Tesco 2015 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2015 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

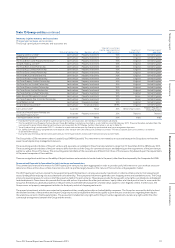

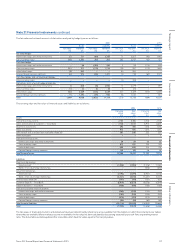

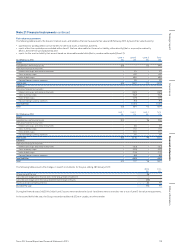

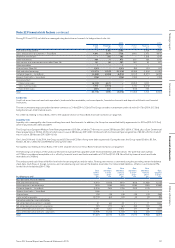

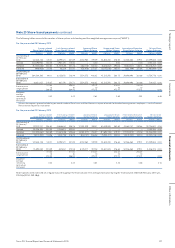

Note 21 Financial instruments continued

Offsetting of financial assets and liabilities

The following tables show those financial assets and liabilities subject to offsetting, enforceable master netting arrangements and similar agreements.

At 28 February 2015

Financial assets offset

Gross

amounts of

recognised

financial

assets/

(liabilities)

£m

Gross

amounts of

financial

assets/

(liabilities) set

off in the

Group

Balance Sheet

£m

Net amounts

presented in

the Group

Balance

Sheet

£m

Related amounts not set off

in the Group Balance Sheet

Net amount

£m

Financial

instruments

£m

Collateral

£m

Cash and cash equivalents 2,405 (240) 2,165 – – 2,165

Derivative financial instruments 1,699 –1,699 (331) (2) 1,366

Trade and other receivables 2,490 (369) 2,121 – – 2,121

Total 6,594 (609) 5,985 ( 331) (2) 5,652

Financial liabilities offset

Bank loans and overdrafts (2,222) 240 (1,982) – – (1,982)

Repurchases, securities lending and similar agreements*(97) –(97) 103 – 6

Derivative financial instruments (1,035) –(1,035) 331 61 (643)

Trade and other payables (10,291) 369 (9,922) – – (9,922)

Total (13,645) 609 (13,036) 434 61 (12,541)

* Repurchases, securities lending and similar agreements are included within the deposits from banks balance of £106m (Note 23).

At 22 February 2014

Financial assets offset

Gross

amounts of

recognised

financial

assets/

(liabilities)

£m

Gross

amounts of

financial

assets/

(liabilities) set

off in the

Group Balance

Sheet

£m

Net amounts

presented in

the Group

Balance

Sheet

£m

Related amounts not set off

in the Group Balance Sheet

Net amount

£m

Financial

instruments

£m

Collateral

£m

Cash and cash equivalents 2,882 (376) 2,506 – – 2,506

Derivative financial instruments 1,576 –1,576 (336) (6) 1,234

Trade and other receivables 2,737 (547) 2,190 – – 2,190

Total 7,195 (923) 6,272 (336) (6) 5,930

Financial liabilities offset

Bank loans and overdrafts (1,206) 376 (830) – – (830)

Repurchases, securities lending and similar agreements*(765) –(765) 765 – –

Derivative financial instruments (869) –(869) 336 16 (517 )

Trade and other payables (11,142) 547 (10,595) – – (10,595)

Total (13,982) 923 (13,059) 1,101 16 (11,942)

* Repurchases, securities lending and similar agreements are included within the deposits from banks balance of £780m (Note 23).

For the financial assets and liabilities subject to enforceable master netting arrangements above, each agreement between the Group and the counterparty

allows for net settlement of the relevant financial assets and liabilities when both elect to settle on a net basis. In the absence of such an election, financial

assets and liabilities will be settled on a gross basis, however each party to the master netting agreement or similar agreements will have the option to settle

all such amounts on a net basis in the event of default of the other party.

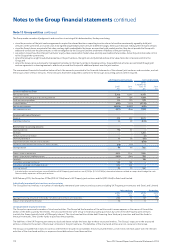

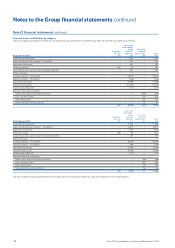

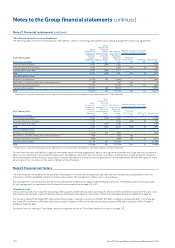

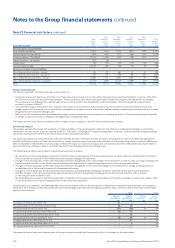

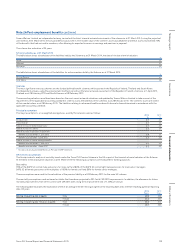

Note 22 Financial risk factors

The main financial risks faced by the Group relate to fluctuations in interest and foreign exchange rates, the risk of default by counterparties to financial

transactions and the availability of funds to meet business needs. The management of these risks is set out below.

Risk management is carried out by a central treasury department under policies approved by the Board of Directors. The Board provides written principles

for risk management, as described in the Principal risks and uncertainties on pages 22 to 25.

Interest rate risk

Interest rate risk arises from long-term borrowings. Debt issued at variable rates as well as cash deposits and short-term investments exposes the Groupto cash

flow interest rate risk. Debt issued at fixed rates exposes the Group to fair value risk. The Group’s interest rate management policy is explained onpage 25.

The Group has Retail Price Index (‘RPI’) debt where the principal is indexed to increases in the RPI. RPI debt is treated as floating rate debt. The Group also

has Limited Price lnflation (‘LPI’) debt, where the principal is indexed to RPI, with an annual maximum increase of 5% and a minimum of0%. LPI debt is

treated as fixed rate debt.

For interest rate risk relating to Tesco Bank, refer to the separate section on Tesco Bank financial risk factors on page 123.

120 Tesco PLC Annual Report and Financial Statements 2015

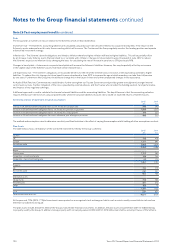

Notes to the Group financial statements continued