Tesco 2015 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2015 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

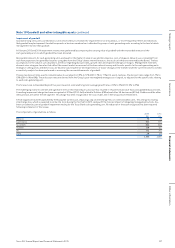

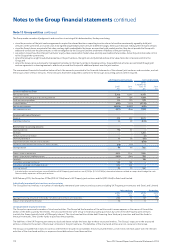

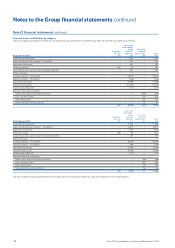

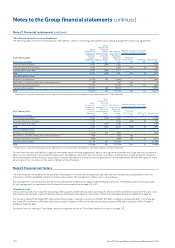

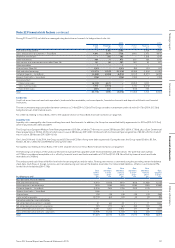

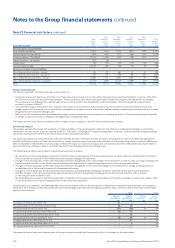

Note 21 Financial instruments continued

The fair value and notional amounts of derivatives analysed by hedge type are as follows:

2015 2014

Asset Liability Asset Liability

Fair value

£m

Notional

£m

Fair value

£m

Notional

£m

Fair value

£m

Notional

£m

Fair value

£m

Notional

£m

Fair value hedges

Interest rate swaps and similar instruments 23 721 (80) 2,303 71 2,057 (42) 1,492

Cross-currency swaps 561 1,201 (11) 817 583 2,055 (25) 551

Cash flow hedges

Interest rate swaps and similar instruments –86 (199) 462 299 (110) 400

Cross-currency swaps 241 311 (170) 1,754 139 287 (115) 1,605

Index-linked swaps 119 942 – – 90 920 – –

Forward foreign currency contracts 84 974 (35) 1,271 10 739 (62) 2,123

Cash flow hedges and net investment hedges

Cross-currency swaps – – – – 10 308 – –

Derivatives not in a formal hedge relationship

Interest rate swaps and similar instruments 6640 (6) 2,982 13 2,079 –595

Cross-currency swaps 10 44 (1) 36 8128 – –

Index-linked swaps 580 3,589 (474) 3,589 614 3,619 (515) 3,589

Forward foreign currency contracts 75 1,292 (59) 965 36 1,035 –181

Total 1,699 9,800 (1,035) 14,179 1,576 13,326 (869) 10,536

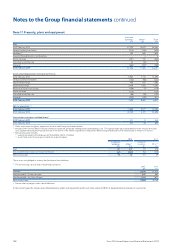

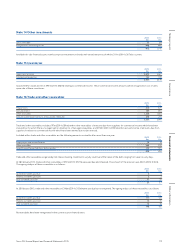

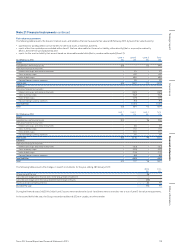

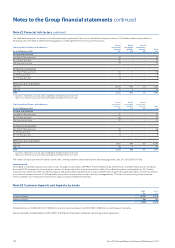

The carrying value and fair value of financial assets and liabilities are as follows:

2015 2014

Carrying

value

£m

Fair

value

£m

Carrying

value

£m

Fair

value

£m

Assets

Cash and cash equivalents 2,165 2,165 2,506 2,506

Loans and advances to customers – Tesco Bank 7,720 7,772 6,915 6,845

Short-term investments 593 593 1,016 1,016

Other investments 975 975 1,015 1,015

Joint venture and associates loan receivables (Note 28) 207 208 255 257

Other receivables 1 1 1 1

Derivative financial assets:

Interest rate swaps and similar instruments 29 29 86 86

Cross-currency swaps 812 812 740 740

Index-linked swaps 699 699 704 704

Forward foreign currency contracts 159 159 46 46

Total financial assets 13,360 13,413 13,284 13,216

Liabilities

Short-term borrowings:

Amortised cost (1,998) (1,998) (1,276) (1,281)

Bonds in fair value hedge relationships – – (628) (660)

Long-term borrowings:

Amortised cost (7,193) ( 7, 299) (4,901) (5,702)

Bonds in fair value hedge relationships (3,327) (3,033) (4,287) (4,227)

Finance leases (Note 34) (141) (141) (121) (121)

Customer deposits – Tesco Bank (6,914) (6,873) (6,078) (6,044)

Deposits by banks – Tesco Bank (106) (106) (780) (780)

Derivative and other financial liabilities:

Interest rate swaps and similar instruments (285) (285) (152) (152)

Cross-currency swaps (182) (182) (140) (140)

Index-linked swaps (474) (474) (515) (515)

Forward foreign currency contracts (94) (94) (62) (62)

Total financial liabilities (20,714) (20,485) (18,940) (19,684)

Total (7, 354) (7,072) (5,656) (6,468)

The fair values of financial instruments and derivatives have been determined by reference to prices available from the markets on which the instruments are traded,

where they are available. Where market prices are not available, the fair value has been calculated by discounting expected future cash flows at prevailing interest

rates. The above tables exclude payables/other receivables which have fair values equal to their carrying values.

117Tesco PLC Annual Report and Financial Statements 2015

Other informationGovernance Financial statementsStrategic report