Supercuts 2008 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2008 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

5. DERIVATIVE FINANCIAL INSTRUMENTS (Continued)

month LIBOR rate) on notional amounts of indebtedness of $35.0 and $15.0 million as of June 30, 2008, and mature in March 2013 and March

2015, respectively. These swaps were designated and are effective as cash flow hedges. These cash flow hedges were recorded at fair value

within other noncurrent liabilities in the Consolidated Balance Sheet, with a corresponding offset in other comprehensive income within

shareholders' equity.

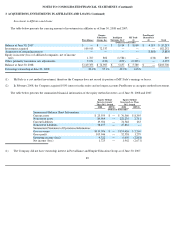

Forward Foreign Currency Contracts

On May 29, 2007, the Company entered into several forward foreign currency contracts to sell Canadian dollars and buy an aggregate of

$16.9 million U.S. dollars, with maturation dates between June 2007 and May 2010. On February 1, 2006, the Company entered into several

forward foreign currency contracts to sell Canadian dollars and buy an aggregate $15.8 million U.S. dollars, with maturation dates between July

2006 and May 2009. The purpose of the forward contracts is to protect against adverse movements in the Canadian dollar exchange rate. The

contracts were designated and are effective as cash flow hedges of Canadian dollar denominated forecasted intercompany transactions related to

monthly product shipments from the U.S. to Canadian salons. These cash flow hedges were recorded at fair value within other assets in the

Consolidated Balance Sheet, with a corresponding offset in other comprehensive income within shareholders' equity.

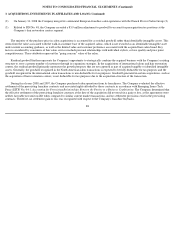

On January 3, 2007, the Company terminated its remaining Canadian forward foreign currency contracts entered into on February 1, 2006

having a $14.5 million notional amount. The termination resulted in a deferred gain of $0.4 million which is recorded in Accumulated Other

Comprehensive Income (AOCI) in the Consolidated Balance Sheet, as the contracts hedged currency risk associated with a portion of the

monthly forecasted intercompany foreign-currency-

denominated transactions stemming from the forecasted monthly product shipments from the

Company's subsidiaries located in the Unites States to its Canadian subsidiaries. The deferred gain will be recorded into income through May 31,

2009 as the forecasted foreign currency transactions are recognized in earnings. Approximately $0.2 and $0.1 million of the deferred gain was

amortized against cost of goods sold during fiscal years 2008 and 2007, respectively, resulting in a remaining deferred gain of $0.1 and

$0.3 million in AOCI at June 30, 2008 and 2007.

When the inventory from the hedged forecasted transaction is sold to an external party by the salon and, therefore, impacts cost of goods

sold in the Company's Consolidated Statement of Operations, amounts are transferred out of AOCI to earnings. The Company uses an inventory

turnover ratio (based on historical results) to estimate the timing of sales to an external third party. Therefore, amounts will be transferred from

AOCI into earnings based on this inventory turnover ratio.

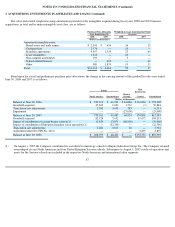

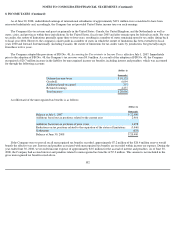

Financial Statement Impact of Cash Flow Hedges

The cumulative tax-effected net loss or gain is included within shareholders' equity in the Consolidated Balance Sheet. At June 30, 2008,

the cumulative tax-effected net loss recorded in AOCI related to the cash flow hedges was $2.2 million. At June 30, 2007 and 2006, the

cumulative tax-effected net gain recorded in AOCI related to the cash flow hedges was, $1.7 and $1.9 million,

96