Tesco 2015 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2015 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

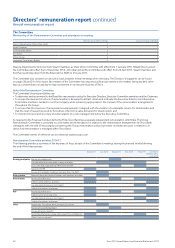

8.07.06.05.04.03.02.01.0

£million

0

Laurie McIlwee

Philip Clarke

Base salary EIP shares Shareholding requirement

Dave Lewis

(CEO)

Alan Stewart

(CFO)

Shares not subject

to performance conditions

Shareholding

requirement

£million

01.0 2.03.0 4.05.0

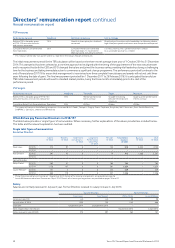

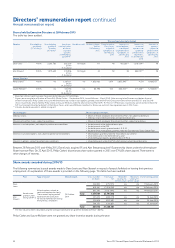

The table below lays out the historical single figure data for the role of CEO as well as annual bonus and Performance Share Plan payout

levels as a percentage of maximum opportunity for the CEO. In each year the award is shown based on the final year of the performance

period, i.e. the year in which it is included in the single figure.

Six year remuneration history

2009/10 2010/11 2011/12 2012/13*2013/14 2014/15

Sir Terry Leahy Sir Terry Leahy Philip Clarke Philip Clarke Philip Clarke Philip Clarke Dave Lewis

CEO single figure of remuneration

(£’000)

7,100 7,150 4,595 1,280 1,634 764 4,133

Annual bonus vesting

(% of maximum award)

89% 75% 0% 0% 0% 0% 0%

PSP vesting

(% of maximum award)

82.7% 75% 46.5% 0% 0% 0% 0%

Share option vesting

(% of maximum award)

100% 100% 100% 0% n/a n/a n/a

* Philip Clarke elected not to take a bonus for 2011/12. Other Executive Directors received a bonus of 13.54% of maximum.

The CEO single figure for Dave Lewis includes £3.3m in respect of buyout of incentives forfeited on leaving his former employer.

See pages 52, 54 and 55 for further details.

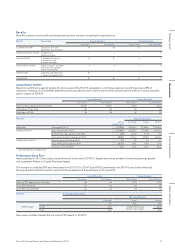

Shareholding guidelines and share ownership

Share ownership guidelines

• Four times base salary for the CEO

• Three times base salary for the CFO

• The purpose is to create alignment with the interests of shareholders

• This requirement is at the upper end of typical market practice for similar-size companies

The Remuneration Committee believes that a significant shareholding by Executive Directors aligns their interests with shareholders

and demonstrates their ongoing commitment to the business.

Shareholding guidelines policy

• Shares included – Shares held outright will be included in the calculation of shareholding guidelines, as will shares held by an Executive’s

connected persons. Shares held in plans which are not subject to forfeiture will be included (on a net of tax basis) for the purposes of

calculating Executive Directors’ shareholdings. Vested but unexercised market value share options are not included in the calculation.

• Accumlation period – New appointees will be expected to achieve this minimum level of shareholding within five years of appointment.

• PSP participation – Full participation in the PSP will generally be conditional upon maintaining the minimum shareholding.

• Holding policy – Where an Executive Director does not meet the shareholding requirement they will be required to hold, and

not dispose of, at least 50% of the net number of shares that vest under incentive arrangements until they meet this requirement.

Given the importance of owning shares, the Executive Committee and a number of other senior managers are also required to build a holding

of Tesco shares.

The chart below illustrates the value of Executive Directors’ shareholdings, based on the three-month average share price to 28 February 2015

of 209.6p per share, compared to the shareholding guideline. Dave Lewis and Alan Stewart will be expected to meet the shareholding

requirement by 1 September 2019 and 23 September 2019 respectively.

53Tesco PLC Annual Report and Financial Statements 2015

Other informationGovernance Financial statementsStrategic report