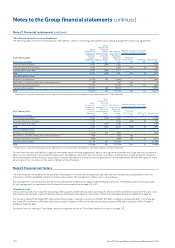

Tesco 2015 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2015 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

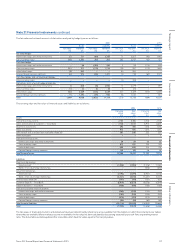

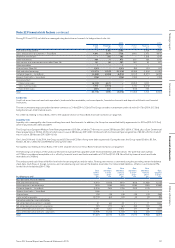

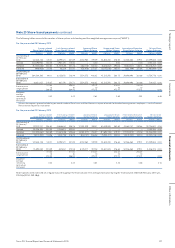

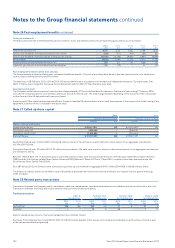

Note 24 Provisions

Property

provisions

£m

Other

provisions

£m

Total

£m

At 23 February 2013 358 102 460

Foreign currency translation (12) –(12)

Amount released in the year (35) –(35)

Amount provided in the year 53 63 116

Amount utilised in the year (38) (60) (98)

Transfer to disposal group classified as held for sale 2 – 2

At 22 February 2014 328 105 433

Foreign currency translation (1) – (1)

Amount released in the year (104) –(104)

Amount provided in the year 773 362 1,135

Amount utilised in the year (61) (42) (103)

Unwinding of discount 6 – 6

At 28 February 2015 941 425 1,366

The balances are analysed as follows:

2015

£m

2014

£m

Current 671 250

Non-current 695 183

1,366 433

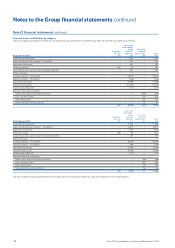

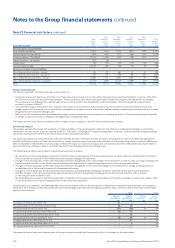

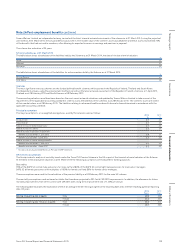

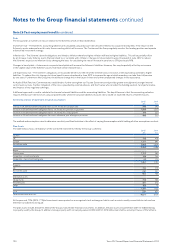

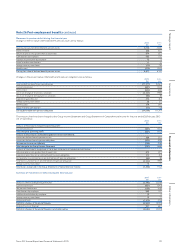

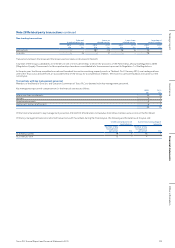

Property provisions

Property provisions comprise onerous lease provisions, including leases on unprofitable stores and vacant properties, and other onerous contacts related

to property. These provisions are based on the least net cost of fulfilling or exiting the contract.

The calculation of the value in use of the leased property to the Group is based on the same assumptions for discount rates, growth rates and expected change

in margins as those for Group owned properties, as discussed in detail in Note 11. The provision calculations also assume that the Group can sublet properties

at market rents. For some leases, termination of the lease at the break clause requires the Group to either purchase the property or buy out the equity ownership

of the property at fair value. No value is attributed to the purchase conditions since they are at fair value. It is also assumed that the Group is indifferent to

purchasing the properties.

Based on the factors set out above, the Group has recognised a net onerous property provision charge in the year of £669m (2014: £18m charge) relating to

contracts in the UK of £561m (2014: £(15)m release), Europe of £62m (2014: £27m charge) and Asia of £46m (2014: £6m charge). These provisions comprise

obligations for future rents payable net of rents receivable on onerous leases and other onerous contracts relating to properties. Of this charge, £536m (2014:

£27m) has been classified as ‘Impairment of PPE and onerous lease provisions included within cost of sales’, £120m (2014: £nil) has been classified as

‘Impairment of PPE and onerous lease provisions included within (losses)/profits arising on property-related items’ within non-GAAP measures in the Group

Income Statement. The remaining £13m charge (2014: £(9)m release) has not been treated as one-off and is recognised in ‘(losses)/profits arising on property-

related items.’

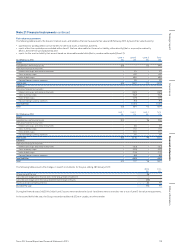

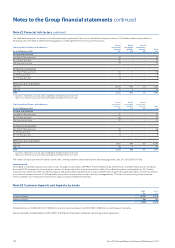

Other provisions

During the year, the Group announced cost saving initiatives including in the UK a restructuring of central overheads, simplification of store management

structures and increased working hour flexibility. The Group authorised a detailed formal plan of restructuring relating to these and announced the plan

to affected employees, leading to recognition of a restructuring provision of £325m.

The remainder of the other provisions relate mainly to provisions for Tesco Bank customer redress in respect of potential complaints arising from the historic

sales of Payment Protection Insurance (‘PPI’), in respect of customer redress relating to the historic sale of certain Cardholder Protection Products (‘CPP’)

to credit card customers and in respect of customer redress relating to instances where certain of the requirements of the Consumer Credit Act (‘CCA’)

for post contract documentation have not been fully complied with. In each instance, management have exercised judgement as to both the timescale

for implementing the redress campaigns and the final scope of any amounts payable. The balances are classified as current at the year end.

125Tesco PLC Annual Report and Financial Statements 2015

Other informationGovernance Financial statementsStrategic report