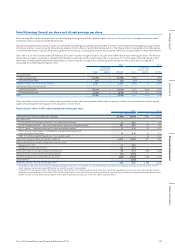

Tesco 2015 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2015 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

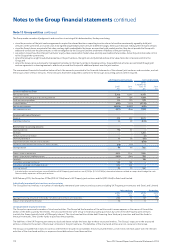

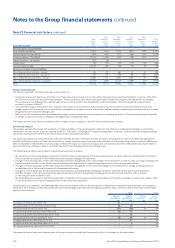

Note 13 Group entities continued

The Group made a number of judgements and assertions in arriving at this determination, the key ones being:

• since the provisions of the joint venture agreements require the relevant decisions impacting investor returns to be either unanimously agreed by both joint

venturers at the same time, or in some cases to be agreed sequentially by each venturer at different stages, there is joint decision making within the joint venture;

• since the Group’s leases are priced at fair value, and any rights embedded in the leases are consistent with market practice, they do not provide the Group with

additional control over the joint ventures or infer an obligation by the Group to fund the settlement of liabilities of the joint ventures;

• any options to purchase the other joint venturers’ equity stakes are priced at market value, and only exercisable at future dates, hence they do not provide control

to the Group at the current time;

• where the Group has a right to substitute properties in the joint ventures, the rights are strictly limited and are at fair value, hence do not provide control to the

Group; and

• where the Group carries out property management activities for third party rentals in shopping centres, these additional activities are controlled through joint

venture agreements or lease agreements, and do not provide the Group with additional powers over the joint venture.

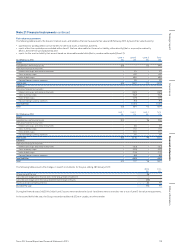

The summarised financial information below reflects the amounts presented in the financial statements of the relevant joint ventures and associates, and not

the Group’s share of those amounts. These amounts have been adjusted to conform to the Group’s accounting policies where required.

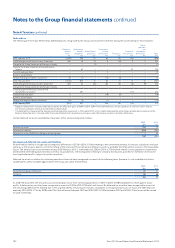

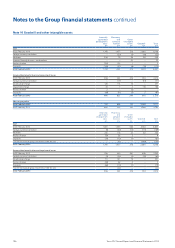

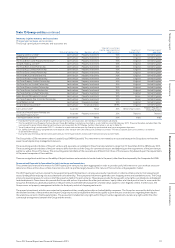

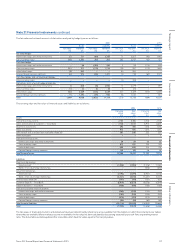

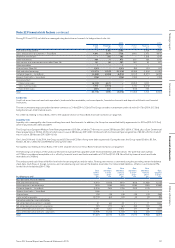

UK Property joint ventures Gain Land Limited

2015

£m

2014

£m

2015

7 months to

Dec 14

£m

2014

£m

Summarised Balance Sheet

Non-current assets 5,768 6,247 4,543 –

Current assets (excluding cash & cash equivalents) 219 164 1,979 –

Cash and cash equivalents 115 130 579 –

Current liabilities*(401) (470) (4,728) –

Non-current liabilities*(6,628) (6,999) (403) –

Net (liabilities)/assets (927) (928) 1,970 –

Summarised Income Statement

Revenue 418 434 4,811 –

Profit/(loss) after tax 15 39 (229) –

Reconciliation to carrying amounts:

Opening balance 90 87 ––

Additions ––1,261 –

Foreign currency translation ––(2) –

Share of profit/(loss) 15 36 (47) –

Impairment of joint ventures and associates ––(630) –

Dividends received from joint ventures and associates (56) (33) ––

Closing balance 49 90 582 –

Group's share in ownership 50% 50% 20% –

Group's share of net (liabilities)/assets (464) (464) 394 –

Goodwill ––188 –

Cumulative unrecognised losses 138 162 ––

Cumulative unrecognised hedge reserves 375 392 ––

Carrying amount 49 90 582 –

* Included within current and non-current liabilities of UK Property joint ventures are £(750)m (2014: £(784)m) derivative balances related to swaps which hedge the cash

flow variability exposures of the joint ventures.

At 28 February 2015, the Group has £179m (2014: £174m) loans to UK Property joint ventures and £nil (2014: £nil) to Gain Land Limited.

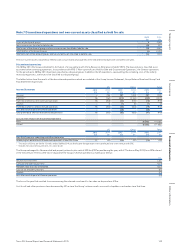

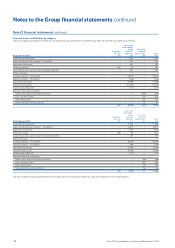

Individually immaterial joint ventures and associates

The Group also has interests in a number of individually immaterial joint ventures and associates excluding UK Property joint ventures and Gain Land Limited.

Joint ventures Associates

2015

£m

2014

£m

2015

£m

2014

£m

Aggregate carrying amount of individually immaterial joint ventures and associates 252 53 57 143

Group’s share of profit for the year 14 16 58

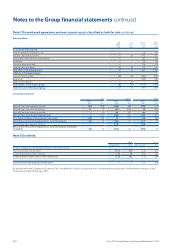

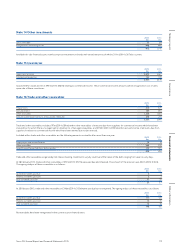

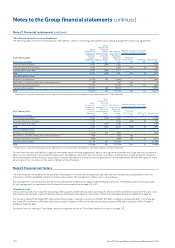

Unconsolidated structured entities

The Group has sponsored a number of structured entities. The Group led the formation of the entities and its name appears in the names of the entities

and/or on the debt issued by the entities. The structured entities were set up to finance property purchases by some of the UK Property joint ventures

in which the Group typically holds a 50% equity interest. The structured entities obtain debt financing from third party investors and lend the funds to

these joint ventures, who use the funds to purchase the properties.

The liabilities of the UK Property joint ventures disclosed above include the loans due to these structured entities. The Group’s exposure to the structured

entities is limited to the extent of the Group’s interests in the joint ventures. The liabilities of the structured entities are non-recourse to the Group.

The Group concluded that it does not control, and therefore should not consolidate, these structured entities, since it does not have power over the relevant

activities of the structured entities, or exposure to variable returns from these entities.

112 Tesco PLC Annual Report and Financial Statements 2015

Notes to the Group financial statements continued