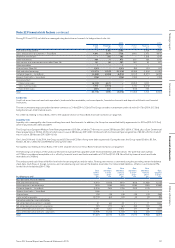

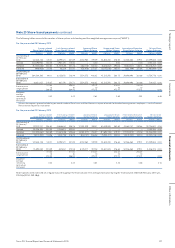

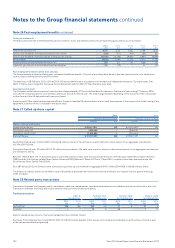

Credit quality of loans and advances

As at 22 February 2014

Retail

unsecured

lending

£m

Retail

mortgage

lending

£m

Retail

instalment

lending

£m

Total

£m

Past due and defaulted

Less than 90 days past due 45 – – 45

90–179 days past due 40 – – 40

180 days plus past due 50 – – 50

Past due but not defaulted

Less than 29 days past due 38 – – 38

30–59 days past due 9 – – 9

60–119 days past due 6 – – 6

Neither past due nor defaulted

Low risk* 5,923 692 167 6,782

High risk** 98 4 – 102

Total 6,209 696 167 7,072

* Low risk is defined as an asset with a probability of default of less than 10%.

** High risk is defined as an asset with a probability of default of 10% or more.

The credit risk exposure from off balance sheet items, mainly undrawn credit card facilities and mortgage offers, was £11.5bn (2014: £9.7bn).

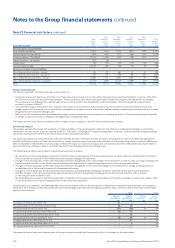

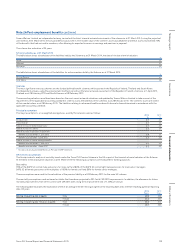

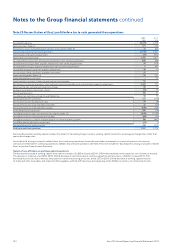

Insurance risk

Tesco Bank is indirectly exposed to insurance risks through its ownership of 49.9% of Tesco Underwriting Limited (‘TU’), an authorised insurance company.

Since late 2010 the majority of new business policies for home and motor insurance products sold by Tesco Bank have been underwritten by TU. The key

insurance risks within TU relate to underwriting risk and specifically the potential fora major weather event to generate significant claims on home insurance,

or on motor insurance the cost of settling bodily injury claims. Exposure tothis risk is actively managed within TU with close monitoring of performance

metrics and the use of reinsurance to limit TU’s exposure above predetermined limits.

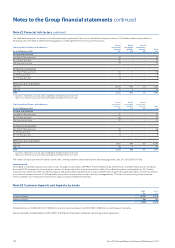

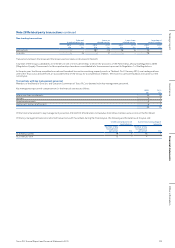

Note 23 Customer deposits and deposits by banks

2015

£m

2014

£m

Customer deposits 6,914 6,078

Deposits by banks 106 780

7,020 6,858

Included above is £1,000m (2014: £1,366m) non-current customer deposits and £nil (2014: £8m) non-current deposits by banks.

Deposits by banks include liabilities of £97m (2014: £765m) which have been sold under sale and repurchase agreements.

124 Tesco PLC Annual Report and Financial Statements 2015

Notes to the Group financial statements continued