Tesco 2015 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2015 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

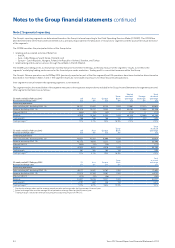

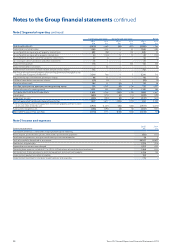

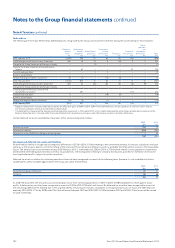

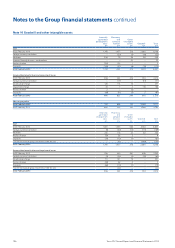

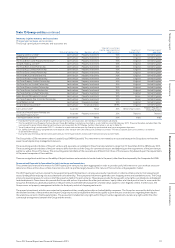

Note 6 Taxation continued

Deferred tax

The following are the major deferred tax (liabilities)/assets recognised by the Group and movements thereon during the current and prior financial years:

Property-

related

items*

£m

Retirement

benefit

obligation

£m

Share-based

payments

£m

Short-term

timing

differences

£m

Tax losses

£m

Financial

Instruments

£m

Other

pre/post

tax

temporary

differences

£m

Total

£m

At 23 February 2013 (1,622) 539 21 83 40 (24) 7(956)

Credit/(charge) to the Group Income Statement 282 29 19 9(19) 2 3 325

Charge to the Group Statement of Changes in Equity – – (1) – – – – (1)

Credit to the Group Statement of Comprehensive

Income –67 –––35 –102

Discontinued operations – – 3 5 7 – – 15

Business combinations – – – – – – – –

Foreign exchange and other movements** 32 (1) –(13) (4) – – 14

At 22 February 2014 (1,308) 634 42 84 24 13 10 (501)

Credit/(charge) to the Group Income Statement 363 35 (40) 184 46 (6) (9) 573

Charge to the Group Statement of Changes in Equity – – – – – – – –

Credit/(charge) to the Group Statement of

Comprehensive Income –291 – – – (17) –274

Discontinued operations 2 – – (19) (2) – – (19)

Business combinations – – – – – – – –

Foreign exchange and other movements** (10) (3) 1(1) 1 – – (12)

At 28 February 2015 (953) 957 3248 69 (10) 1315

* Property-related items include a deferred tax liability on rolled over gains of £294m (2014: £294m) and deferred tax assets on capital losses of £101m (2014: £58m).

The remaining balance relates to accelerated tax depreciation.

**

The deferred tax charge/credit for foreign exchange and other movements is £12m debit (2014: £14m credit) relating to the retranslation of deferred tax balances at the

balance sheet date and is included within the Group Statement of Comprehensive Income under the heading currency translation differences.

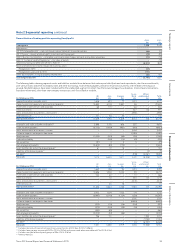

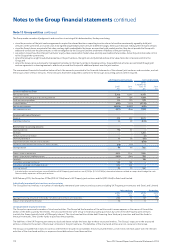

Certain deferred tax assets and liabilities have been offset and are analysed as follows:

2015

£m

2014

£m

Deferred tax assets 514 73

Deferred tax liabilities (199) (594)

Deferred tax assets/(liabilities) relating to disposal groups –20

315 (501)

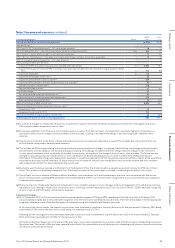

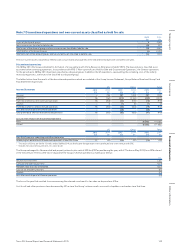

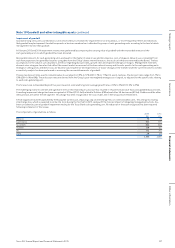

Unrecognised deferred tax assets and liabilities

No deferred tax liability is recognised on temporary differences of £3.0bn (2014: £4.0bn) relating to the unremitted earnings of overseas subsidiaries and joint

ventures as the Group is able to control the timing of the reversal of these temporary differences and it is probable that they will not reverse in the foreseeable

future. The deferred tax on unremitted earnings at 28 February 2015 is estimated to be £200m (2014: £213m) which relates to taxes payable on repatriation

and dividend withholding taxes levied by overseas tax jurisdictions. UK tax legislation relating to company distributions provides for exemption from tax for

most repatriated profits, subject to certain exceptions.

Deferred tax assets in relation to continuing operations have not been recognised in respect of the following items (because it is not probable that future

taxable profits will be available against which the Group can utilise the benefits):

2015

£m

2014

£m

Deductible temporary differences 97 27

Tax losses 66 66

163 93

As at 28 February 2015, the Group has unused trading tax losses from continuing operations of £631m (2014: £398m) available for offset against future

profits. A deferred tax asset has been recognised in respect of £335m (2014: £95m) of such losses. No deferred tax asset has been recognised inrespect of

the remaining £296m (2014: £303m) due to the unpredictability of future profit streams. Included in unrecognised tax losses are losses of £118m that will

expire by 2019 (2014: £71m by 2018) and £15m that will expire between 2020 and 2035 (2014: £142m between 2019 and 2034). Other losses will be carried

forward indefinitely.

102 Tesco PLC Annual Report and Financial Statements 2015

Notes to the Group financial statements continued