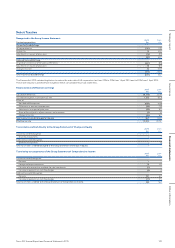

Tesco 2015 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2015 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

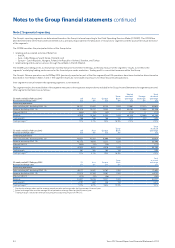

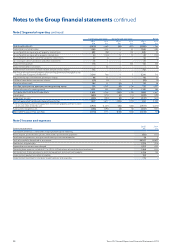

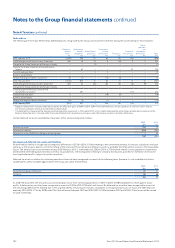

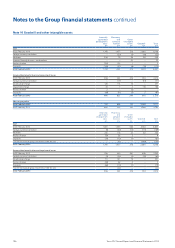

Continuing operations Notes

2015

£m

2014

£m

(Loss)/profit before tax from continuing operations (6,376) 2,259

Adjustments for:

IAS 32 and IAS 39 ‘Financial Instruments’ – fair value remeasurements 126 11

IAS 19 ‘Employee Benefits’ – non-cash Group Income Statement charge for pensions 1,26 204 117

IAS 17 ‘Leases’ – impact of annual uplifts in rent and rent-free periods 112 22

IFRS 3 ‘Business Combinations’ – intangible asset amortisation charges and costs arising from acquisitions 113 14

IFRIC 13 ‘Customer Loyalty Programmes’ – fair value of awards 1–10

Restructuring and other one-off items:

Impairment of PPE and onerous lease provisions included within cost of sales 11 3,802 734

Impairment/(impairment release) of PPE and onerous lease provisions included within (losses)/profit arising on property-related

items 11 925 (98)

Impairment of goodwill 10 116 –

Impairment of intangible fixed assets(a) 50 –

Impairment of investment in China associate(b) 630 –

Impairment of investment in and loans to joint ventures and associates(c) 82 –

Inventory valuations and provisions(d) 570 –

Provision for customer redress 27 63

ATM rates charge(e) 41 –

Loss on disposal/closure of non-core businesses(f) 81 –

Restructuring costs including trading store redundancies(g) 416 –

Other restructuring and one-off items 74 102

Total restructuring and other one-off items 6,814 801

Reversal of commercial income recognised in previous years(h):

Recognised in 13/14 53 –

Recognised in years prior to 13/14 155 –

Other losses/(profits) arising on property-related items 60 (180)

Underlying profit before tax from continuing operations 961 3,054

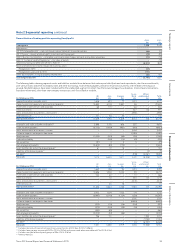

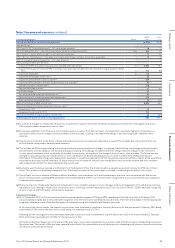

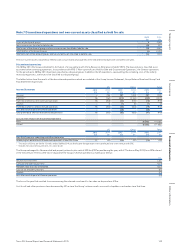

(a) As a result of changes to simplify the UK business, a number of IT projects have been cancelled, resulting in an impairment of intangible fixed assets.

This charge has been recognised in cost of sales.

(b) Increasing competition from Chinese e-commerce businesses as well as the financial impact of a longer-than-expected integration of operations is

expected to affect short-to-medium-term profitability of the associate, resulting in an impairment charge in the year recognised in administrative

expenses.

(c) Investments in and loans to the Harris + Hoole and Euphorium businesses have been impaired as a result of the strategic decision to slow the roll-out

of these brands recognised in administrative expenses.

(d) This includes a £402m charge relating to increased inventories provisioning due to changes to range and stockholding, including general merchandise

transformation, and the adoption of a forward looking provisioning methodology. An additional £107m charge relates to changes in the estimate of

in-store payroll overheads which are directly attributable to inventories, arising due to the change in focus of our in-store activities. The Group has also

changed its accounting policy to exclude certain in-store overheads from directly attributable costs in order to reflect more reliable and relevant

information. If the policy change were applied retrospectively, it would have reduced the 2013/14 inventories balance by £59m, of which £10m would have

impacted the prior year income statement. As these amounts are not material, the prior year comparatives have not been restated and the cumulative

policy adjustment of £61m has been reflected in the current year.

(e) During the year, the Group received a notification from the Valuation Office that it had moved to a separate assessment of rates for ATM sites in Tesco

stores. This resulted in a backdated charge of £41m. The charge in respect of the current year is included in underlying profit within cost of sales.

(f) This includes the loss on disposal of Blinkbox Movies and Music, and redundancy cost, asset impairments and other costs associated with the closure

of non-core businesses including Blinkbox Books and Tesco Broadband. Of this loss, £74m has been recognised in cost of sales and £7m was recognised

in administrative expenses.

(g) Restructuring costs include redundancy and compensation costs related to changes in store colleague working arrangements in the UK, Europe and Asia,

redundancy costs relating to Head Office restructures across the Group, and the redundancy cost of store closures in the UK. £266m has been recognised

in costs of sales and £150m within administrative expenses.

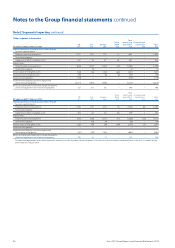

Commercial income

(h) On 22 September 2014 the Group announced that the previous guidance given on 29 August 2014 regarding profit for the six months to 23 August 2014

was overstated principally due to the accelerated recognition of commercial income and delayed accrual of costs. The internal investigation into the appropriate

recognition included a review of whether the impact of accelerated recognition should be attributed to prior years.

At the time of the interim results, the impacts on prior years were estimated as resulting in the profit before tax for the year ended 22 February 2014 being

overstated by £70m and for the years prior to that being overstated by a total of £75m.

Following further investigations, these estimates have been revised to a total overstatement to profit before tax of £53m for the year ended 22 February

2014, and a total overstatement of £155m for the years prior to that.

On the basis that these figures are not material in the prior years, a prior year restatement has not been made with the amounts instead being corrected in

the current year. The impact of this has been separately identified in the reconciliation of profit before tax to underlying profit above as the correction does

not reflect current year performance.

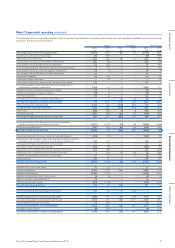

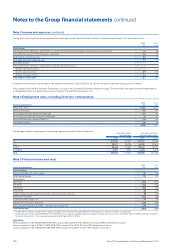

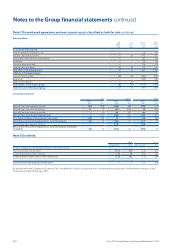

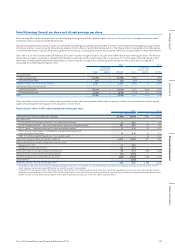

Note 3 Income and expenses continued

99Tesco PLC Annual Report and Financial Statements 2015

Other informationGovernance Financial statementsStrategic report