Tesco 2015 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2015 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

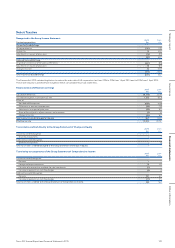

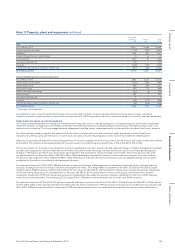

Note 13 Group entities continued

Interests in joint ventures and associates

Principal joint ventures and associates

The Group’s principal joint ventures and associates are:

Nature of relationship Business activity

Share of issued share

capital, loan capital and

debt securities

Country of

incorporation

Principal area of

operation

Shopping Centres Limited(a) Joint venture Property investment 50% England United Kingdom

BLT Properties Limited(a) Joint venture Property investment 50% England United Kingdom

The Tesco British Land Property Partnership(b) Joint venture Property investment 50% England United Kingdom

Tesco BL Holdings Limited(b) Joint venture Property investment 50% England United Kingdom

The Tesco Red Limited Partnership Joint venture Property investment 50% England United Kingdom

The Tesco Aqua Limited Partnership Joint venture Property investment 50% England United Kingdom

The Tesco Coral Limited Partnership Joint venture Property investment 50% England United Kingdom

The Tesco Blue Limited Partnership Joint venture Property investment 50% England United Kingdom

The Tesco Atrato Limited Partnership Joint venture Property investment 50% England United Kingdom

The Tesco Property Limited Partnership Joint venture Property investment 50% England United Kingdom

The Tesco Passaic Limited Partnership Joint venture Property investment 50% England United Kingdom

The Tesco Navona Limited Partnership Joint venture Property investment 50% England United Kingdom

The Tesco Sarum Limited Partnership Joint venture Property investment 50% England United Kingdom

The Tesco Dorney Limited Partnership Joint venture Property investment 50% England United Kingdom

Arena (Jersey) Management Limited Joint venture Property investment 50% Jersey United Kingdom

The Tesco Property (No. 2) Limited Partnership Joint venture Property investment 50% Jersey United Kingdom

Tesco Mobile Limited Joint venture Telecommunications 50% England United Kingdom

Tesco Underwriting Limited(c) Joint venture Financial services 49.9% England United Kingdom

Gain Land Limited(d) Associate Retail 20% British Virgin Islands People's Republic of

China/Hong Kong

Tesco Lotus Retail Growth Freehold and

Leasehold Property Fund(a) Associate Property investment 25% Thailand Thailand

Trent Hypermarket Limited(e) Joint venture Retail 50% India India

(a) Held by the Parent Company (all other significant joint ventures and associates are held by an intermediate subsidiary).

(b) The Tesco British Land Property Partnership and Tesco BL Holdings Limited are classified as assets held for sale at 28 February 2015. They are therefore excluded from the

summarised financial information for joint ventures and associates for 2015 below. Further information is set out in Note 35.

(c) Tesco Underwriting Limited under IFRS 11 is treated as a joint venture because the Group has joint control over key management decisions.

(d) On 28 May 2014 the Group completed its formation of a new venture with China Resources Enterprise Limited. The new associate, Gain Land Limited, is a material

associate to the Group.

(e) During the year the Group formed a new joint venture, Trent Hypermarket Limited, with Trent Limited at a cost of £102m.

The Group holds a 22% investment stake in Lazada Group GMBH (‘Lazada’). This investment is not treated as an associate because the Group does not have the

power to participate in key management decisions.

The accounting period end dates of the joint ventures and associates consolidated in these financial statements range from 31 December 2014 to 28 February 2015.

The accounting period end dates of the joint ventures differ from those of the Group for commercial reasons and depend upon the requirements of the joint venture

partner as well as those of the Group. The accounting period end dates of the associates are different from those of the Group as they depend upon the requirements

of the parent companies of those entities.

There are no significant restrictions on the ability of the joint ventures and associates to transfer funds to the parent, other than those imposed by the Companies Act 2006.

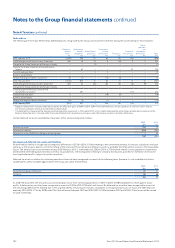

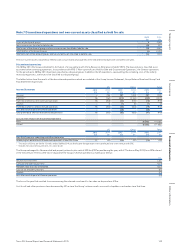

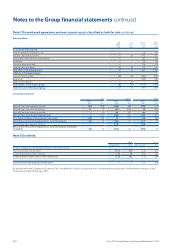

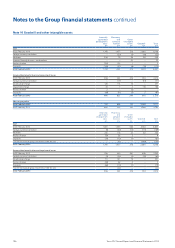

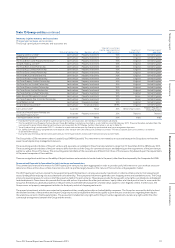

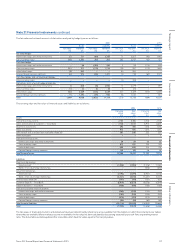

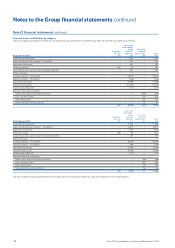

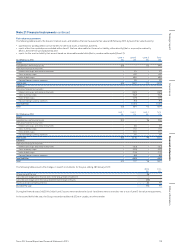

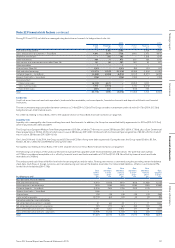

Summarised financial information for joint ventures and associates

The summarised financial information for UK Property joint ventures has been aggregated in order to provide useful information to users without excessive

detail since these entities have similar characteristics and risk profiles largely based on the nature of their activites and geographic market.

The UK Property joint ventures involve the Group partnering with third parties in carrying out property investments in order to enhance returns from property and

access funding whilst reducing risks associated with sole ownership. These property investments generally cover shopping centres and standalone stores. The Group

enters into operating leases for some or all of the properties held in the joint ventures. These leases provide the Group with some rights over alterations and adjacent

land developments. Some leases also provide the Group with options to purchase the other joint venturers’ equity stakes at a future point in time. In some cases the

Group has the ability to substitute properties in the joint ventures with alternative properties of similar value, subject to strict eligibility criteria. In other cases, the

Group carries out property management activities for third party rentals of shopping centre units.

The property investment activities are carried out in separate entities, usually partnerships or limited liability companies. The Group has assessed its ability to direct

the relevant activities of these entities and impact Group returns and concluded that the entities qualify as joint ventures since decisions regarding them require

the unanimous consent of both equity holders. This assessment included not only rights within the joint venture agreements, but also any rights within the other

contractual arrangements between the Group and the entities.

111Tesco PLC Annual Report and Financial Statements 2015

Other informationGovernance Financial statementsStrategic report