Tesco 2015 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2015 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

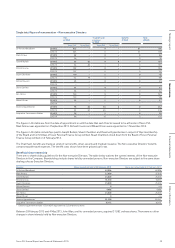

Legacy plans

Deferred bonus shares awarded prior to 2014 were granted under the 2004 Executive Incentive Plan. Under this plan, in the event that a

participant leaves for ‘good leaver’ reasons (death, injury, ill-health, disability, redundancy, retirement, the entity which employs the Executive

Director ceasing to be part of the Group or any other reason determined by the Committee) awards will vest at leaving and participants will

normally have 12 months from cessation to exercise awards in the form of options. If a participant leaves in other circumstances (other than

in circumstances of gross misconduct) awards will normally vest at the normal vesting date and participants will normally have 12 months

from vesting to exercise awards in the form of options.

Philip Clarke and Laurie McIlwee hold vested options under the 2004 Discretionary Share Option Plan and 2004 PSP. Under these plans,

when participants leave, they have 12 months from leaving to exercise options.

Other vesting circumstances

Awards may also vest early if:

(i) a participant is transferred to a country, as a result of which the participant will suffer a tax disadvantage or become subject to restrictions

on his award (under the PSP and 2004 Executive Incentive Plan); or

(ii) in the event of a takeover, winding-up or other corporate event affecting the Company, which may affect the value of share awards

(such as a demerger or special dividend).

The number of shares under an award which vest in these circumstances will be determined by the Committee. In the case of the PSP,

when determining the level of vesting the Committee will consider performance and the time elapsed since grant. In the case of the

deferred bonus shares (under the 2004 and 2014 Executive Incentive Plan) awards will vest in full.

Where an Executive Director leaves as a result of summary dismissal they will forfeit outstanding share incentive awards.

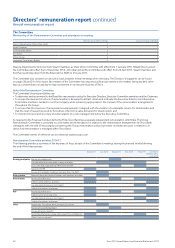

Remuneration policy for Non-executive Directors

Approach to setting fees Basis of fees Other items

• Fees for the Non-executive Chairman and

Non-executive Directors are set at an appropriate

level to recruit and retain Directors of a sufficient

calibre to guide and influence Board level decision

making without paying more than is necessary

• Fees are set taking into account the following

factors:

– The time commitment required to fulfil the role

– Typical practice at other companies of a similar

size and complexity to Tesco

• Non-executive Directors’ fees are set by the Board

and the Chairman’s fee is set by the Committee

(the Chairman does not take part in any discussion

about his fees)

• Fees are reviewed by the Board at appropriate

intervals (normally once every two years)

• Fees paid to the Non-executive Chairman and

Non-executive Directors may not exceed the

aggregate limit of £2m set out in the Company’s

articles of association

• Non-executive Director fees policy is to pay:

– A basic fee for membership of the Board

– An additional fee for the Chairman of a Committee

and the Senior Independent Director to take into

account the additional responsibilities and time

commitment of the role

– An additional fee for membership of a Committee

to take into account the additional responsibilities

and time commitment of the role

• Additional fees may be paid to reflect additional

Board or Committee responsibilities as appropriate

• Non-executive Directors of Tesco PLC may also serve

on the Board of Tesco Personal Finance Group Limited

• Such Non-executive Directors also receive a basic

fee for serving on this Board and additional fees for

Committee membership in line with other members

of this Board. Fees for membership of the Board of

Tesco Personal Finance Group Limited are determined

by the Board of Tesco Personal Finance Group Limited

and are reviewed at appropriate intervals

• The Non-executive Chairman of Tesco PLC receives

an all-inclusive fee for the role

• Where significant travel is required to attend Board

meetings, additional fees may be paid to reflect this

additional time commitment

• The Non-executive Directors are not entitled

to participate in the annual bonus or Performance

Share Plan

• The Non-executive Directors have the benefit

of Directors’ and Officers’ liability insurance and

provision of indemnity and staff discount on the

same basis as other employees. The Board may

introduce additional benefits for Non-executive

Directors if it is considered appropriate to do so

• The Non-executive Chairman may have the benefit

of a company car and driver, home security, staff

discount and healthcare for himself and his partner.

The Committee may introduce additional benefits

for the Chairman if it is considered appropriate

to do so

• The Company reimburses the Chairman and

Non-executive Directors for reasonable expenses

in performing their duties and may settle any tax

incurred in relation to these

• The Company will pay reasonable legal fees

for advice in relation to terms of engagement

• If a Non-executive Director was based overseas

then the Company would meet travel and

accommodation expenditure as required

to fulfil Non-executive duties

Non-executive Director letters of appointment

Non-executive Directors have letters of appointment setting out their duties and the time commitment expected. Appointments are for

an initial period of three years after which they are reviewed. The unexpired term of Non-executive Directors’ appointments can be found

on page 35. In line with the UK Corporate Governance Code, all Non-executive Directors submit themselves for re-election by shareholders

every year at the Annual General Meeting. All Non-executive Directors’ appointments can be terminated by either party without notice.

Non-executive Directors have no entitlement to compensation on termination.

The letters of appointment are available for shareholders to view at the Company’s registered office.

68 Tesco PLC Annual Report and Financial Statements 2015

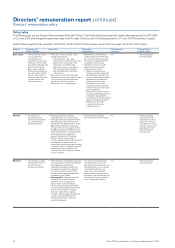

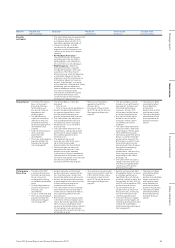

Directors’ remuneration report continued

Directors’ remuneration policy