Tesco 2015 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2015 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

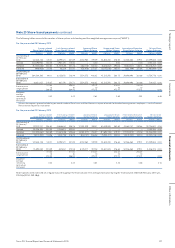

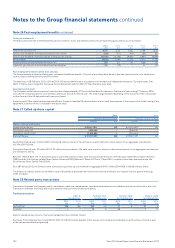

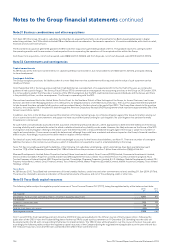

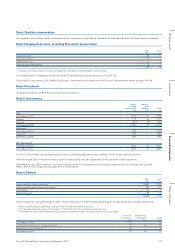

The movement of tier 1 capital during the financial year is analysed as follows:

2015

£m

2014

£m

At beginning of the year 913 705

Share capital and share premium –140

Profit attributable to shareholders 131 115

Other reserves 14 1

Ordinary dividends (50) (100)

Movement in material holdings 311

Increase in intangible assets 25 (30)

Other – Tier 1 (1) –

At end of the year, excluding CRD IV adjustments 1,035 842

CRD IV adjustment – deferred tax liabilities related to intangible assets 6–

CRD IV adjustment – movement in material holdings –32

CRD IV adjustment – other –39

At end of the year, including CRD IV adjustments 1,041 913

It is the Group’s policy to maintain a strong capital base, to expand it as appropriate and to utilise it efficiently throughout its activities to optimise the return

to shareholders while maintaining a prudent relationship between the capital base and the underlying risks of the business. In carrying out this policy, the

Group has regard to the supervisory requirements of the PRA.

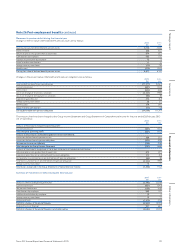

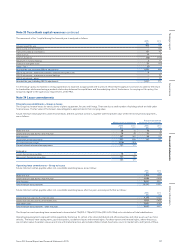

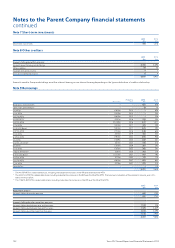

Note 34 Lease commitments

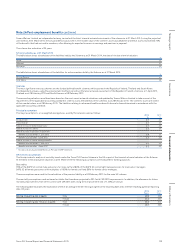

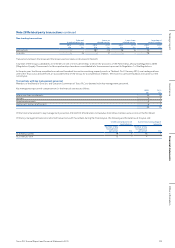

Finance lease commitments – Group as lessee

The Group has finance leases for various items of plant, equipment, fixtures and fittings. There are also a small number of buildings which are held under

finance leases. The fair value of the Group’s lease obligations approximate to their carrying value.

Future minimum lease payments under finance leases and hire purchase contracts, together with the present value of the net minimum lease payments,

are as follows:

Minimum lease payments

Present value of net

minimum lease payments

2015

£m

2014

£m

2015

£m

2014

£m

Within one year 20 12 10 6

Greater than one year but less than five years 70 49 35 14

After five years 167 185 96 101

Total minimum lease payments 257 246 141 121

Less future finance charges (116) (125)

Present value of minimum lease payments 141 121

Analysed as:

Current finance lease payables 10 6

Non-current finance lease payables 131 115

141 121

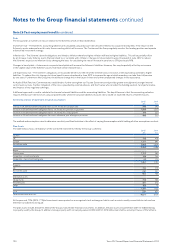

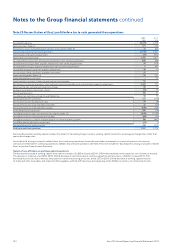

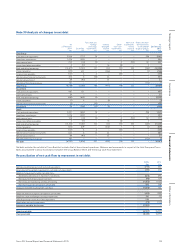

Operating lease commitments – Group as lessee

Future minimum rentals payable under non-cancellable operating leases are as follows:

2015

£m

2014

£m

Within one year 1,324 1,334

Greater than one year but less than five years 4,686 4,676

After five years 9,697 9,911

Total minimum lease payments 15,707 15,921

Future minimum rentals payable under non-cancellable operating leases after five years are analysed further as follows:

2015

£m

2014

£m

Greater than five years but less than ten years 4,243 4,250

Greater than ten years but less than fifteen years 2,853 2,894

After fifteen years 2,601 2,767

Total minimum lease payments – after five years 9,697 9,911

The Group has used operating lease commitments discounted at 7% (2014: 7%) of £9,353m (2014: £9,419m) in its calculation of total indebtedness.

Operating lease payments represent rentals payable by the Group for certain of its retail, distribution and office properties and other assets such as motor

vehicles. The leases have varying terms, purchase options, escalation clauses and renewal rights. Purchase options and renewal rights, where they occur,

are at market value. Escalation clauses are in line with market practices and include inflation linked, fixed rates, resets to market rents and hybrids of these.

Note 33 Tesco Bank capital resources continued

137Tesco PLC Annual Report and Financial Statements 2015

Other informationGovernance Financial statementsStrategic report